Yes. Insurance for a single day is available.

Car Hire Excess Insurance USA & Canada

When selecting car hire excess insurance for your trip to the USA, consider our comprehensive coverage to ensure peace of mind throughout your journey. Our policy provides protection against excess costs of up to US$ 4,500 in case of damage or theft to your rental vehicle, offering reassurance and financial security. With coverage tailored to drivers aged between 21 and 84, we cater to a wide range of travelers, ensuring that you can embark on your adventure with confidence.

See How Much You Can Save on Your Car Hire Excess Insurance USA

Get StartedCar Hire Excess Insurance USA Coverage Chart

| Warranty | What does it cover? | How much does it cover? |

|---|---|---|

| Damage due to collision or theft | Reimbursement of the deductible applied by the rental company as a result of accidental damage caused to the vehicle, including tires, windshield, underbody and other parts | $ 2,500 - $ 4,500 |

| Improper Fuel Use Charges | Tank emptying costs and vehicle towing, when the wrong fuel is refueled into the vehicle by mistake. | $ 500 |

| Loss or theft of keys | In the replacement of lost or stolen keys, including lock and locksmith costs. | $ 500 |

| Towing charges | Covers the tow truck of the rented car in the event of a breakdown or accident. | $ 500 |

| Vehicle return charges | If as a result of an accident or illness with hospitalization you cannot return the vehicle. | $ 250 |

| Personnal belongings | In case your baggage, personal belongings or valuables are taken, permanently lost or unintentionally damaged during your trip | $ 500 |

| Hotel expensses | If You are unable to use your rental vehicle as a result of it being stolen or damaged | $ 150 |

Vehicle rental excess insurance

What is insured?

- Excess reimbursement up to US$ 4,500

- Damage Waiver (LDW) up to US$ 4,500

- Towing charges up to US$ 500

- Improper fuel charges up to US$ 500

- Loss or theft of keys up to US$ 500

- Vehicle return charges up to US$ 250

- Personnal belongings up to US$ 500

- Hotel expenses up to US$ 150

What is not covered?

- Damage to the vehicle or property of a third party

- Damage caused by a person not authorized to drive the rented vehicle

- Mechanical failure of the rented vehicle

- Loss or damage to the vehicle’s interior that is not related to a collision.

- Parking tickets or fines, traffic violations and such

- Any loss that occurs outside the validity of the insurance

- Any rental contract of more than 45 days

Is the coverage subject to any type of restrictions?

- Any claim resulting from a direct breach of any of the terms and conditions of your rental agreement

- Any person under 21 or above 84 years of age

- Rentals that begin or end outside the insurance period, as indicated on the insurance certificate

- The policyholder must be designated as the main driver in the rental agreement

- The maximum amount that can be claimed for a single loss is US$ 4,500

- Damage to Recreational vehicles (RVs) / Motorhomes / Campervans (unless you have purchased a specific cover)

- Damage to vehicles provided by a peer-to-peer vehicle rental service platform or a subscription vehicle service is excluded (unless purchased specific coverage)..

Where do I have coverage?

- Anywhere in the world except trips in, to or through Afghanistan, Cuba, Congo, Iran, Iraq, Ivory Coast, Liberia, North Korea, Myanmar, Russia, Sudan, Syria, Ukraine and Zimbabwe

What are my obligations?

- When applying for your policy, you must exercise reasonable care to honestly and carefully answer any questions asked.

- You must take all reasonable steps to avoid or reduce any loss (for example, you must report accidents or other damage to your rental company nd to CarInsuRent as soon as reasonably possible).

- If you make a claim, you must provide the documents and other evidence that claims handlers need to process your claim.

- You must repay any sums to which you are not entitled (for example, if we pay your claim for an accident which is later compensated by a third party).

- You must not violate the terms of the rental agreement.

When and how do I make the payment?

- The premium must be paid in full before the policy start date. Payment can be made by credit or debit card or PayPal through our website

What is the start and end date of coverage?

