Yes. Insurance for a single day is available.

Car Hire Excess Insurance Comparison: Find the Best Car Hire Excess Insurance for Your Rental

PUBLISHED ON May, 18 2023

UPDATED ON Mar, 26 2024

Car hire excess insurance provides an added layer of protection when renting a vehicle by covering the excess amount you would be liable for in case of damage, theft, or loss. This type of insurance is important because it helps shield you from unexpected expenses and potential financial burdens that may arise during your rental period. By understanding car hire excess insurance and its significance, you can make informed decisions and ensure a worry-free rental experience, knowing that you are adequately covered against unforeseen circumstances.

The purpose of this article is to provide a comprehensive comparison of various car hire excess insurance options available in the market. By evaluating and comparing these options, readers will gain a better understanding of the coverage, benefits, pricing, and additional features offered by different providers. The article aims to empower readers to make informed decisions when choosing car hire excess insurance, enabling them to select the option that best suits their specific needs, travel habits, and budget. Through this comparison, readers can gain valuable insights and confidence in selecting the right car hire excess insurance to protect themselves from unexpected costs and enjoy peace of mind during their rental car experience.

Understanding Car Hire Excess Insurance

Car hire excess insurance, also known as rental car excess insurance or car rental excess waiver, is a type of insurance that provides coverage for the excess amount you would be responsible for in case of damage, theft, or loss to a rental vehicle. When you rent a car, the rental agreement typically includes an excess amount, also known as a deductible or a franchise, which is the maximum liability you would have to pay towards repairs or replacement of the vehicle. Car hire excess insurance helps protect you from these potential out-of-pocket expenses by covering the excess amount, reducing or eliminating your financial liability in case of an incident during the rental period. This insurance is separate from the standard insurance coverage provided by the rental company and can be purchased from independent insurance providers, offering an additional layer of protection and peace of mind while renting a vehicle.

Here’s how the excess works in car rentals:

- Rental Agreement: When you sign the rental agreement, it outlines the excess amount that you would be responsible for in case of any damage to the rental vehicle. The excess can vary depending on factors such as the rental company, the type of vehicle, and the level of insurance coverage selected.

- Incident Occurs: If the rental vehicle gets damaged, stolen, or lost during your rental period, you would need to report the incident to the rental company immediately. They will assess the damage and determine the cost of repairs or replacement.

- Excess Liability: If the cost of repairs or replacement is less than or equal to the excess amount, you would be responsible for paying the full excess to the rental company. For example, if the excess is $500 and the repair cost is $300, you would need to pay $300 as the excess.

- Insurance Coverage: If you have car hire excess insurance, it will cover the excess amount specified in the rental agreement. The insurance provider will reimburse you for the excess that you paid to the rental company, subject to the terms and conditions of the policy.

- Excess Reduction: Some car rental companies offer excess reduction options, often referred to as “excess waivers” or “super waivers.” These options allow you to reduce the excess amount or even eliminate it entirely by paying an additional fee. By choosing excess reduction, you can minimize your financial liability in case of an incident.

It’s essential to carefully read and understand the terms and conditions of the rental agreement regarding the excess amount and any insurance coverage provided. Car hire excess insurance can provide an added layer of protection by covering the excess, reducing your potential financial liability and giving you peace of mind during your rental period.

