Yes. Insurance for a single day is available.

Annual Car Hire Excess Insurance from US$ 94.90

Sorting out car hire can be one of the most stressful parts of arranging a vacation. Even with a relatively good-value deal there is the worry that when you arrive the desk will have closed for the evening, or run out of cars or given yours to someone else etc., or you will be subjected to unpleasant hard-sell tactics.

See How Much You Can Save on Your Annual Car Hire Excess Insurance

Get StartedAnnual Car Hire Excess Insurance Coverage Chart

| Warranty | What does it cover? | How much does it cover? |

|---|---|---|

| Damage due to collision or theft | Reimbursement of the deductible applied by the rental company as a result of accidental damage caused to the vehicle, including tires, windshield, underbody and other parts | $ 2,500 - $ 4,500 |

| Improper Fuel Use Charges | Tank emptying costs and vehicle towing, when the wrong fuel is refueled into the vehicle by mistake. | $ 500 |

| Loss or theft of keys | In the replacement of lost or stolen keys, including lock and locksmith costs. | $ 500 |

| Towing charges | Covers the tow truck of the rented car in the event of a breakdown or accident. | $ 500 |

| Vehicle return charges | If as a result of an accident or illness with hospitalization you cannot return the vehicle. | $ 250 |

| Personnal belongings | In case your baggage, personal belongings or valuables are taken, permanently lost or unintentionally damaged during your trip | $ 500 |

| Hotel expensses | If You are unable to use your rental vehicle as a result of it being stolen or damaged | $ 150 |

Vehicle rental excess insurance

What is insured?

- Excess reimbursement up to US$ 4,500

- Damage Waiver (LDW) up to US$ 4,500

- Towing charges up to US$ 500

- Improper fuel charges up to US$ 500

- Loss or theft of keys up to US$ 500

- Vehicle return charges up to US$ 250

- Personnal belongings up to US$ 500

- Hotel expenses up to US$ 150

What is not covered?

- Damage to the vehicle or property of a third party

- Damage caused by a person not authorized to drive the rented vehicle

- Mechanical failure of the rented vehicle

- Loss or damage to the vehicle’s interior that is not related to a collision.

- Parking tickets or fines, traffic violations and such

- Any loss that occurs outside the validity of the insurance

- Any rental contract of more than 45 days

Is the coverage subject to any type of restrictions?

- Any claim resulting from a direct breach of any of the terms and conditions of your rental agreement

- Any person under 21 or above 84 years of age

- Rentals that begin or end outside the insurance period, as indicated on the insurance certificate

- The policyholder must be designated as the main driver in the rental agreement

- The maximum amount that can be claimed for a single loss is US$ 4,500

- Damage to Recreational vehicles (RVs) / Motorhomes / Campervans (unless you have purchased a specific cover)

- Damage to vehicles provided by a peer-to-peer vehicle rental service platform or a subscription vehicle service is excluded (unless purchased specific coverage)..

Where do I have coverage?

- Anywhere in the world except trips in, to or through Afghanistan, Cuba, Congo, Iran, Iraq, Ivory Coast, Liberia, North Korea, Myanmar, Russia, Sudan, Syria, Ukraine and Zimbabwe

What are my obligations?

- When applying for your policy, you must exercise reasonable care to honestly and carefully answer any questions asked.

- You must take all reasonable steps to avoid or reduce any loss (for example, you must report accidents or other damage to your rental company nd to CarInsuRent as soon as reasonably possible).

- If you make a claim, you must provide the documents and other evidence that claims handlers need to process your claim.

- You must repay any sums to which you are not entitled (for example, if we pay your claim for an accident which is later compensated by a third party).

- You must not violate the terms of the rental agreement.

When and how do I make the payment?

- The premium must be paid in full before the policy start date. Payment can be made by credit or debit card or PayPal through our website

What is the start and end date of coverage?

- As set out in the insurance certificate, as agreed in the application process, your policy will cover you from the start date and time of your booking to the end date and time of your booking.

How do I cancel the contract?

- You can cancel your policy before the start date or within 14 days from your purchase through our customer service team.

