Yes. Insurance for a single day is available.

Essential Guide to International Car Rental Insurance: Coverage and Costs

Are you covered when driving a rental car abroad? This is the pressing question for travelers, and the answer lies in understanding international car rental insurance. It’s a safeguard against unexpected costs from accidents or theft and a requirement for peace of mind as you navigate foreign roads.

See How Much You Can Save on Your International Car Rental Insurance

Get StartedInternational Car Rental Insurance Coverage Chart

| Warranty | What does it cover? | How much does it cover? |

|---|---|---|

| Damage due to collision or theft | Reimbursement of the deductible applied by the rental company as a result of accidental damage caused to the vehicle, including tires, windshield, underbody and other parts | $ 2,500 - $ 4,500 |

| Improper Fuel Use Charges | Tank emptying costs and vehicle towing, when the wrong fuel is refueled into the vehicle by mistake. | $ 500 |

| Loss or theft of keys | In the replacement of lost or stolen keys, including lock and locksmith costs. | $ 500 |

| Towing charges | Covers the tow truck of the rented car in the event of a breakdown or accident. | $ 500 |

| Vehicle return charges | If as a result of an accident or illness with hospitalization you cannot return the vehicle. | $ 250 |

| Personnal belongings | In case your baggage, personal belongings or valuables are taken, permanently lost or unintentionally damaged during your trip | $ 500 |

| Hotel expensses | If You are unable to use your rental vehicle as a result of it being stolen or damaged | $ 150 |

Vehicle rental excess insurance

What is insured?

- Excess reimbursement up to US$ 4,500

- Damage Waiver (LDW) up to US$ 4,500

- Towing charges up to US$ 500

- Improper fuel charges up to US$ 500

- Loss or theft of keys up to US$ 500

- Vehicle return charges up to US$ 250

- Personnal belongings up to US$ 500

- Hotel expenses up to US$ 150

What is not covered?

- Damage to the vehicle or property of a third party

- Damage caused by a person not authorized to drive the rented vehicle

- Mechanical failure of the rented vehicle

- Loss or damage to the vehicle’s interior that is not related to a collision.

- Parking tickets or fines, traffic violations and such

- Any loss that occurs outside the validity of the insurance

- Any rental contract of more than 45 days

Is the coverage subject to any type of restrictions?

- Any claim resulting from a direct breach of any of the terms and conditions of your rental agreement

- Any person under 21 or above 84 years of age

- Rentals that begin or end outside the insurance period, as indicated on the insurance certificate

- The policyholder must be designated as the main driver in the rental agreement

- The maximum amount that can be claimed for a single loss is US$ 4,500

- Damage to Recreational vehicles (RVs) / Motorhomes / Campervans (unless you have purchased a specific cover)

- Damage to vehicles provided by a peer-to-peer vehicle rental service platform or a subscription vehicle service is excluded (unless purchased specific coverage)..

Where do I have coverage?

- Anywhere in the world except trips in, to or through Afghanistan, Cuba, Congo, Iran, Iraq, Ivory Coast, Liberia, North Korea, Myanmar, Russia, Sudan, Syria, Ukraine and Zimbabwe

What are my obligations?

- When applying for your policy, you must exercise reasonable care to honestly and carefully answer any questions asked.

- You must take all reasonable steps to avoid or reduce any loss (for example, you must report accidents or other damage to your rental company nd to CarInsuRent as soon as reasonably possible).

- If you make a claim, you must provide the documents and other evidence that claims handlers need to process your claim.

- You must repay any sums to which you are not entitled (for example, if we pay your claim for an accident which is later compensated by a third party).

- You must not violate the terms of the rental agreement.

When and how do I make the payment?

- The premium must be paid in full before the policy start date. Payment can be made by credit or debit card or PayPal through our website

What is the start and end date of coverage?

- As set out in the insurance certificate, as agreed in the application process, your policy will cover you from the start date and time of your booking to the end date and time of your booking.

How do I cancel the contract?

- You can cancel your policy before the start date or within 14 days from your purchase through our customer service team.

Amazing service. always efficient, friendly, responsive. i got my payment within days of submission. Bill is warm. A pleasure to work with them. highly recommended. I feel safe with them.