- As set out in the insurance certificate, as agreed in the application process, your policy will cover you from the start date and time of your booking to the end date and time of your booking.

How do I cancel the contract?

- You can cancel your policy before the start date or within 14 days from your purchase through our customer service team.

Amazing service. always efficient, friendly, responsive. i got my payment within days of submission. Bill is warm. A pleasure to work with them. highly recommended. I feel safe with them.

Car Rental Insurance for USA Explained

When renting a car in the USA, it’s important to understand the types of car rental insurance that may be available to you. Here are some key points to consider:

- Collision Damage Waiver (CDW): This type of insurance is highly recommended in the USA as it limits your liability for vehicle damage in case of an accident. However, it’s worth noting that CDW usually has a deductible amount, which means you may still be responsible for a portion of the repair costs.

- Theft Protection (TP): This type of insurance removes the driver’s responsibility in case of the vehicle being stolen.

- Super Collision Damage Waiver (SCDW) is an optional car rental insurance that reduce your deductible amount for CDW and TP insurance. This means that if you have an accident or theft, you’ll be responsible for a smaller amount of the repair costs.

- Supplemental Liability Insurance (SLI): Most states in the US do not require SLI as rental car insurance and so the car rental prices reflect that. However, you need to check the states you intend to travel to for more information. In Canada too, third-party liability is included in the car rental and you can opt-out of buying SLI.

- Personal Accident Insurance (PAI) – If you are in an accident, Personal Accident Insurance will pay for your passengers’ and your own medical bills. This covers expenses for hospital stays, ambulance rides, and even death benefits.

It’s important to note that the availability and specifics of USA car rental insurance options may vary depending on the car rental company and the type of car you’re renting. Before renting a car in USA, it’s important to do your research and understand the insurance options that are available to you. You can also request a free online quote to get more information on pricing and coverage options.

Why Is It Important To Buy a Collision Damage Waiver USA?

Collision damage waiver (CDW) is not insurance as it is primarily offered by rental agencies. One of the main benefits of CDW insurance USA is that it can provide peace of mind and protect you from having to pay for expensive repairs or the full value of the rental vehicle in case of an accident. It can help minimize your financial responsibility and potentially save you from significant out-of-pocket expenses. However, you still have to pay a sum, also known as “excess” or “deductible”, depending on your plan.

What are Your Options to Reduce the Excess?

Purchase SCDW Directly With the Rental Company

You can only purchase Super Collision Damage waiver (SCDW) from the rental agency. The amount is charged per day and depends on the type of car, agency, location, and duration.

Pros –

- Offers a quick solution and is helpful to travelers who are in a hurry or don’t have any insurance cover.

- No waiting for reimbursements.

Cons –

- The charges are very high, often exceeding the car rent.

- You still have to pay a reduced amount if there’s any damage.

- Only the bodywork of the car is covered and parts like glass, undercarriage, windscreen, and tires are excluded.

- Vandalism or theft of parts is not covered.

Cover Your Excess Through CarInsuRent

The excess cover insurance offered by insurance companies like CarInsuRent offers a better alternative. For a lesser premium payment, your excess liability for the rental vehicle is covered or greatly reduced. It is advisable that you buy excess waiver insurance before you go and save your hard-earned money, time, and peace of mind.

What is Covered By CarInsuRent USA Car Hire Excess Insurance?

- Excess liability up to your benefit limit – US$2,500 / US$3,500 / US$4,500.

- Your excess liability for the rental vehicle for theft or damage due to collision or vandalism. The policy covers the whole car including glass, windscreen, undercarriage, roof, and tires.

- The damages to others in the event of an accident.

- Stolen or damaged baggage or personal belongings.

- Lost or stolen car keys.

Pros –

- Car hire excess insurance offers a comprehensive insurance cover for your hire car.

- You can enjoy your holiday without worrying about the car.

Cons –

- You have to pay the excess upfront and CarInsuRent will reimburse you the excess charges according to your benefit limit.

