Yes. Insurance for a single day is available.

Sixt Loss Damage Waiver: Know Your Options

PUBLISHED ON May, 17 2023

UPDATED ON Mar, 26 2024

When renting a car from Sixt, understanding your options for Loss Damage Waiver (LDW) is crucial. LDW provides protection against potential damage or theft of the rental vehicle, giving you peace of mind during your rental period. In this article, we will delve into the details of Sixt’s Loss Damage Waiver and explore the different options available. By familiarizing yourself with these options, you can make an informed decision that best suits your needs and ensures a hassle-free car rental experience.

By understanding your LDW options and evaluating your individual needs, you can choose the most appropriate level of coverage for your rental. We will provide insights on assessing personal risk tolerance, considering the value and condition of the rental vehicle, and comparing costs associated with LDW options. Additionally, we will discuss the importance of reviewing car rental agreements and exploring any existing insurance coverage or credit card benefits that may affect your decision.

Sixt Car Rental Insurance Options

Sixt offers different car rental insurance options that customers can choose from based on their specific needs and preferences. Here are some of the insurance options typically available with Sixt:

- Loss Damage Waiver (LDW): Sixt LDW is a standard insurance option that provides coverage for damage or loss to the rental vehicle. It typically includes Collision Damage Waiver (CDW) and Theft Protection, which protect against accidents, collisions, and theft. LDW may have an excess amount, also known as a deductible, which is the maximum amount the renter is responsible for in case of damage or theft.

- Super Loss Damage Waiver (Super LDW): Sixt offers an upgraded insurance option called Super Loss Damage Waiver (Super LDW). Super LDW provides enhanced coverage with a lower excess or deductible amount compared to the standard LDW. By choosing Super LDW, renters can reduce their financial liability and enjoy added peace of mind during their rental period.

- Personal Accident Protection (PAP): Personal Accident Protection (PAP) is an optional insurance coverage that provides medical and accidental death benefits in the event of an accident during the rental period. This coverage can help protect the driver and passengers against unexpected medical expenses or financial hardships resulting from accidents.

- Supplemental Liability Insurance (SLI): Supplemental Liability Insurance (SLI) is an optional coverage that extends the liability protection for the renter. SLI covers damages or injuries caused to third parties, including other vehicles or property, in case of an at-fault accident. It provides additional coverage beyond the minimum liability limits required by the state or country where the rental takes place.

It’s important to note that the availability and specific details of these insurance options may vary depending on the location and specific rental terms. Renters should carefully review the terms and conditions of each insurance option to understand the coverage, exclusions, limitations, and any additional costs associated with their choice.

By offering different insurance options, Sixt aims to provide flexibility and cater to the varying needs of their customers. Renters should consider their personal preferences, budget, and level of desired coverage when selecting the appropriate insurance option from Sixt.

Sixt Car Rental Insurance Cost

The cost of Sixt LDW can vary depending on several factors, including the location, duration of the rental, type of coverage, and any additional options or add-ons chosen. Here are some key factors that can influence the cost of car rental insurance from Sixt:

- Location: The cost of Sixt LDW can vary based on the country or specific location where you rent the vehicle. Insurance rates may differ depending on factors such as local regulations, risk assessment, and insurance market conditions.

- Rental Duration: The duration of your rental can impact the insurance cost. Short-term rentals, such as daily or weekly, may have a different pricing structure compared to long-term rentals, such as monthly rentals. Some rental companies may offer discounted rates for longer rental periods.

- Type of Coverage: The specific type of insurance coverage you choose will affect the cost. Standard Loss Damage Waiver (LDW) coverage is typically included in the rental price but may have an excess or deductible amount. Upgrading to Super Loss Damage Waiver (Super LDW) with a lower excess may involve additional costs. Optional coverages like Personal Accident Protection (PAP) or Supplemental Liability Insurance (SLI) may also have separate charges.

- Additional Options: Sixt may offer additional options or add-ons, such as roadside assistance or additional driver coverage, which can impact the overall cost of the insurance package. These options are typically available for an extra fee.