Car Hire Excess Insurance Comparison: CarInsuRent vs. Cost at Counter

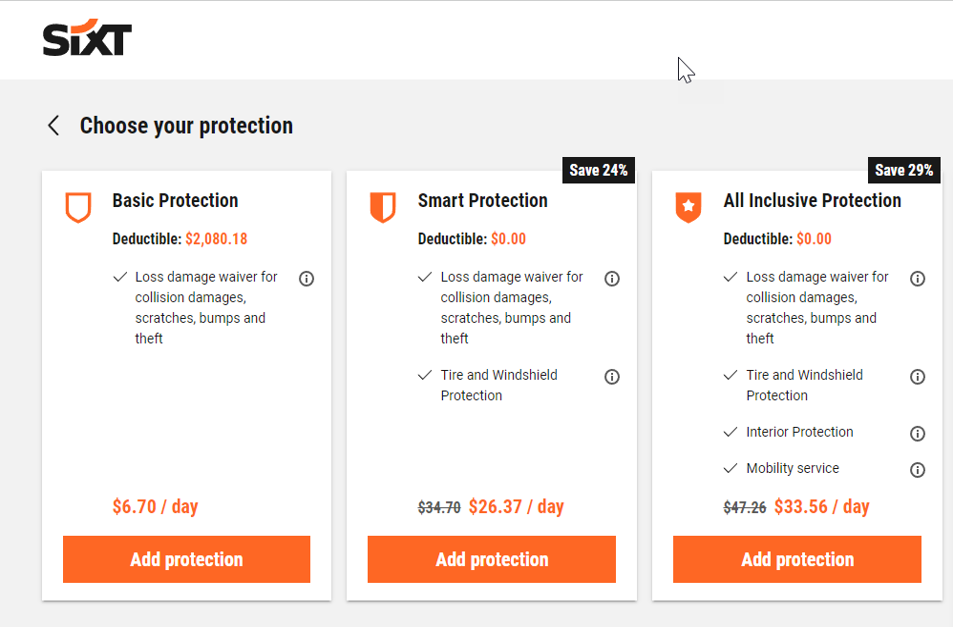

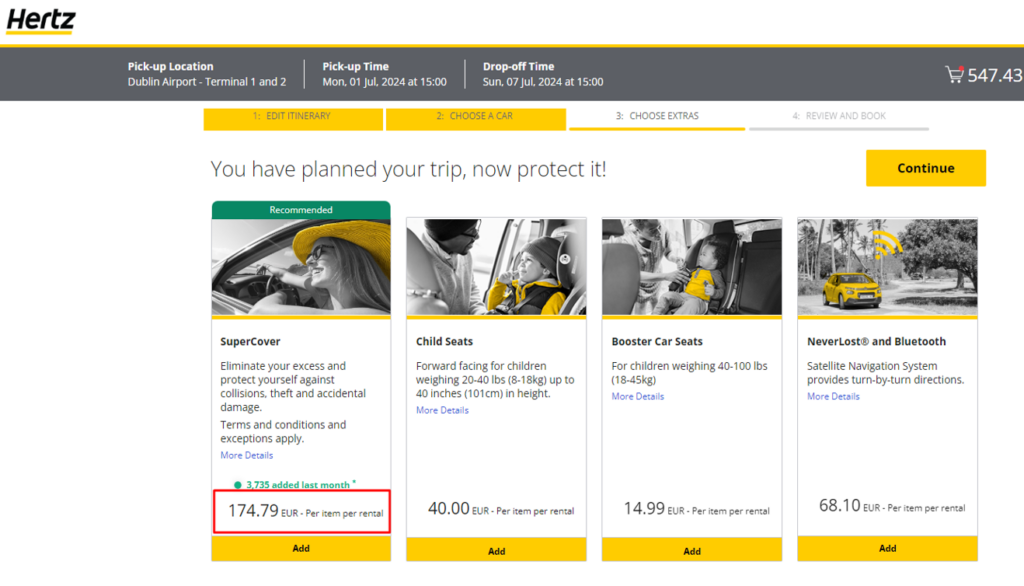

We compared and analyzed Super Collision Damage Waiver costs for a 7-day rental of a standard car class (July 1st – July 7th). The car rental insurance rates listed here are subject to change by the car rental companies without notice. For the most up-to-date pricing information, we encourage you to request a free online quote prior to booking.

CarInsuRent’s car hire excess protection for rental vehicles in Europe offers the same coverage at a 70% lower cost!

| Country | Collision Damage Waiver (CDW) + Theft Protection (TP) | Avg. Super Collision Damage Waiver Cost at Counter* | Avg. Insurance Deductible at Counter* | Avg. Cost for Rental Car Excess Insurance with CarInsuRent | Cost of Deductible with Zero-Excess from CarInsuRent |

| France | Included at the rental price | € 19.00 | € 2,250 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Germany | Included at the rental price | € 28.00 | € 1,250 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Iceland | Included at the rental price | € 32.00 | € 1,950 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Ireland | Included at the rental price | € 25.00 | € 2,300 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Italy | Included at the rental price | € 36.00 | € 2,200 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Spain | Included at the rental price | € 32.00 | € 1,850 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

See How Much You Can Save on Your Car Hire Excess Insurance

Get StartedSixt Rental Car Insurance in France

CarInsuRent – the Best Car Hire Excess Insurance

Comprehensive Coverage for Car Hire Excess

CarInsuRent offers comprehensive coverage for car hire excess, providing customers with peace of mind during their rental period. With our car hire excess insurance, customers are protected against unexpected expenses and potential financial liabilities that may arise from damage, theft, or loss to the rental vehicle.