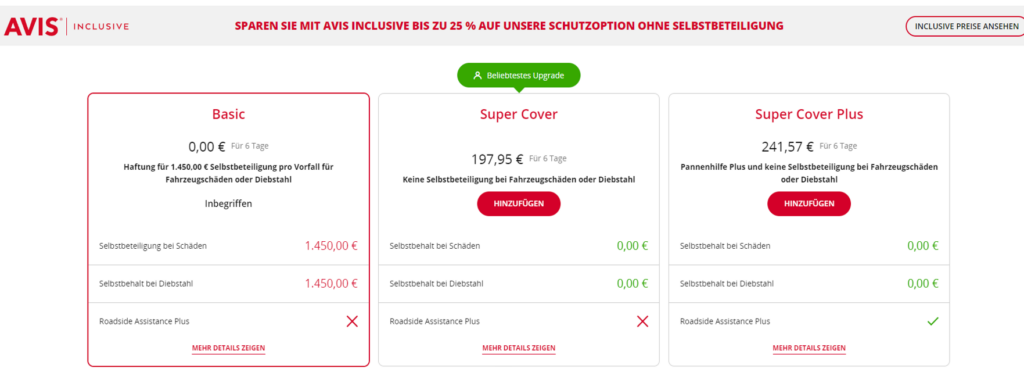

International Car Rental Insurance Comparison: CarInsuRent vs. Cost at Counter

We compared and analyzed Super Collision Damage Waiver costs for a 7-day rental of a standard car class (July 1st – July 7th). The car rental insurance rates listed here are subject to change by the car rental companies without notice. For the most up-to-date pricing information, we encourage you to request a free online quote prior to booking. CarInsuRent’s car hire excess protection for rental vehicles in Europe offers the same coverage at a 70% lower cost!

| Country | Collision Damage Waiver (CDW) + Theft Protection (TP) | Avg. Super Collision Damage Waiver Cost at Counter* | Avg. Insurance Deductible at Counter* | Avg. Cost for Rental Car Excess Insurance with CarInsuRent | Cost of Deductible with Zero-Excess from CarInsuRent |

| Australia | Included at the rental price | AUD 38.00 | AUD 4,300 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| France | Included at the rental price | € 19.00 | € 2,250 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Germany | Included at the rental price | € 28.00 | € 1,250 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Iceland | Included at the rental price | € 32.00 | € 1,950 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Ireland | Included at the rental price | € 25.00 | € 2,300 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Italy | Included at the rental price | € 36.00 | € 2,200 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Mexico | Included at the rental price | US$ 39.00 | US$ 3,100 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| New-Zealand | Included at the rental price | NZ$ 38.25 | NZ$ 4,640 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Spain | Included at the rental price | € 32.00 | € 1,850 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

Avis Rental Car Insurance in Germany

Navigating International Car Rental Insurance

This guide explores the essential aspects of car rental insurance globally, from choosing the right coverage to managing costs effectively.

Most car rental companies offer a Collision Damage Waiver (CDW) or a Loss Damage Waiver (LDW) which can help lower your out-of-pocket costs if you are in an accident. However, both protections come with an excess or deductible that must be paid, and this can range from $500 to $2,500 or more.

A car hire excess insurance policy is a very affordable way to make sure that an excess or deductible payment doesn’t ruin your holiday. This coverage will reimburse you if you must pay the excess or deductible due to an accident with your hire car.

We encourage you to check out our specific car hire excess insurance for the following destinations:

-

Car Rental Insurance Australia

-

Car Rental Insurance France

-

Rental Car Insurance Germany

-

Car Rental Insurance Iceland

-

Car Rental Insurance Ireland

-

Car Rental Insurance Italy

-

Car Rental Insurance Mexico

-

Car Rental Insurance New-Zealand

-

Car Rental Insurance Spain

See How Much You Can Save on Your International Car Rental Insurance

Get StartedKey Takeaways

- Personal car insurance and credit card coverage often do not provide international car rental insurance, necessitating renters to secure appropriate coverage for protection abroad.

- Costs for international car rental insurance, such as Collision Damage Waivers, can be significant and vary by provider; customers should compare offers from credit card companies, U.S. insurers, and rental agencies for the most economical option.

