Yes. Insurance for a single day is available.

Worldwide Car Hire Excess Insurance

Hiring a car may seem like a simple process, but there is more to it. Unforeseen events like an accident or theft of the hired car may lead to a lot of spending on your part. This article aims to help you make informed decisions about getting car hire excess insurance when renting a car anywhere in the world.

Worldwide Car Hire Excess Insurance Coverage Chart

| Warranty | What does it cover? | How much does it cover? |

|---|---|---|

| Damage due to collision or theft | Reimbursement of the deductible applied by the rental company as a result of accidental damage caused to the vehicle, including tires, windshield, underbody and other parts | $ 2,500 - $ 4,500 |

| Improper Fuel Use Charges | Tank emptying costs and vehicle towing, when the wrong fuel is refueled into the vehicle by mistake. | $ 500 |

| Loss or theft of keys | In the replacement of lost or stolen keys, including lock and locksmith costs. | $ 500 |

| Towing charges | Covers the tow truck of the rented car in the event of a breakdown or accident. | $ 500 |

| Vehicle return charges | If as a result of an accident or illness with hospitalization you cannot return the vehicle. | $ 250 |

| Personnal belongings | In case your baggage, personal belongings or valuables are taken, permanently lost or unintentionally damaged during your trip | $ 500 |

| Hotel expensses | If You are unable to use your rental vehicle as a result of it being stolen or damaged | $ 150 |

Vehicle rental excess insurance

What is insured?

- Excess reimbursement up to US$ 4,500

- Damage Waiver (LDW) up to US$ 4,500

- Towing charges up to US$ 500

- Improper fuel charges up to US$ 500

- Loss or theft of keys up to US$ 500

- Vehicle return charges up to US$ 250

- Personnal belongings up to US$ 500

- Hotel expenses up to US$ 150

What is not covered?

- Damage to the vehicle or property of a third party

- Damage caused by a person not authorized to drive the rented vehicle

- Mechanical failure of the rented vehicle

- Loss or damage to the vehicle’s interior that is not related to a collision.

- Parking tickets or fines, traffic violations and such

- Any loss that occurs outside the validity of the insurance

- Any rental contract of more than 45 days

Is the coverage subject to any type of restrictions?

- Any claim resulting from a direct breach of any of the terms and conditions of your rental agreement

- Any person under 21 or above 84 years of age

- Rentals that begin or end outside the insurance period, as indicated on the insurance certificate

- The policyholder must be designated as the main driver in the rental agreement

- The maximum amount that can be claimed for a single loss is US$ 4,500

- Damage to Recreational vehicles (RVs) / Motorhomes / Campervans (unless you have purchased a specific cover)

- Damage to vehicles provided by a peer-to-peer vehicle rental service platform or a subscription vehicle service is excluded (unless purchased specific coverage)..

Where do I have coverage?

- Anywhere in the world except trips in, to or through Afghanistan, Cuba, Congo, Iran, Iraq, Ivory Coast, Liberia, North Korea, Myanmar, Russia, Sudan, Syria, Ukraine and Zimbabwe

What are my obligations?

- When applying for your policy, you must exercise reasonable care to honestly and carefully answer any questions asked.

- You must take all reasonable steps to avoid or reduce any loss (for example, you must report accidents or other damage to your rental company nd to CarInsuRent as soon as reasonably possible).

- If you make a claim, you must provide the documents and other evidence that claims handlers need to process your claim.

- You must repay any sums to which you are not entitled (for example, if we pay your claim for an accident which is later compensated by a third party).

- You must not violate the terms of the rental agreement.

When and how do I make the payment?

- The premium must be paid in full before the policy start date. Payment can be made by credit or debit card or PayPal through our website

What is the start and end date of coverage?

- As set out in the insurance certificate, as agreed in the application process, your policy will cover you from the start date and time of your booking to the end date and time of your booking.

How do I cancel the contract?

- You can cancel your policy before the start date or within 14 days from your purchase through our customer service team.

I have bought two yearly policies with CarInsurent so far based on the good reviews here. Thinking that I would never need to use it, unfortunately I was wrong and had an accident with my rental car while traveling abroad. I'm glad to say that CarInsuRent fully reimbursed me promptly for the excess that I was charged. I'm a very satisfied customer!

What Is Annual Worldwide Car Hire Excess Insurance?

When you hire a car, the rental agreement will typically include Collision Damage Waiver coverage. This means that in the event that the rental vehicle is damaged, you are not liable to the entire cost of repairing the damage and you should only pay a certain amount known as “excess” (or deductible). The car rental agreement will usually specify a rental car excess, which you will be liable for in the event that the rented vehicle is damaged.