Our comprehensive coverage includes:

- Excess Limit Coverage: We offer generous coverage for the excess amount specified in the rental agreement ranging between US$ 2,500 – US$ 4,500. This means that if an incident occurs and you are required to pay the excess amount towards repairs or replacement of the rental vehicle, we will reimburse you for that amount, subject to the terms and conditions of the policy. This coverage helps eliminate your financial liability in case of an incident, allowing you to avoid substantial out-of-pocket expenses.

- Damage Coverage: Our policies covers the excess and provide full protection that Includes single vehicle damage, roof and undercarriage damage, auto glass and widescreen damage, towing expenses, misfuelling, loss of car key and tire damage. We cover multiple drivers between the ages of 21 and 84 years.

- Theft Coverage: In the unfortunate event of theft or attempted theft of the rental vehicle, our coverage provides financial protection. We will reimburse you for the excess amount related to the theft, helping alleviate the financial burden that may arise from such incidents.

- Loss Coverage: CarInsuRent’s comprehensive coverage also extends to cover loss of the rental vehicle. If the vehicle is declared a total loss by the rental company due to factors such as an accident or natural disaster, we will reimburse you for the excess amount specified in the policy.

By offering comprehensive coverage for car hire excess, CarInsuRent ensures that customers can enjoy their rental experience without the worry of potential financial liabilities. Our policy provides valuable protection, giving customers the confidence to explore and travel with peace of mind. With CarInsuRent’s comprehensive coverage, you can focus on your journey and make lasting memories, knowing that you are well-protected against unexpected expenses that may arise during your rental period.

Competitive Pricing Options

CarInsuRent stands out with its competitive pricing options, ensuring that customers can secure reliable car hire excess insurance at affordable rates. WE understand the importance of providing cost-effective coverage without compromising on the quality and extent of protection.

Here are some key aspects of Our competitive pricing options:

- Affordable Premiums: We offer insurance premiums that are competitively priced, considering factors such as rental duration, geographical coverage, and the level of coverage selected. If you purchase CarInsuRent car hire excess insurance, the excess amount can be eliminated and reduced to zero for as low as $6.49 per day* to $94.90 for an annual car hire excess insurance policy. You can choose from a wide range of geographical coverage, including: European Car Hire Excess Insurance, USA & Canada Car Hire Excess Insurance, Australia Car Hire Excess Insurance, UK Car Hire Excess Insurance and Worldwide Car Hire Excess Insurance.

- Flexible Coverage Plans: CarInsuRent understands that each customer’s needs may vary, and as such, they provide flexible coverage plans to suit different budgets and preferences. Customers have the option to choose from various coverage levels and excess reduction options – ranging from US$ 2,500 – US$ 4,500, allowing them to customize their insurance policy based on their specific requirements. CarInsuRent offers annual car hire excess Insurance for hiring cars around the world for up to 45 days.

- Transparent Pricing Structure: CarInsuRent maintains a transparent pricing structure, ensuring that customers have a clear understanding of the costs involved. We provide detailed information about the premiums, excess amounts, and any additional fees or charges upfront, so there are no surprises or hidden costs along the way.

- Cost Savings Compared to Rental Company’s Excess: Opting for CarInsuRent’s car hire excess insurance can result in significant cost savings compared to relying solely on the excess provided by the rental company. By avoiding high excess charges imposed by rental companies, customers can protect their budget and avoid unexpected financial burdens. For example: Car hire excess insurance for 10 days rental in Europe with CarInsuRent will cost US$64.90 compared to US$ 295 when purchasing Hertz Car Rental Insurance. Another example: Car hire excess insurance for 10 days rental in Europe with CarInsuRent will cost US$64.90 compared to US$ 278.40 when purchasing the equivalent Enterprise car rental insurance.

- Value for Money: CarInsuRent’s competitive pricing options offer customers the opportunity to obtain comprehensive coverage at a reasonable price. With their cost-effective solutions, customers can benefit from valuable protection without breaking the bank.