Read More: How does reimbursement insurance work?

Personal auto insurance policies

- Personal auto insurance policies may cover rental cars, but it depends on the policy and the coverage. If the policy includes collision and comprehensive coverage, it may extend to rental cars. However, liability coverage may not extend to rental cars, so it’s important to check with the insurance company before renting a car.

Travel insurance –

- Travel insurance may offer coverage for rental cars, including collision damage and theft protection. However, it is important to check the policy to confirm the coverage and any limitations or exclusions.

Credit card rental car insurance benefits –

- Some credit cards offer rental car insurance benefits, which may include coverage for damage and theft. However, the coverage and limitations can vary by credit card, so it’s important to check with the credit card company to confirm the coverage. Check if your personal insurance or credit card covers Italy rental car insurance.

Don’t Buy Any Additional Insurance At All

- You are not required by law to buy a Rental Vehicle Excess Insurance or a Collision Damage Waiver. Such products are completely optional. In case of an accident (whether major or minor), rental companies would quickly bill your credit card the maximum damage. Excess fee can reach $3,000–$6,500 depending on the car rental company and the type of car you rented.

Read More: Purchasing car rental excess insurance Pros and Cons

What Should You Do In The Event Of a Rental Car Accident?

- Assess if you and others are safe and unharmed.

- Try to record the nature and the extent of the damage. Try to get eyewitness accounts of what happened.

- Call your rental agency and inform them. You should also inform them if you need any towing.

- Call your insurance service provider.

Car Rental Insurance in California

Car rental insurance in California is an important consideration for anyone planning to rent a car in the state. California law requires car rental companies to provide minimum liability coverage to protect drivers and other parties in case of accidents. Here is some key information about car rental insurance in California:

- Liability Coverage: Rental car companies in California are required to offer liability insurance that meets the state’s minimum requirements. This coverage typically includes Bodily Injury Liability (BIL) and Property Damage Liability (PDL) coverage. BIL covers medical expenses and lost wages for injured parties, while PDL covers property damage caused by the rental vehicle.

- Optional Insurance: In addition to the mandatory liability coverage, car rental companies may offer optional insurance coverage, such as Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW). These options can provide additional protection for the rental vehicle against damage or theft. It’s important to carefully review the terms and conditions of these optional coverages to understand their limitations and exclusions.

- Personal Auto Insurance: If you have personal auto insurance, it may extend coverage to hire cars in California. Check with your insurance provider to confirm if your policy includes rental car coverage and the extent of that coverage. Keep in mind that deductibles and coverage limits may still apply.

- Credit Card Coverage: Some credit cards offer hire car insurance as a benefit when you use the card to pay for the rental. It’s essential to understand the specific terms and conditions of your credit card’s rental car insurance coverage, including any limitations or exclusions.

Car Rental Insurance in Florida

Car rental insurance in Florida is an important consideration for travelers. In the state of Florida, the minimum required insurance coverage for rental cars is typically the same as the state’s minimum liability insurance requirements for personal vehicles. This means that rental car drivers must carry at least the minimum amount of liability coverage required by law. Additionally, it’s important to note that personal auto insurance policies may not automatically extend coverage to rental cars, so it’s advisable to check with your insurance provider beforehand. In Florida, car rental companies often offer supplemental insurance options such as Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW) which can provide additional coverage for damage or loss of the rental vehicle.

CarInsuRent is a reputable provider of car rental insurance in California, offering coverage options to ensure peace of mind during your rental period. When renting a car in California, it’s important to have adequate insurance coverage to protect yourself and the rental vehicle against potential risks and damages. CarInsuRent specializes in providing car hire excess insurance, which helps cover the excess cost that you may be responsible for in the event of an accident or damage to the rental vehicle. Car excess insurance from CarInsuRent can refund the entire excess cost, up to a certain limit, depending on the policy and benefits cap. This coverage is available to both residents and non-residents driving in the European Union (EU) or the United Kingdom (UK). With CarInsuRent, you can have the peace of mind knowing that you’re protected against unexpected expenses that may arise from accidents or damages to the rental car. CarInsuRent car hire excess insurance starts from as low as $6.49 per day* to $94.90 for an annual policy. Our policies covers the excess on damage and theft up to $4500 and provide full protection that Includes single vehicle damage, roof and undercarriage damage, auto glass and widescreen damage, towing expenses, misfuelling, loss of car key and tire damage. We cover multiple drivers between the ages of 21 and 84 years.