If you are a frequent traveler that takes two or more trips a year and hiring a car in different countries, an annual worldwide rental vehicle excess insurance (also known as multi-trip cover) is what you need to prevent car rental companies from making a fortune out of you.

See How Much You Can Save on Your Worldwide Car Hire Excess Insurance

Get StartedWhat to Look Out For When Buying Worldwide Car Hire Insurance

One important thing to look out for is, will the insurance cover the car hire in the destination where you rent a car? Will it cover you in your home country and abroad? Some policies restrict certain territories and destinations (mainly war zones). Getting flexible insurance is always the best option. Carefully read through the offer before you buy in.

Useful Examples of Potential Claims

When you return the rented vehicle, any damage that wasn’t listed on your pickup slip, might be considered as damage that was created while the vehicle was under your possession. We’ve listed below a few examples:

- Extra charges by the hiring company for damaged seats that are not covered by the insurance policy.

- Scratches or dents on the vehicle.

- Flat tire

- Broken side mirror – this can result as an accident or even when the park is “safely” parked in the street.

- Broken glass resulted by thieves or vandalism.

- Towing expenses.

- Loss of use – in the event that the car rental company need to fix the rental vehicle, the rental company might charge you for the money they couldn’t make while the car is been repaired.

How Does Annual Worldwide Car Hire Insurance Work?

If you have an accident with a hired car and there are scratches or damages, the hiring company can charge you up to a thousand dollars or more. Car rental excess insurance protects you from any outrageous fees that the hiring company may bill you.

In case you might be asking yourself how you can eliminate your risk, we’ve outlined the process:

When you book you next overseas car rental, you can simply purchase CarInsuRent’s car hire excess insurance policy and pay the annual premium.

When you pick-up the rental car, the car rental company may offer you to pay an additional amount for a Super CDW (SCDW) coverage to reduce the rental car excess to zero. The additional cost of SCDW is typically calculated based on the number of days that you will hire the car for and may double the entire cost of the rental.

Assuming that you purchased our annual worldwide car rental insurance, you can simply waive the car rental’s offer and save the cost of the rental car excess waiver.

If your rental car is damaged, the rental company will charge you the lower between the actual amount of the repair and the excess amount that is listed on the car rental agreement.

You should then submit a claim with us, and our claims team will review and assess your claim. After your claim is approved CarInsuRent will reimburse you.

See How Much You Can Save on Your Worldwide Car Hire Excess Insurance

Get StartedIn Which Countries Can I Drive With the Excess Worldwide Policy?

As the name implies, this insurance is meant to cover hire in any part of the world. There is a reason to pause, though, because different agencies offer different services.

Some insurance policy does not cover trips to Afghanistan, Iraq, and other countries as advised against by the Foreign and Commonwealth Office. According to the terms of our worldwide rental car insurance policy, we cover rentals in all countries EXCEPT trips in, to or through Afghanistan, Cuba, Congo, Iran, Iraq, Ivory Coast, Liberia, North Korea, Myanmar, South America, Sudan and Zimbabwe.

What Does It Protect Me Against?

If your hire car is damaged, car hire excess insurance protects you from excess (up to the amount you have chosen and as specified on your policy) that you are liable to pay. It may be related to damage to the tire, windshield, scratch, or theft of the hired vehicle. In the absence of this insurance, you could incur about a thousand dollar or more. Our international car hire insurance will cover you for the following:

- Rental car excess insurance of $2,500 is automatically included with our standard policy. We cover the Excess on damage or theft up to US$ 4,500 (depend on the amount that you choose).

- Damage to bodywork, Undercarriage, Roof, Tires Mirrors and Windscreen.

- Payments for towing, breakdown and misfuelling excess costs.

- Protection against theft and vandalism is included

- We cover car damage resulting from single-vehicle accidents.

- Covers up to 8 additional nominated drivers (so long they are listed on your rental car agreement).

- Up to 45 days continuous cover on any one rental agreement.

- Drivers aged between 21 and 85 inclusive.

What’s Not Included?

- Vehicle breakdown due to old parts. Some of these parts wear and tear easily, so it is advisable to select your vehicle wisely because in cases like this, the policy has got nothing to do with it. The bills are on you to settle.

- Interior damage to the vehicle. Sometimes while using this vehicle, we might come across some unforeseen situations that might lead to the damage of any of the internal parts; in any of these cases, the policy won’t cover this damage. Better hope for no accidental damage to its interiors because it’s on you.

