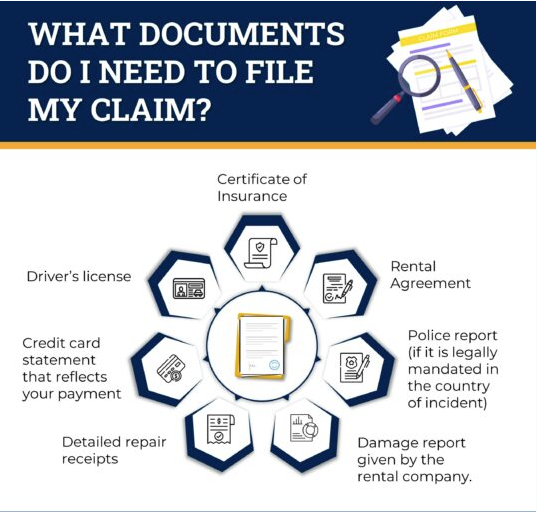

What Documents Do I Need to File My Claim?

- A copy of the Certificate of Insurance

- A copy of the rental agreement

- A copy of the police report if:

- you got in an accident with a third party

- It is legally mandated in the country of incident

- your claim is about stolen personal belongings

- A copy of the damage report given by the rental company, detailing each cost incurred. Photographs of the damage are optional but may help ensure that the charges are reasonable.

- Detailed repair receipts, invoices, or other documents showing the breakdown of the amount the rental company charged you for the accidental damage or loss

- A copy of your credit card statement that reflects your payment for the claimed damages

- A copy of the driver’s license of the person driving the car during the accident

The inability to provide these documents may cause your claim to be delayed.

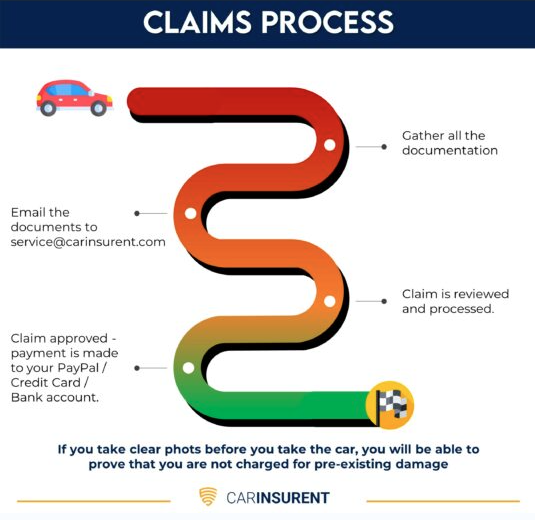

Claims Process

- Gather all the documentation listed above.

- Once you have all the documents in hand, you can simply email them to us at service@carinsurent.com.

- Your claim will be reviewed and processed by a claims handler. We might have a few questions, so we will send you our questions within up to 48 hours.

- We aim to complete all claims within five business days. It can take longer if documents are missing or if you don’t reply to our questions.

- A decision is made on your claim – Once approved, payment is made straight to your PayPal / Credit Card / Bank account.