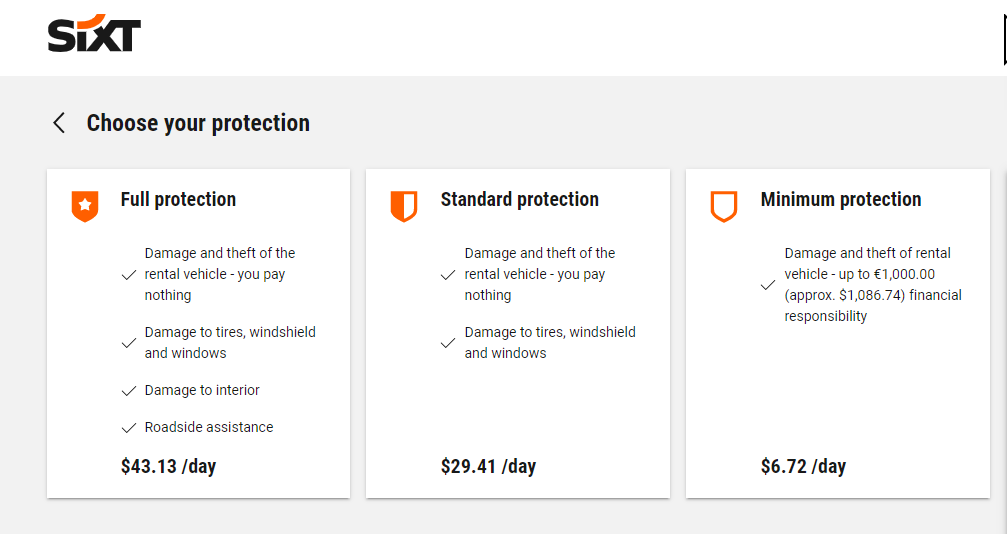

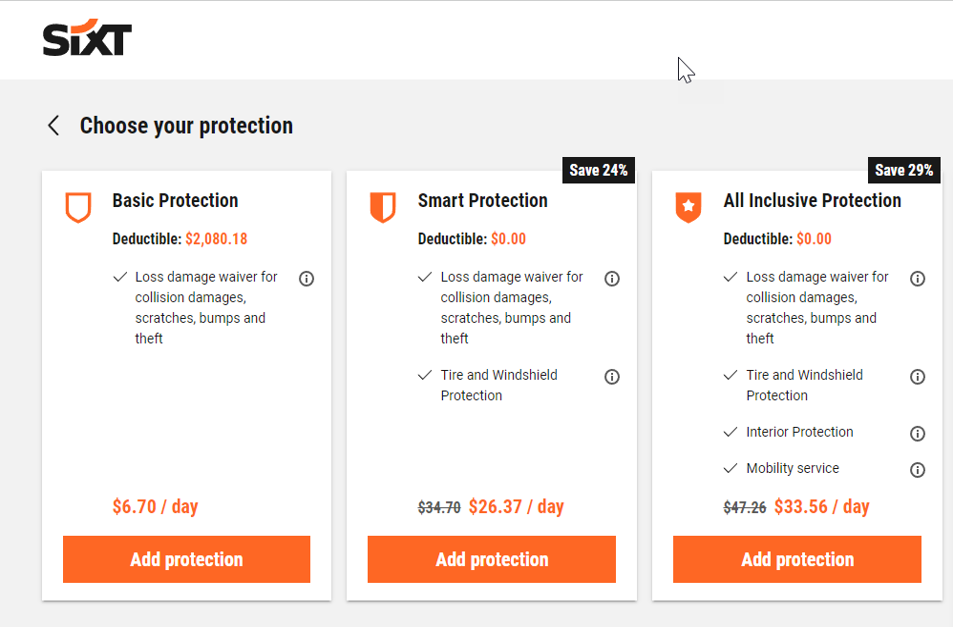

In general, Sixt offer 3 types of coverage –

- Minimum protection – This option covers damage and theft of the rental vehicle with up to €950.00 (approx. $1,032) excess (also know as “deductible” which is your financial responsibility). This coverage will cost you US$ 6.72 per day.

- Standard protection – This option covers damage and theft of the rental vehicle and you don’t need to pay anything in the event that the rental vehicle is damaged (zero excess). This option also cover damage to tires, windshield and windows. This coverage will cost you US$ 29.41 per day.

- Full protection – This option covers damage and theft of the rental vehicle and you don’t need to pay anything in the event that the rental vehicle is damaged (zero excess). This option also cover damage to tires, windshield and windows, damage to the interior of the vehicle and roadside assistance. This coverage will cost you US$ 43.13 per day.