- The insurance policy does not include vehicles with about nine seats due to their capacity. They rather prefer vehicles with smaller capacities of about 5seats, which in such cases they are sure they are not exploited. Our standard policy cover vehicles with less than 9 seats (including the driver), and if you want to rent a bigger vehicle you can check out our “minibus” coverage.

- Commercial vehicles, motorbikes, camper vans, mobile homes, vans or any vehicle with more than nine seats are NOT covered.

- Driving fines due to violations or incomplete credentials, both vehicle and personal. It is important to always have this factor in mind because most people think the policy covers it. Any error or expenses spent aside from the expected ones is a NO for CarInsuRent. They won’t be responsible for charges due to driving or traffic violations, lack of complete personal information, and also car details.

- The policy does not cover hired vehicles before its policy is put in place. That is, any vehicle hired before implementing a car insurance policy is not covered by it. So whatever happens to the vehicle has to be sorted out by you or whoever is responsible for it.

- Damage due to off-road driving, reckless driving or bad driving habits. The policy will not in any way pay for any damage on the vehicle due to avoidable mistake(s) or carelessness on your part. They feel everyone behind the wheels should be responsible enough to handle a car well, not to the extent of wreaking havoc with it.

- Local “in country” rental (unless you have 2 nights pre-booked accommodation in your home country).

How to File a Claim

What to Do in Case of an Accident or Damage – If you are involved in an accident while driving a rental car, there are certain steps you should follow to file a claim with the rental car insurance company. First, exchange personal information with the other driver, including name, address, license plate number, rental vehicle information, insurance company, and policy number, and document the accident with pictures and notes. If the other driver is at fault, you should get their contact and insurance information and call their insurance company directly to file a claim. If you are at fault or have non-collision damage, you can file a claim with the rental car insurance company. The process for filing a claim with the rental car insurance company may vary depending on the provider, but typically, you would need to provide details of the incident, including the date, time, and location of the accident, as well as any police report numbers, if applicable. Additionally, you may need to provide documentation of the damage, such as photographs or repair estimates.

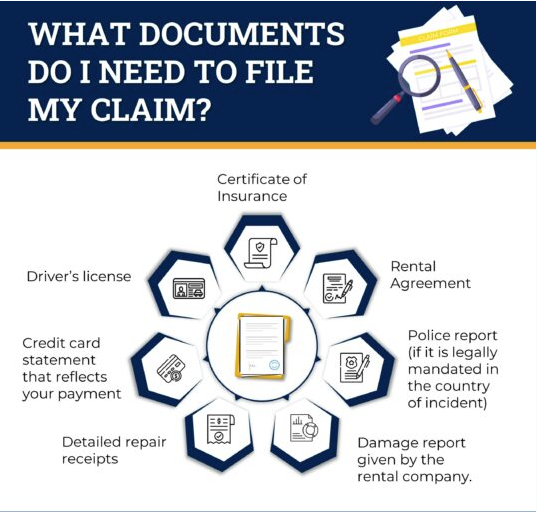

Required Documentation for Filing a Claim

- A copy of the Certificate of Insurance

- A copy of the rental agreement

- A copy of the police report if:

- you got in an accident with a third party

- It is legally mandated in the country of incident

- your claim is about stolen personal belongings

- A copy of the damage report given by the rental company, detailing each cost incurred. Photographs of the damage are optional but may help ensure that the charges are reasonable.

- Detailed repair receipts, invoices or other documents showing the breakdown of the amount the rental company charged you for the accidental damage or loss

- A copy of your credit card statement that reflects your payment for the claimed damages

- A copy of the driver’s license of the person driving the car during the accident

What Documents Do I Need to File My Claim?

Tips for a Smooth Claims Process: Filing an insurance claim can be a complicated and stressful process. The following tips can help ensure a smoother claims process:

- Document everything: Documenting all the details of the accident or loss, including taking photos and notes, can help speed up the claims process and reduce the possibility of disputes.

- Communication: Communication is key in any insurance claim process. Keep thorough records of all communication with the insurer, and discuss your expectations for the claims process with the adjuster. You can also ask about the frequency of updates and the preferred type of communication.

- Avoid duplicate claims: Avoid submitting duplicate claims, as it slows down the claims payment process and creates confusion.

- Understand your coverage: It’s important to understand your insurance coverage, including the limits and deductibles, before filing a claim. Understanding your policy can help ensure that you receive the maximum benefit to which you are entitled.

- Be patient: Claims processing can take time, so it’s important to be patient.