- Understanding the terms of rental agreements and insurance policies, including the differences between primary and secondary coverage, is essential to avoid unexpected liabilities and costs in the event of an accident or theft.

When you collect your keys from the car rental counter, you’re not just taking possession of a vehicle; you’re assuming responsibility for a valuable asset in an environment that’s likely quite different from what you’re used to. Whether it’s deciphering foreign road signs or adapting to left-hand traffic, international driving is fraught with challenges. Rental car insurance becomes not just a formality, but a crucial safety net. Yet, many travelers are unaware that their personal car insurance and credit card coverage often don’t extend beyond their home country’s borders.

The reality is that renting a car abroad without the appropriate insurance is a gamble. The peace of mind that comes from knowing you’re legally and financially protected is invaluable. It allows you to enjoy your international road trip without the looming worry of potential mishaps. This is why understanding the intricacies of car rental insurance is a must before you even set foot in another country. It’s not just about legality; it’s about ensuring your journey remains an adventure, not a misadventure.

Securing the Right Coverage for Your Trip

Illustration of credit card coverage

Preparing for your journey requires securing the right coverage for your rental car. The Collision Damage Waiver (CDW), for instance, can be a saving grace, waiving costs for damages or theft of the vehicle, thus avoiding deductibles and lengthy reimbursement processes. Theft protection is another layer of assurance, capping your financial liability in the distressing event of vehicle theft.

However, the devil is often in the details. Credit card companies may offer free coverage, but it’s imperative to check for any exclusions, especially since some countries may be left out of the credit card’s coverage umbrella. You might also consider adding collision coverage through a comprehensive travel insurance policy or purchasing a standalone international car rental insurance policy for more extensive protection. Before you pack your bags, a thorough interrogation of your rental company’s offerings and a chat with your insurance agent are in order. It’s the only way to ensure you won’t encounter any unwelcome surprises or find yourself inadequately covered.

Costs Associated with International Car Rental Insurance

Let’s talk numbers. The cost of a Collision Damage Waiver (CDW) can add a significant amount to your rental bill, typically ranging from $10 to $30 per day. Over a two-week trip, this could mean a considerable increase in your total rental cost. However, credit card companies like American Express offer primary rental coverage at a flat rate, which can be a more economical choice compared to the daily rates of rental companies. Similarly, Chase Sapphire stands out by providing primary rental insurance without country exclusions, which can be a cost-effective safeguard against a variety of damages.

Choosing to forego a CDW could leave you vulnerable to deductibles and upfront costs if you’re not covered elsewhere, but it could also save you money if your credit card or existing insurance is adequate. Be wary of additional fees, particularly at airport locations where local taxes and operation costs can inflate the price of rental insurance. Your best strategy is to compare the costs from various sources, including U.S. insurance providers, credit card companies, and car rental agencies, to secure the most cost-effective coverage for your needs.

The Fine Print of Rental Agreements

Illustration of rental agreement fine print

When you’re handed the rental agreement, it’s tempting to skim and sign just to get on the road. Resist this urge. The fine print often contains critical information, such as the exclusion of coverage for parts like tires, windows, and mirrors, as well as details about the rental period. Moreover, any non-compliance with terms, such as leaving a car unlocked, can void theft protection, leaving you fully liable.

There are also use restrictions to consider. Racing, illegal use, or driving on unmaintained roads can all invalidate your CDW. In some countries, like Ireland, declining CDW can lead to a substantial hold on your credit card by the credit card company. Don’t overlook potential extra fees, either. Extra driver fees may apply, but can sometimes be waived through loyalty programs or certain travel services, and young driver surcharges are common for those under 25.

Cancellation fees on prepaid rates are another consideration; it’s often best to avoid prepayment unless your travel plans are concrete. Lastly, if you damage the rental vehicle without proper coverage, you could face charges for:

- repairs

- loss of use

- diminished value

- administrative expenses.

Adding Collision Coverage to Your Insurance Plan

Adding collision and comprehensive coverage to your existing personal auto insurance policy may extend protection to rental cars, but remember that this usually comes with a deductible. Filing a claim for a rental can also affect your premiums, so it’s essential to weigh the pros and cons of relying on personal insurance while abroad.