To obtain the precise cost of car rental insurance from Sixt, it is advisable to request a quote or contact their customer service directly. By providing specific rental details and preferences, such as location, dates, and desired coverage, Sixt can provide you with an accurate estimate of the insurance cost associated with your rental. If you purchase CarInsuRent car rental insurance, the excess amount can be eliminated and reduced to zero for as low as $6.49 per day* to $94.90 for an annual policy. You will also need to provide a deposit at the time of picking the car, which is totally refundable. For the majority of vehicles, this is set at €900.

See How Much You Can Save on Your Sixt Car Rental Insurance

Get StartedHow does CarInsuRent differ from Sixt LDW?

- CarInsuRent car hire excess insurance starts from as low as $6.49 per day* to $94.90 for an annual policy. Sixt LDW for damage & theft waiver Can be purchased separately for US$ 22.45 per day. Note that if you purchase Sixt LDW for Damage you are still liable for excess €900.

- Sixt Roadside Assistance Protection covers tyre & glass / Replacement keys costs can be purchased separately for an extra fee of US$ 5.39 per day. CarInsuRent car hire excess waiver insurance covers damage to the rental car’s windscreen, auto glass, tyres, undercarriage or roof and is included at the price of the policy.

- CarInsuRent covers baggage and personal belongings – up to US$ 1,500 included at the price.

- CarInsuRent covers the replacement of a lost or stolen Rental Car key.

- CarInsuRent covers exorbitant rental company fees added to your repair bill – including fees for loss of use, processing, relocation and towing.

- CarInsuRent covers single-vehicle accidents – claim even if the damage or theft to your car was not your fault.

- CarInsuRent offers annual worldwide car hire excess Insurance for hiring cars around the world for up to 45 days.

Here’s How CarInsuRent Car Hire Excess Insurance saved Our Client a Significant Amount of Money

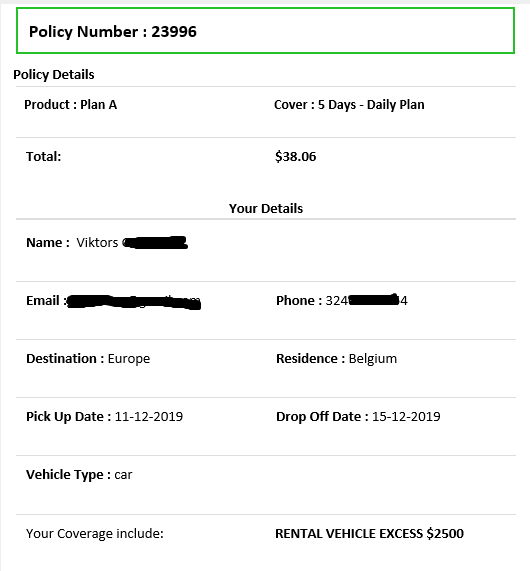

Mr .Viktor, a customer from Belgium, rented a Volvo XC40 for 4 days at Charles de Gaulle airport. Despite declining the rental company’s insurance coverage due to its high cost, Viktor decided to purchase standalone car hire excess insurance from CarInsuRent after reading about its benefits.