See How Much You Can Save on Your Car Hire Excess Insurance

Get StartedCustomer Support and Claims Assistance

CarInsuRent prioritizes exceptional customer support and claims assistance, ensuring that customers receive prompt and reliable assistance throughout their car hire excess insurance journey. We understand the importance of providing attentive and responsive service to address any inquiries, concerns, or claims that customers may have.

Here are the key aspects of our customer support and claims assistance:

- Knowledgeable and Friendly Staff: CarInsuRent’s customer support team comprises knowledgeable professionals who are well-versed in car hire excess insurance. They are trained to provide accurate and helpful information, guiding customers through the insurance process, policy details, and claim procedures. Their friendly and approachable demeanor ensures a positive and reassuring customer experience.

- Claims Assistance: In the event of an incident or claim, CarInsuRent’s claims assistance ensures a smooth and efficient process. Their team will guide you through the necessary steps, helping you gather the required documentation and navigate the claim submission process. They understand that timely resolution is essential, and they work diligently to ensure that claims are processed promptly and fairly.

- Clear Communication: CarInsuRent places great emphasis on clear and transparent communication. We strive to provide customers with comprehensive information regarding their policy, coverage details, and claims process. Any policy terms, conditions, or claim-related documentation will be communicated clearly, ensuring that customers have a thorough understanding of their coverage and the steps involved in making a claim.

- Customer Satisfaction: CarInsuRent’s commitment to customer satisfaction is evident through positive customer reviews and feedback. We prioritize resolving customer inquiries and concerns promptly, ensuring that their customers feel supported and valued throughout their insurance journey.

CarInsuRent’s strong customer support and claims assistance demonstrate our dedication to providing excellent service. With our accessible and knowledgeable support team, customers can expect reliable guidance, prompt assistance, and a seamless claims process. By prioritizing customer satisfaction and effective communication, Carinsurent aims to build trust and long-term relationships with our valued customers.

Customer Reviews and Ratings

CarInsuRent has garnered positive customer reviews and high ratings, reflecting their commitment to customer satisfaction and the quality of their car hire excess insurance service. Here are some key aspects of their customer reviews and ratings:

- Excellent Claims Process: Customers have praised CarInsuRent for their efficient and hassle-free claims process. Reviews often highlight the smooth handling of claims, quick response times, and fair settlements. The ease and effectiveness of the claims process have left customers satisfied and impressed.

- Responsive Customer Support: Many customers appreciate the responsiveness and helpfulness of CarInsuRent t’s customer support team. Reviews often mention the knowledgeable and friendly staff who have provided prompt and accurate assistance with inquiries, policy details, and claim-related matters. The availability of 24/7 customer support has also been positively acknowledged.

- Overall Satisfaction: Numerous reviews express high levels of satisfaction with CarInsuRent ‘s car hire excess insurance service. Customers have commended the company for delivering on their promises, providing reliable coverage, and exceeding expectations. Positive reviews often highlight the peace of mind that CarInsuRent t’s insurance offers during the rental period.

- Trust and Reliability: Customers have emphasized the trust and reliability they feel towards CarInsuRent. The company’s transparent communication, adherence to policy terms and conditions, and timely claim resolutions have instilled confidence in their services. Many customers have expressed a sense of security and trust in CarInsuRent’s ability to protect them against unexpected costs.

- Positive Overall Experience: Across various review platforms, customers consistently report positive experiences with CarInsuRent. They value the comprehensive coverage, competitive pricing, and the smooth handling of insurance matters. The positive reviews and high ratings serve as a testament to CarInsuRent’s dedication to customer satisfaction.

I wholeheartedly recommend CarInsuRent. Their response time was exceptionally prompt. They requested standard documentation and photos of the damage, and I received payment directly to my PayPal account almost immediately.

Final Thoughts

See How Much You Can Save on Your Car Hire Excess Insurance

Get StartedFrequently Asked Questions (FAQ)

No. We provide a single journey plan. You are covered from the time you pick up the rental car up to the time you return it or on the last date written on your Certificate of Insurance, whichever comes first.

No. You should purchase a policy before starting your travel.

Find the answers you’re looking for to the most frequently asked car hire insurance questions as well as other questions relating to our products and services.