Amazing service. always efficient, friendly, responsive. I got my payment within days of submission. Bill is warm. A pleasure to work with them. highly recommended. I feel safe with them.

The Basics of Car Hire Excess Insurance Policy

Excess reduction is optional coverage from car rental companies, which reduces the renter’s financial liability if the vehicle is damaged or stolen. The maximum limit is reduced in the case a claim has already occurred.

What is Super Collision Damage Waiver (SCDW)?

Super Collision Damage Waiver (SCDW) is an upgraded form of Collision Damage Waiver (CDW) offered by rental car companies. It significantly reduces the lessee’s financial liability in case of damage to the rental vehicle. While CDW typically comes with a deductible or excess amount that the renter is responsible for in case of damage, SCDW lowers or eliminates this excess, providing more comprehensive coverage. Essentially, SCDW serves as a means for renters to minimize their out-of-pocket expenses in case of accidents or damages to the rented vehicle during the rental period.

What is the Best Way to Get the Cheapest Car Rental Insurance?

Purchasing SCDW directly from the rental company would not be the best deal, and it will probably always be more expensive than other alternatives.

With CarInsuRent, your car hire excess insurance will be paid daily or annually, depending on the type of coverage you choose.

We encourage you to shop around, compare deals online, get a few quotes that will assist you to find the best deal. Keep in mind that car hire excess insurance comparison is not only for the best price and you should search and read some car hire excess insurance reviews as well.

See How Much You Can Save on Your Annual Car Rental Insurance

Get StartedAnnual Car Hire Excess Insurance – Reducing your Rental Car Insurance Excess

When you rent a car, the price usually includes insurance cover for a major crash or write-off, but But many car hire insurance policies impose an insurance excess of several hundred Euros. This leaves you with the bill for the first €900-€2,500 – the excess – after an accident. Car rental companies make their profits by selling add-ons, and in particular overpriced excess insurance. Car hire firms try to persuade you to buy “super CDW” insurance to bring the excess down to zero – but they charge as much as €25 per day for limited cover. It doesn’t generally cover damage to the roof, tyres, window and undercarriage of the car.

Here’s How CarInsuRent Annual Car Hire Excess Insurance Saved Our Client a Significant Amount of Money

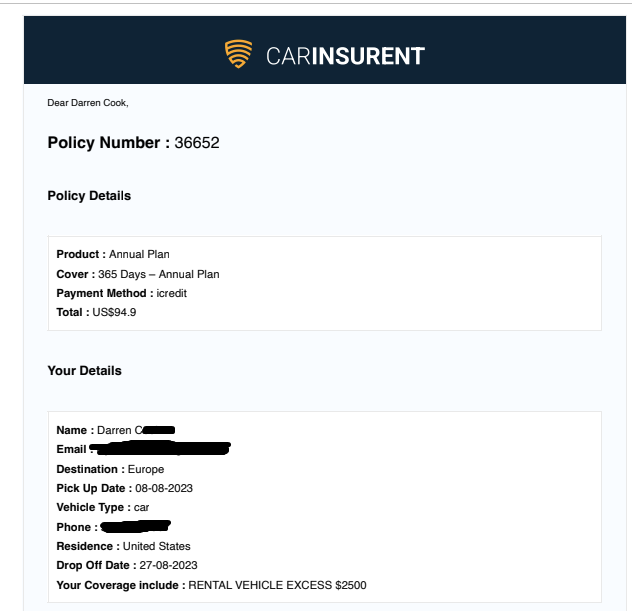

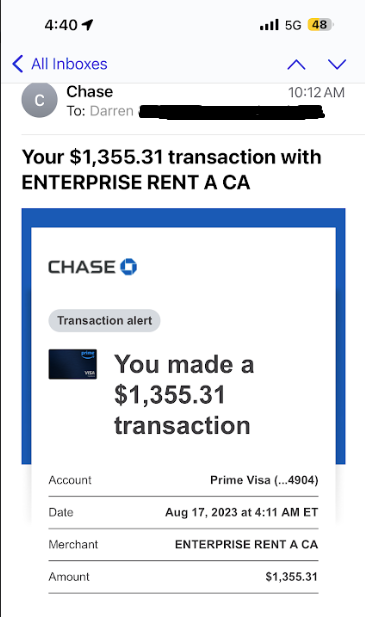

Mr. Darren C, rented a vehicle from Enterprise in Spain. Despite declining the rental company’s insurance coverage due to its high cost, Darren decided to purchase standalone annual car hire excess insurance from CarInsuRent after reading about its benefits.