Copy of Viktor Car Hire Excess Policy

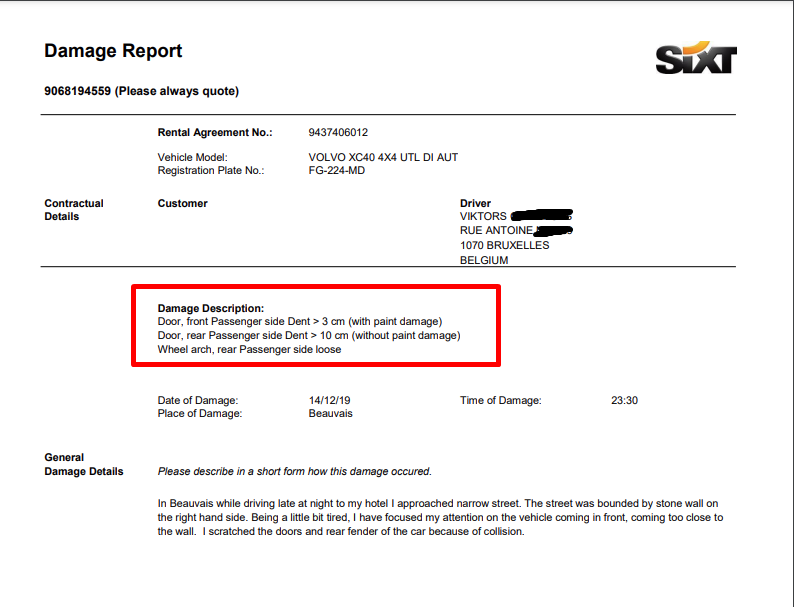

While driving in Beauvais late at night to his hotel, he approached a narrow street. The street was bounded by stone wall on the right hand side. Being a little bit tired, he focused his attention on the vehicle coming in front, coming too close to the wall. Viktor scratched the doors and rear fender of the rental car because of the collision.

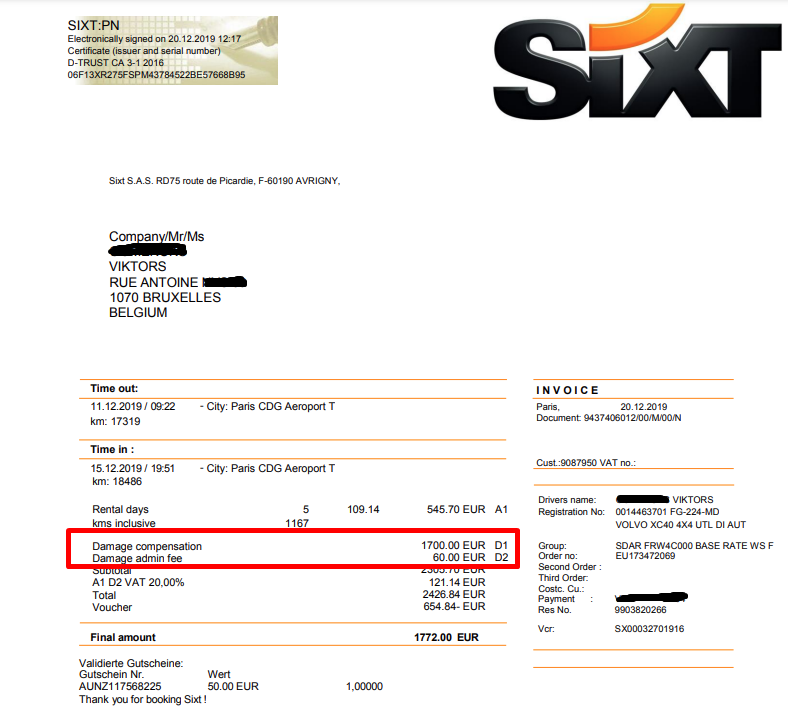

Sixt Damage Report

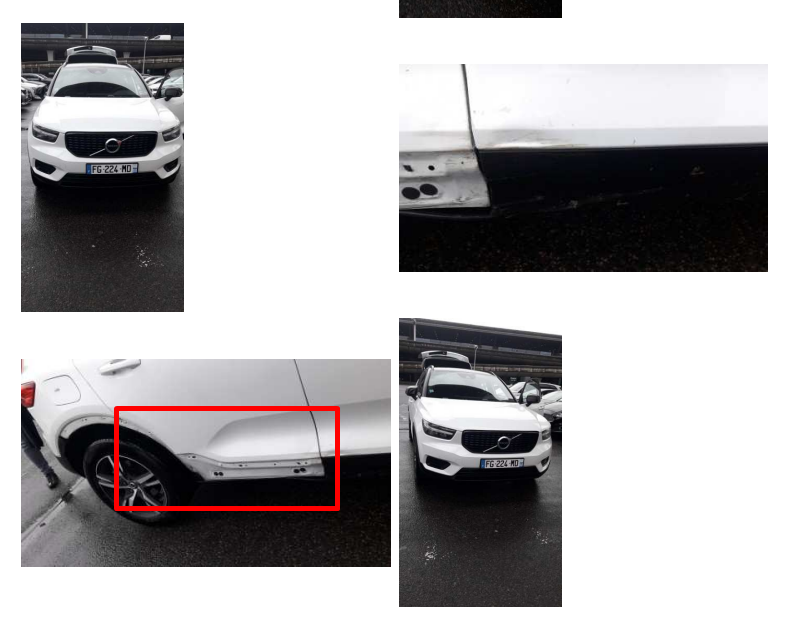

Images of Viktor Damage to Sixt Rental car

Unfortunately, Sixt charged Mr. Viktor EUR 1,760 + VAT for the damage.