Florida Car Rental Insurance Requirements

In Florida, car rental insurance requirements are similar to the state’s minimum liability insurance requirements for personal vehicles. When renting a car in Florida, drivers are typically required to carry at least the minimum amount of liability coverage mandated by law. The minimum liability insurance coverage in Florida includes $10,000 for Personal Injury Protection (PIP) and $10,000 for Property Damage Liability (PDL).

It’s important to note that personal auto insurance policies may not automatically extend coverage to rental cars, so it’s advisable to check with your insurance provider beforehand. If your personal policy does not provide coverage for rental cars or if you don’t have personal auto insurance, you will need to consider obtaining insurance through the rental car company or a third-party provider.

Car rental companies in Florida often offer supplemental insurance options, such as Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW). These options can provide additional coverage for damage or loss of the rental vehicle. However, it’s essential to carefully review the terms and conditions of these insurance options as they may come with certain limitations or exclusions.

Before renting a car in Florida, it’s crucial to understand the insurance requirements and options available to you. Make sure to familiarize yourself with the specific coverage offered by the rental car company, consider your personal insurance situation, and assess your comfort level with assuming certain risks. By being well-informed and prepared, you can ensure that you have adequate insurance coverage during your car rental experience in Florida.

Car Rental Insurance in Ontario

Car rental insurance in Ontario, Canada, is an important consideration for individuals planning to rent a car in the province. Here is some key information about car rental insurance in Ontario:

- Mandatory Coverage: In Ontario, car rental companies are required by law to provide minimum liability coverage, including Third Party Liability (TPL) coverage, to protect drivers and other parties in case of accidents. This coverage helps cover the costs of injuries or damages caused to other individuals or their property.

- Optional Coverage: In addition to the mandatory liability coverage, car rental companies in Ontario offer optional insurance coverage that customers can choose to purchase. This may include Collision Damage Waiver (CDW), which covers damage to the rental vehicle, and Loss Damage Waiver (LDW), which covers the loss or theft of the rental vehicle. These optional coverages provide additional protection and can help minimize your financial responsibility in case of damage or theft. CarInsuRent car excess insurance starts from as low as $6.49 per day* to $94.90 for an annual policy. Our policies covers the excess on damage and theft up to $4500 and provide full protection that Includes single vehicle damage, roof and undercarriage damage, auto glass and widescreen damage, towing expenses, misfuelling, loss of car key and tire damage. We cover multiple drivers between the ages of 21 and 84 years.

- Personal Auto Insurance: If you have a personal auto insurance policy in Ontario, it may extend coverage to rental cars. Contact your insurance provider to confirm if your policy includes rental car coverage and the extent of that coverage. Keep in mind that deductibles and coverage limits may still apply.

- Credit Card Coverage: Some credit cards offer car hire insurance as a benefit when you use the card to pay for the rental. Check with your credit card issuer to understand the specific terms and conditions of the rental car insurance coverage provided.

- Reviewing Options: Before renting a car in Ontario, carefully review the Ontario car rental insurance options available to you. Consider your personal insurance coverage, any coverage offered by the rental car company, and additional options like credit card coverage. By understanding the available options and making informed decisions, you can ensure you have appropriate insurance coverage during your car rental experience in Ontario.

Remember to thoroughly review the terms and conditions of any insurance coverage offered by the rental company and consult with your insurance provider to understand the specifics of your personal coverage. This will help you make the best decision regarding car rental insurance in Ontario and ensure you have adequate protection during your rental period.