Copy of Mr. Darren C. Car Hire Excess Policy

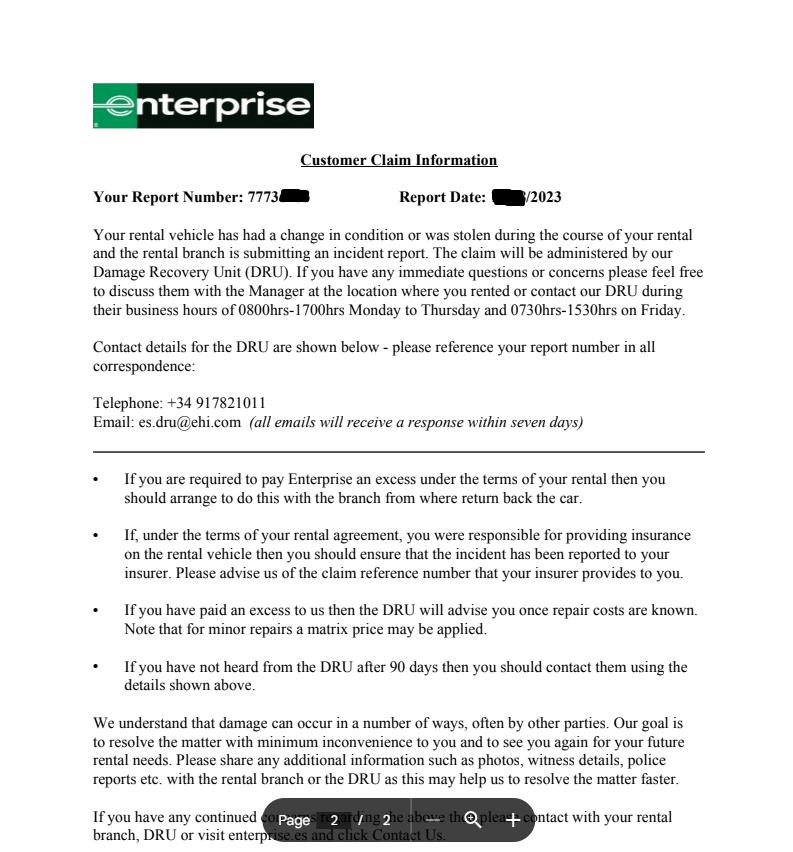

After Darren returned the rental vehicle, he received a letter from Enterprise stating that the rental car was damaged during his rental.

Enterprise Damage Recovery Unit Notification

Enterprise Damage to Rental Car

Unfortunately, Enterprise charged Darren US$ 1,355.31 for the damage.

Enterprise Damage – Repair Cost

However, Darren had purchased annual car hire excess insurance, which covered the excess amount he would have to pay in such situations. As a result, he was able to file a claim with CarInsuRent, and we reimbursed him for the repair costs incurred by the rental company. This saved Viktor hundreds of Euros, as he only had to pay US$ 94.90 for the car hire excess coverage instead of the full repair bill.

Buy Car Hire Excess Insurance in Advance

We recommend that you don’t hire a car without taking care of the excess on the insurance policy unless you’re happy to pay a hefty bill should the worst happen.

If you are reading this article it means that you’ve understand the risk and that you are aware to the fact that you don’t have to sign up to the policy you’re offered by the car rental company and that you can buy car hire excess waiver insurance from a specialist car hire excess insurance company.

CarInsuRent annual car hire excess insurance policy for Europe is US$ 89.90 (or US$ 115.90 for Worldwide coverage), and covers almost all eventualities – damage to windows, wheels and tyres, undercarriage and roof, misfuelling and the rest of the car up to US$ 2,500 per year. You can hire as many cars as you like for up to 45 days. For shorter rentals you can buy daily cover for US$ 6.50.

If you damage the car, the firms will charge the agreed excess, which you reclaim when you return home.