Sixt Repair Cost

However, Viktor had purchased car hire excess insurance, which covered the excess amount he would have to pay in such situations. As a result, he was able to file a claim with CarInsuRent, and we reimbursed him for the repair costs incurred by the rental company. This saved Viktor thousands of Euros, as he only had to pay US$ 38.06 for the car hire excess coverage instead of the full repair bill.

How much could you save on Car Hire Excess Insurance for Your Sixt car hire?

We compared and analyzed Super Collision Damage Waiver costs for a 7-day rental of a standard car class (July 1st – July 7th). The car rental insurance rates listed here are subject to change by the car rental companies without notice. For the most up-to-date pricing information, we encourage you to request a free online quote prior to booking.

CarInsuRent’s car hire excess protection for rental vehicles in Europe offers the same coverage at a 70% lower cost!

| Country | Sixt Loss Damage Waiver | Avg. Super Collision Damage Waiver Cost at Counter* | Avg. Insurance Deductible at Counter* | Avg. Cost for Rental Car Excess Insurance with CarInsuRent |

| France | $ 6.70 / day | $ 33.56 | $ 2,080 | US$ 6.49 per day or US$ 94.90 for annual coverage |

| Germany | Included at the rental price | € 17.82 | € 1,050 | US$ 6.49 per day or US$ 94.90 for annual coverage |

| Iceland | Included at the rental price | € 46.00 | € 1,500 | US$ 6.49 per day or US$ 94.90 for annual coverage |

| Ireland | Included at the rental price | € 27.00 | € 2,700 | US$ 6.49 per day or US$ 94.90 for annual coverage |

| Italy | Included at the rental price | € 29.39 | € 2,300 | US$ 6.49 per day or US$ 94.90 for annual coverage |

| Spain | Included at the rental price | € 31.33 | € 1,850 | US$ 6.49 per day or US$ 94.90 for annual coverage |

Sixt Rental Car Insurance in France

Car hire excess insurance for 10 days rental in Europe with CarInsuRent will cost US$64.90 compared to US$ 414.70 when purchasing the equivalent coverage from Sixt. Total potential saving: US$ 349.80.

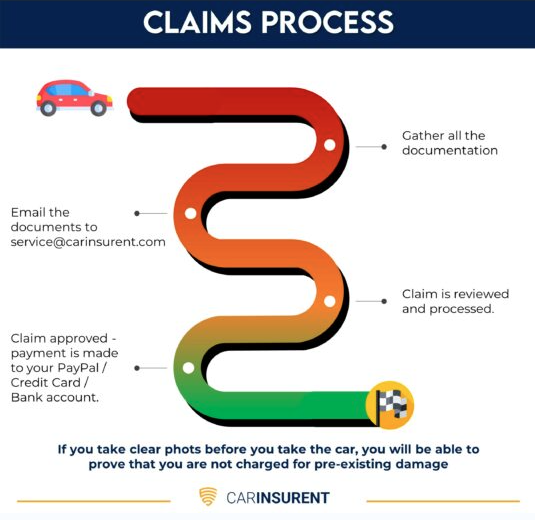

How to File a Claim

What to Do in Case of an Accident or Damage – If you are involved in an accident while driving a rental car, there are certain steps you should follow to file a claim with the rental car insurance company. First, exchange personal information with the other driver, including name, address, license plate number, rental vehicle information, insurance company, and policy number, and document the accident with pictures and notes. If the other driver is at fault, you should get their contact and insurance information and call their insurance company directly to file a claim. If you are at fault or have non-collision damage, you can file a claim with the rental car insurance company. The process for filing a claim with the rental car insurance company may vary depending on the provider, but typically, you would need to provide details of the incident, including the date, time, and location of the accident, as well as any police report numbers, if applicable. Additionally, you may need to provide documentation of the damage, such as photographs or repair estimates.