Rental Car Insurance in Hawaii: What Should You Know?

When planning a trip to Hawaii and renting a car, it’s important to understand the ins and outs of car hire insurance. Here’s what you should know:

- Mandatory Liability Coverage: In Hawaii, car rental companies are required by law to provide minimum liability coverage. This coverage protects you and others in the event of an accident, covering the costs of injuries or damages caused to third parties or their property.

- Optional Collision Damage Waiver (CDW): Rental car companies typically offer a Collision Damage Waiver (CDW) as an optional coverage. CDW protects you from financial responsibility for damages to the rental car due to accidents, theft, or vandalism. However, it’s essential to carefully review the terms and conditions of the CDW, including any deductibles or limitations. CarInsuRent car hire excess insurance starts from as low as $6.49 per day* to $94.90 for an annual policy. Our policies covers the excess on damage and theft up to $4500 and provide full protection that Includes single vehicle damage, roof and undercarriage damage, auto glass and widescreen damage, towing expenses, misfuelling, loss of car key and tire damage. We cover multiple drivers between the ages of 21 and 84 years.

- Personal Auto Insurance: Check with your personal auto insurance provider to understand if your policy covers hire cars in Hawaii. Your existing coverage may extend to rental cars, offering you protection without the need for additional insurance. Be sure to verify the extent of coverage and any applicable deductibles.

- Credit Card Coverage: Some credit cards provide rental car insurance as a benefit when you use the card to pay for the rental. Review your credit card’s terms and conditions to determine if it offers rental car coverage. Keep in mind that coverage may vary depending on the card issuer and the specific car rental agreement.

Consider your personal circumstances, risk tolerance, and the value of the rental car when deciding on insurance options. Evaluate the coverage provided by the rental company, your personal insurance, and any additional coverage options to determine the level of protection that best suits your needs. Remember, rental car insurance is not mandatory in Hawaii, but it’s crucial to make an informed decision based on your specific situation. Carefully review your existing insurance coverage, explore optional insurance offered by the rental company, and consider credit card benefits. By understanding the options and assessing your needs, you can ensure you have the appropriate level of coverage for a worry-free car rental experience in Hawaii.

How to File a Claim

What to Do in Case of an Accident or Damage – If you are involved in an accident while driving a rental car, there are certain steps you should follow to file a claim with the rental car insurance company. First, exchange personal information with the other driver, including name, address, license plate number, rental vehicle information, insurance company, and policy number, and document the accident with pictures and notes. If the other driver is at fault, you should get their contact and insurance information and call their insurance company directly to file a claim. If you are at fault or have non-collision damage, you can file a claim with the rental car insurance company. The process for filing a claim with the rental car insurance company may vary depending on the provider, but typically, you would need to provide details of the incident, including the date, time, and location of the accident, as well as any police report numbers, if applicable. Additionally, you may need to provide documentation of the damage, such as photographs or repair estimates.

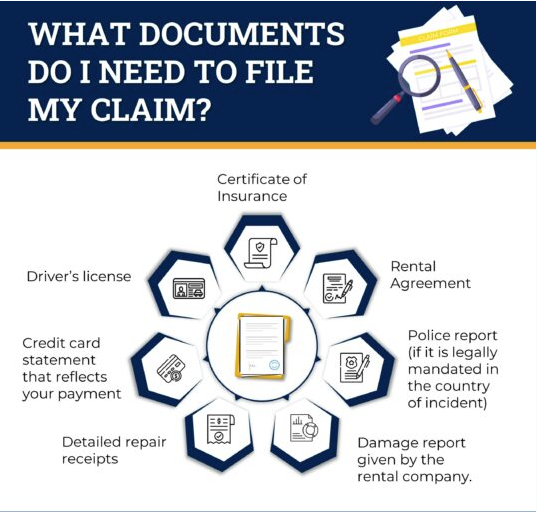

Required Documentation for Filing a Claim

- A copy of the Certificate of Insurance

- A copy of the rental agreement

- A copy of the police report if:

- you got in an accident with a third party

- It is legally mandated in the country of incident

- your claim is about stolen personal belongings

- A copy of the damage report given by the rental company, detailing each cost incurred. Photographs of the damage are optional but may help ensure that the charges are reasonable.