By following these tips, you can help ensure a smoother claims process, and increase the chances of receiving the maximum benefit that you are entitled to under your insurance policy.

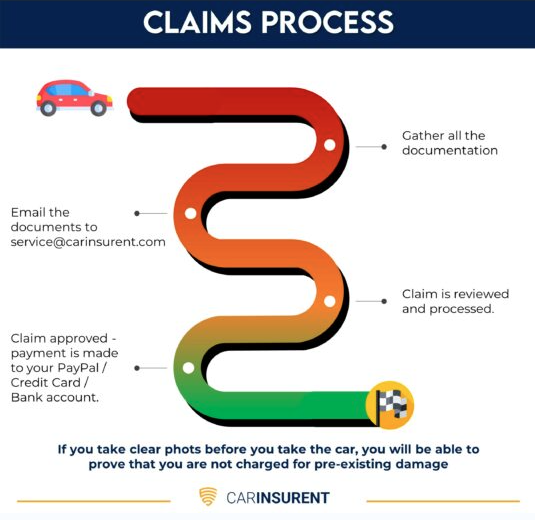

Claims Process

By following these tips, you can help ensure a smoother claims process, and increase the chances of receiving the maximum benefit that you are entitled to under your insurance policy.

5 Reasons Why Taking Out Annual Worldwide Rental Car Excess Insurance Is Important

- You can choose your preferred level of rental vehicle excess cover to suit your needs – from US$ 2,500 to US$ 4,500.

- If you are a frequent traveler, the cost of standalone car rental excess cover may be significantly less than the cost of purchasing excess waiver from the rental company.

- Authorized drivers listed on your car rental agreement are also covered.

- You can file multiple claims, up to the Excess limit that you have purchased.

- Rental vehicle excess insurance cover can give you peace of mind if the rental car is damaged in an accident.

FAQ:

Do I Have to Buy Excess Waiver Insurance From My Hire Company?

You do not need it. Excess waiver offered at the rental desk, may double your rental price. You can simply buy a standalone car rental excess cover and save up to 70% of the cost.

What Are the Advantages of Buying Annual Car Hire Excess Insurance?

The crucial merit is that rental car insurance will provide safety for the most powerless parts of the vehicle, such as the tires, wheels, windscreen, and sometimes engines.

As long as the parts or, in general, the car was in a good state when picked-up, the rental vehicle excess insurance is mandated to cover any unavoidable damage like, car accident, theft and even loss of keys.

In addition, the cost of an annual standalone car rental excess cover may be significantly less than the cost of purchasing excess waiver from the rental company.

What is Annual Worldwide Car Hire Excess Insurance?

It is an insurance agreement that conserves you are not excessively charged if something happens to the rental vehicle while it is in your custody. The annual policy covers you for multiple rentals and multiple claims during a 365 days period.

How Does Annual Worldwide Car Hire Excess Insurance Work?

In short:

- Before your trip – Purchase a standalone car rental excess cover.

- When you pick up the rental vehicle – Turn down excess waivers offered by the rental company.

- In case of damage to the rental vehicle – Pay the rental company for the damage incurred (up to the excess amount).

- File a claim – you can file multiple claims during your 365 days period.

- Wait for the approval and payment.

An annual worldwide car hire’s excess insurance could protect you and your money If you have a disaster and damage your hire car.

9 Responses

Leave a Reply

Frequently Asked Questions (FAQ)

No. We provide a single journey plan. You are covered from the time you pick up the rental car up to the time you return it or on the last date written on your Certificate of Insurance, whichever comes first.

No. You should purchase a policy before starting your travel.

Find the answers you’re looking for to the most frequently asked car hire insurance questions as well as other questions relating to our products and services.

Please send a qoute for 9 seats car Excess Insurance, 70-80 days in Austria, Italy and Czech Republic

Hi,

Thank you for taking the time to contact us.

We have replied to you via email.

All the best,

The CarInsuRent Team

You are my intake, I own few blogs and very sporadically run out from to post .

Thank you for taking the time to read and comment

How do you differentiate between Minibus and Car? Is a 7-seater car a Car?

Thank you for taking the time to contact us.

Minibus is for 9+ seater.

If you rent a 7 seater vehicle, you should choose “car” under vehicle type.

All the best,

The CarInsuRent Team

Some times its a pain in the ass to read what people wrote but this internet site is rattling user friendly! .

Thank you for some other informative website.

I am impressed with your site.

I had no trouble navigating through all the tabs and related info ended up being truly easy to do to access. I found what I hoped for before you know it in the least. Quite unusual.

Nice task.