Understanding the difference between primary coverage and secondary coverage is crucial. Primary insurance steps in first in the event of a claim, whereas secondary may cover additional expenses not handled by the primary. For some, the inclusion of collision coverage in a comprehensive travel insurance plan may be the answer, offering an alternative to standalone policies or rental agency offerings. However, always check for any geographical restrictions or exclusions that could impact your coverage during an international trip.

Making an Informed Decision at the Rental Counter

Illustration of making an informed decision at the rental counter

The moment of truth arrives at the rental counter. Here, knowledge is power. Begin by understanding the extent of your current insurance policy’s coverage for rental vehicles. If your policy or credit card coverage is sufficient, you might save money and time by declining additional offers at the counter. However, if you don’t have personal auto insurance, are worried about potential premium hikes, or are traveling to a location where your policy is void, it’s a good idea to buy rental car insurance from the rental company, as it could be a lifesaver.

Loss-damage waivers (LDW) or collision damage waivers (CDW) are not insurance policies per se; they are agreements that waive your responsibility for certain damages. Yet, without them, you could be charged for repairs, loss of use, and other related costs. If the thought of navigating these potential expenses is daunting, consider standalone rental car insurance policies from companies like CarInsuRent as an alternative. Remember, to take advantage of your credit card’s collision coverage, you often have to decline the rental company’s CDW, a decision that may not be easy, especially with the counter’s hard sell tactics.

Preparing for the Unexpected: Accident and Theft Scenarios

Even the most cautious drivers can encounter the unexpected. In the unfortunate event of an accident, prioritize safety first, then:

- Contact emergency services if necessary.

- Document everything, take detailed notes, photographs, and gather information from any other involved parties.

- If the rental car is stolen, report the theft immediately to the local police and obtain a police report.

Next, contact the rental car company and your insurance provider to report the incident and establish a claim. If your credit card’s insurance is applicable, notify them as well. You’ll need to sort out who is responsible for costs like collision damage and additional rental days. Remember, even if you’re not at fault, you may need to pay a deductible up front, which your insurer may reclaim later. Stay on top of the claim process with your insurance and the rental company to avoid any incorrect charges.

Summary

In summary, the road to renting a car internationally can be as smooth as the autobahn or as tricky as a winding mountain pass. Armed with the right information about rental car insurance, however, you can navigate this journey with confidence. From understanding the coverage you need to evaluating options at the rental counter and preparing for the unexpected, this guide has outlined the essential steps to ensure your trip remains memorable for all the right reasons.

Frequently Asked Questions

What is worldwide rental car insurance?

Worldwide rental car insurance provides coverage for charges applied by the Rental Company if your rental car is stolen or damaged, including damage to the vehicle underbody, roof, windows, and tires. It also serves as excess insurance against damage or loss to a rental vehicle.

Does my insurance cover international rentals?

Most standard auto insurance policies won’t cover international rentals. It’s crucial to check with your specific insurance provider to understand your coverage limitations when driving overseas. Your current insurance policy for your personal vehicle will not apply when driving a rental car abroad.

What is a Collision Damage Waiver (CDW), and should I get one?

Yes, you should consider getting a Collision Damage Waiver (CDW) for rental car protection, especially for international rentals. It can help waive costs and avoid deductibles in case of damage or theft.

What should I do if I’m involved in an accident with my rental car?

If you’re involved in an accident with your rental car, ensure everyone’s safety, document the incident, exchange information, and report it to the rental car company and your insurance provider to follow the proper procedure and ensure necessary support.

Can I decline the rental company’s insurance if my credit card provides coverage?

Yes, you can decline the rental company’s insurance and use your credit card’s coverage, but be sure to check the coverage and any exclusions beforehand.

Frequently Asked Questions (FAQ)

No. We provide a single journey plan. You are covered from the time you pick up the rental car up to the time you return it or on the last date written on your Certificate of Insurance, whichever comes first.

No. You should purchase a policy before starting your travel.

Find the answers you’re looking for to the most frequently asked car hire insurance questions as well as other questions relating to our products and services.