- Detailed repair receipts, invoices or other documents showing the breakdown of the amount the rental company charged you for the accidental damage or loss

- A copy of your credit card statement that reflects your payment for the claimed damages

- A copy of the driver’s license of the person driving the car during the accident

What Documents Do I Need to File My Claim?

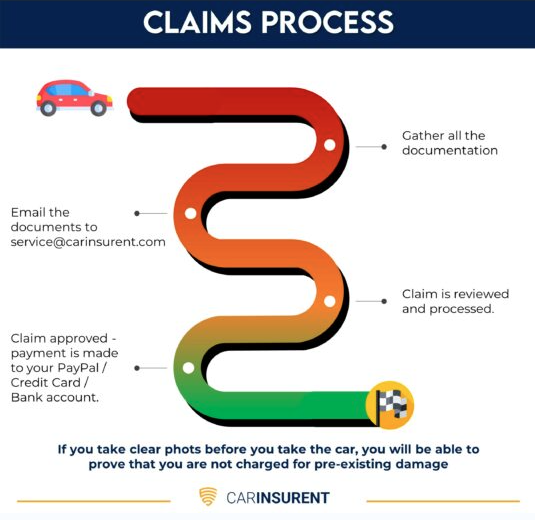

Tips for a Smooth Claims Process: Filing an insurance claim can be a complicated and stressful process. The following tips can help ensure a smoother claims process:

- Document everything: Documenting all the details of the accident or loss, including taking photos and notes, can help speed up the claims process and reduce the possibility of disputes.

- Communication: Communication is key in any insurance claim process. Keep thorough records of all communication with the insurer, and discuss your expectations for the claims process with the adjuster. You can also ask about the frequency of updates and the preferred type of communication.

- Avoid duplicate claims: Avoid submitting duplicate claims, as it slows down the claims payment process and creates confusion.

- Understand your coverage: It’s important to understand your insurance coverage, including the limits and deductibles, before filing a claim. Understanding your policy can help ensure that you receive the maximum benefit to which you are entitled.

- Be patient: Claims processing can take time, so it’s important to be patient.

By following these tips, you can help ensure a smoother claims process, and increase the chances of receiving the maximum benefit that you are entitled to under your insurance policy.

Claims Process

Choosing the Best Car Hire Excess Waiver Insurance for Rental Car in the USA

To find the car insurance best suited to you, search and compare the offers from insurance providers near your destination. Go through the customer feedbacks before selecting one. You can also contact us for all your insurance needs and questions.

See How Much You Can Save on Your Car Hire Excess Insurance USA

Get StartedFAQ

Do car rentals in the USA include insurance?

No, you need to buy car rental insurance in addition to the rent.

Do you need extra insurance when renting a car in the USA?

Legally you don’t need extra insurance to rent a car in the USA. When you hire a car in the USA, it is highly recommended to have Collision Damage Waiver (CDW), Loss Damage Waiver (LDW) and Theft Protection (TP) coverage. You may be liable for an excess, which can be hundreds of dollars, thus we recommend that you either purchase Super CDW from the rental company or Excess Waiver Insurance from a 3rd party.

Do I need extra insurance when renting a car in Canada?

If you are visiting Canada from another country you may find that you need to purchase CDW / LDW / TPI separately, as the rental price may not cover this.

What is the best excess waiver insurance for a rental car in the USA?

Search in Google about car rental insurance in the USA. Contact them and compare the offers to find out what is best for you.

Does CarInsuRent offer Insurance for Australian residents?

Yes, as CarInsuRent operates from all over the world – You shouldn’t be an UK citizen or resident in order to buy a policy.