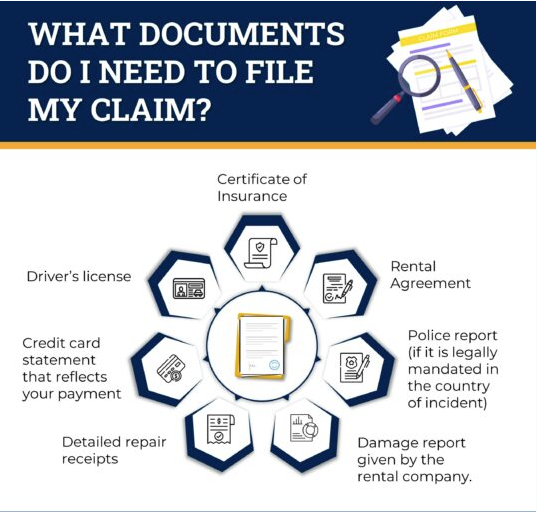

Required Documentation for Filing a Claim

- A copy of the Certificate of Insurance

- A copy of the car rental agreement

- A copy of the police report if:

- you got in an accident with a third party

- It is legally mandated in the country of incident

- your claim is about stolen personal belongings

- A copy of the damage report given by the rental company, detailing each cost incurred. Photographs of the damage are optional but may help ensure that the charges are reasonable.

- Detailed repair receipts, invoices or other documents showing the breakdown of the amount the rental company charged you for the accidental damage or loss

- A copy of your credit card statement that reflects your payment for the claimed damages

- A copy of the driver’s license of the person driving the car during the accident

What Documents Do I Need to File My Claim?

Tips for a Smooth Claims Process: Filing an insurance claim can be a complicated and stressful process. The following tips can help ensure a smoother claims process:

- Document everything: Documenting all the details of the accident or loss, including taking photos and notes, can help speed up the claims process and reduce the possibility of disputes.

- Communication: Communication is key in any insurance claim process. Keep thorough records of all communication with the insurer, and discuss your expectations for the claims process with the adjuster. You can also ask about the frequency of updates and the preferred type of communication.

- Avoid duplicate claims: Avoid submitting duplicate claims, as it slows down the claims payment process and creates confusion.

- Understand your coverage: It’s important to understand your insurance coverage, including the limits and deductibles, before filing a claim. Understanding your policy can help ensure that you receive the maximum benefit to which you are entitled.

- Be patient: Claims processing can take time, so it’s important to be patient.

By following these tips, you can help ensure a smoother claims process, and increase the chances of receiving the maximum benefit that you are entitled to under your insurance policy.

Claims Process

Final Thoughts and Recommendations

In conclusion, having car rental insurance with Sixt is not mandatory. Sixt offers several auto insurance products to cover your rental car. While LDW is a part of your rental fee, there is an excess. You purchase Excess Protection, a package offered by Sixt, that lowers the excess for the majority of cars to zero. The daily fee for this service is US$ 5.71 – US$ 41.47, depending on the type of coverage you choose.

Sixt’s collision damage waiver can be the best option if you want the greatest level of comfort and are willing to pay for it. You can save money by shopping around and buy car rental insurance online for as low as $6.49 per day* to $94.90 for an annual policy.

Before choosing an Sixt rental car insurance policy, you should confirm what level of coverage is included with your personal auto insurance policy or the credit card you used to reserve the vehicle. By doing this, you can avoid paying for the same coverage more than once.

Ultimately, understanding the different types of insurance available to you and making an informed decision can help you have a stress-free and affordable car rental experience with Sixt.

See How Much You Can Save on Your Sixt Car Rental Insurance

Get StartedIn conclusion, this article aims to equip you with the knowledge needed to make an informed decision regarding Sixt’s Loss Damage Waiver options. By understanding the coverage, costs, and personal considerations, you can confidently select the LDW option that aligns with your needs and enjoy a worry-free car rental experience with Sixt.

Frequently Asked Questions (FAQ)

No. We provide a single journey plan. You are covered from the time you pick up the rental car up to the time you return it or on the last date written on your Certificate of Insurance, whichever comes first.

No. You should purchase a policy before starting your travel.

Find the answers you’re looking for to the most frequently asked car hire insurance questions as well as other questions relating to our products and services.