The drawback is that car hire desks will seek to block around €1,500 on your credit card for the duration of the rental if you don’t buy their insurance. So make sure your card has the capacity before you travel.

How to Find the Right Car Hire Excess Insurance Cover?

- The claims limits, which should be enough to cover your excess

- The price, which needs to be less than the price offered for Super CDW by the rental company to be cost effective.

- The exclusions, so you know what you can claim for

See How Much You Can Save on Your Car Rental Insurance

Get StartedAnnual Car Hire Excess Insurance Policy – the Cheapest Way to Reduce the Car Hire Excess?

You are likely to find that CarInsuRent annual car hire excess insurance policy is cheaper than single trip policies for trips of around 14 days or longer. If you are going on multiple trips across the year and will be hiring a car for these then you may find it better value in the long-term to purchase one annual policy instead of numerous single trip policies.

CarInsuRent offers you the flexibility to cover your car hire excess for a length of time which suits you.

Other Tips to Avoid Car Rental Scams

Check the car thoroughly

When you pick up the car, make sure that you mark every blemish or scratch on the rental agreement. Also check the spare wheel and whether the car is full of fuel (if it is supposed to be), and note down the mileage. We recommend that you take a video or photos as extra proof. When you return the vehicle, ask staff to inspect it and, ideally, to sign a confirmation that there is no new damage.

Vehicle inspection for rental car

Keep hold of the paperwork

After you return the car and even if the rental passed off uneventfully, we recommend that you keep hold of the paperwork. In the following weeks keep an eye on your credit card to make sure promised payments are made, and that you’re not hit with extra charges.

So whether you hire a car regularly or just for a few days per year, we can provide a cover period to match. If you have any further queries please contact our customer service center either by email or over the phone within our office hours and we will be happy to help you.

FAQ

Is it worth buying car hire excess insurance?

If you are renting a car, 3rd party car hire excess insurance could save you a lot of money. If you are renting a vehicle a few times during the year or if you rent a vehicle for a long term, you are likely to find that CarInsuRent annual car hire excess insurance policy is cheaper than single trip policies for trips of around 14 days or longer.

What is normal excess on hire car?

If you are renting the vehicle and the rental vehicle is damaged, you can cover the excess costs. For the average SUV, this is generally around $800 – 3,500. Car rentals often upsell a hefty day charge to reduce your excess to $0-$350.

What is the best way to cover rental car excess?

The best way to cover rental car excess is by purchasing standalone car hire excess insurance, also known as excess waiver insurance. This policy provides coverage for the excess amount charged by the rental company in case of damage or theft of the rental vehicle. It’s often more cost-effective than purchasing excess reduction directly from the rental company and offers broader coverage.

6 Responses

Leave a Reply

Frequently Asked Questions (FAQ)

No. We provide a single journey plan. You are covered from the time you pick up the rental car up to the time you return it or on the last date written on your Certificate of Insurance, whichever comes first.

No. You should purchase a policy before starting your travel.

Find the answers you’re looking for to the most frequently asked car hire insurance questions as well as other questions relating to our products and services.

I am renting two different cars in two different countries (France and Portugal). It is essentially one trip, two weeks in France and 2 weeks in Portugal. Should i take out the annual or single trip policy? My quote was $85.00 for the annul cover. I want to make sure that it is a once-off annual payment, not a monthly deduction from my account, Thank you in advance.

Good morning James.

Thank you for taking the time to contact us.

The annual policy is billed only once – when you place your order. There is no recurring fee, and a friendly reminder to renew the policy (with a loyalty discount) is sent after 11 months.

You are not obligated to renew the policy (although we hope that the discount will drive you to do so).

I hope that I have addressed your question and concerns.

Have a safe trip.

The CarInsuRent Team

I have problems buying annual policy using your website. There is always some issues – either the dates cannot be chosen, or the button for changing plan A to plan B is not working. Fix these issues, please!

Thank you for the auspicious writeup. It in fact was a leisure reading it.

Great amazing things here. I am very happy to look your article. Thank you a lot and i’m taking a look ahead to touch you. Will you please drop me a mail?

Thank you for the interesting tips.