Is Collision Damage Waiver (CDW) the same as Loss Damage Waiver (LDW)?

CDW covers only the body of a car in the event of an accident but LDW also covers the theft or loss of the vehicle.

Do I need Car Hire Excess Insurance when I rent a car in the USA?

No, legally you don’t need a car hire excess insurance in the USA. You may be liable for an excess, which can be hundreds of dollars, thus we recommend that you purchase Excess Waiver Insurance.

Which car hire excess insurance policy is best for Canada car rental?

Cost and offers depending on the customers’ requirements, type of car, and duration of the rent. You can simply submit the form and “Get a Quote” on our website to get a suitable product at an affordable and attractive cost.

How does CarIsnuRent car hire excess insurance work?

This is reimbursement insurance that covers any excess payment to the rental agency. This means that you have to pay excess charges upfront and then get reimbursed by CarInsuRent.

Is damage to windows and tires covered?

Yes, damage to all glass, tires, undercarriage, windscreen, and roof are covered.

Can I purchase CarIsnuRent Excess Waiver Policies if I am not a resident of the UK?

Yes, you can purchase CarIsnuRent Excess Waiver Policies if you are not a resident of the UK.

What do you mean by the annual policy? Can I use it throughout the year?

An annual policy covers the excess insurance for a year. Frequent travellers can benefit from an Annual Car Hire Excess Insurance Policy

Is Florida car rental insurance mandatory?

In Florida, car rental insurance is not mandatory by law. However, car rental companies typically require customers to have some form of insurance coverage in order to rent a vehicle. This requirement is in place to protect both the rental car company and the driver in case of any accidents, damages, or theft that may occur during the rental period.

While car rental insurance is not legally mandated, there are several options available to meet the rental company’s requirements:

- Third party insurance: CarInsuRent is a reputable provider of car rental insurance in Florida, offering coverage options to ensure peace of mind during your rental period. When renting a car in Florida, it’s important to have adequate insurance coverage to protect yourself and the rental vehicle against potential risks and damages. CarInsuRent specializes in providing car hire excess insurance, which helps cover the excess cost that you may be responsible for in the event of an accident or damage to the rental vehicle. Car hire excess insurance from CarInsuRent can refund the entire excess cost, up to a certain limit, depending on the policy and benefits cap. This coverage is available to both residents and non-residents driving in the European Union (EU) or the United Kingdom (UK). With CarInsuRent, you can have the peace of mind knowing that you’re protected against unexpected expenses that may arise from accidents or damages to the rental car.

- Personal Auto Insurance: If you have a personal auto insurance policy, it may extend coverage to rental cars. Contact your insurance provider to confirm if your policy includes coverage for rental vehicles and what the specific terms and conditions are.

- Credit Card Coverage: Some credit card companies offer rental car insurance as a benefit when you use their card to pay for the rental. Check with your credit card issuer to understand the coverage provided and any limitations or requirements.

- Rental Car Company Insurance: Rental car companies typically offer their own insurance options, such as Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW). These policies can provide coverage for damage or loss of the rental vehicle. However, they often come with additional costs, so it’s important to review the terms and conditions and consider your needs before making a decision.

4 Responses

Leave a Reply

Travel Tips and Guides

Frequently Asked Questions (FAQ)

No. We provide a single journey plan. You are covered from the time you pick up the rental car up to the time you return it or on the last date written on your Certificate of Insurance, whichever comes first.

No. You should purchase a policy before starting your travel.

Find the answers you’re looking for to the most frequently asked car hire insurance questions as well as other questions relating to our products and services.

Hey There. I discovered your blog on msn. This is a very well written article. I’ll be sure to bookmark it and return to read extra of your helpful info. Thanks for the post. I will definitely return.

Wonderful blog and helpful tips

Regards for this fantastic post, I am glad I discovered this website on yahoo.

I’m no longer certain the place you’re getting your information, however good topic. I needs to spend some time learning much more or figuring out more. Thanks for magnificent information I was in search of this info for my mission.