Yes. Insurance for a single day is available.

Hertz Rental Car Insurance: Know Your Options

PUBLISHED ON Mar, 05 2023

UPDATED ON Mar, 26 2024

Introduction to Hertz Car Rental Insurance

Hertz Rental Car Insurance is a type of protection offered by Hertz to cover renters against loss or damage to the rental car. There are different types of Hertz rental car insurance policies available, including Loss Damage Waiver (LDW) and Collision Damage Waiver (CDW) protection. LDW offers 24/7 coverage of the vehicle, even when you’re not in it. If you purchase LDW or Vehicle Protection from Hertz, you will have no financial responsibility for loss or damage to the rental vehicle. However, before determining the cost of Hertz rental car insurance, it’s important to compare Hertz’s insurance versus other alternatives.

It’s also worth noting that rental car insurance coverage can come from different sources, including personal auto policies, rental car counter, or a third-party insurer such as CarInsuRent. It’s important to understand the different types of rental car insurance and liability coverage available, as well as the terms and conditions of each policy, to ensure you’re adequately covered and not paying for unnecessary insurance.

Hertz Rental Car Insurance Explained

Hertz Car Rental Insurance offers different types of coverage to renters. One of the most common types of Hertz Rental Car Insurance is Loss Damage Waiver (LDW) protection, which waives the renters’ responsibility for loss or damage to the rental vehicle, regardless of fault. LDW is not an insurance product, and you don’t have to report any incidents to your insurance company if you purchase LDW from Hertz.

Herz’s collision damage waiver covers the following:

- All damage to the Hertz rental vehicle

- Coverage for vehicle theft up to the car’s full value.

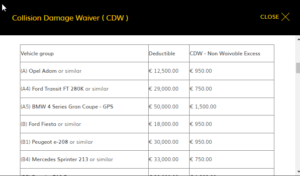

While the Hertz CDW/LDW is part of your rental fee, it is subjected to an excess. Should something happen to your rental car, you are financially responsible for this excess which ranges between € 950 – € 1500 as shown below.

Hertz rental car insurance

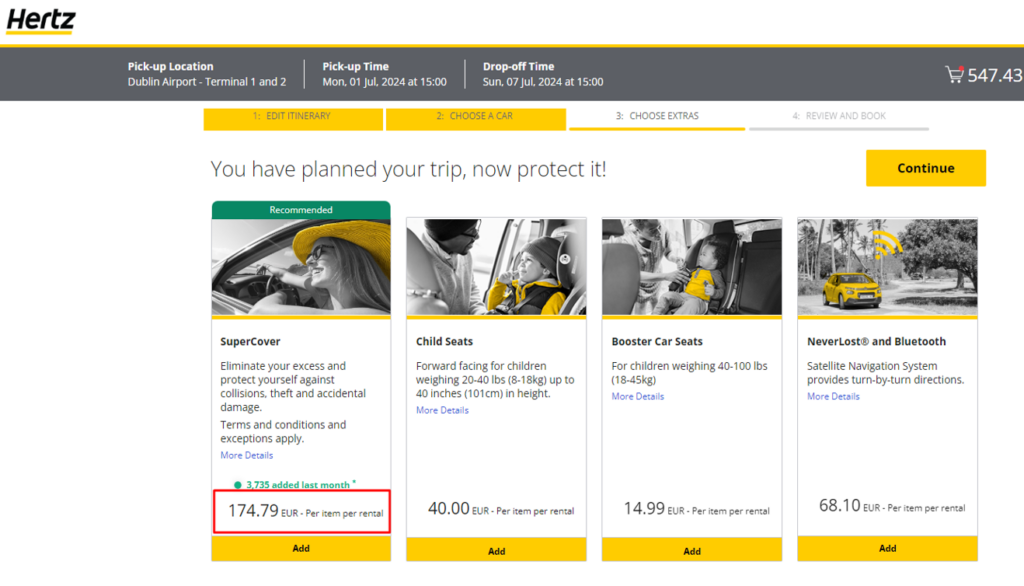

SuperCover, a package offered by Hertz, lowers the excess for the majority of cars to € 0. Hertz insurance cost per day for this service is € 28*. It is significant to keep in mind that excess reduction fees can change according to the location and type of rental car being used. For the most precise and recent information regarding excess reduction fees, it is advised to contact Hertz directly.

*based on a quote for 10 days rental for Group E (Opel Insignia) as shown below

Hertz SuperCover Protection

Another type of Hertz Rental Car Insurance is Supplemental Liability Insurance (SLI), which provides additional liability coverage above the minimum limits required by the state where the rental takes place. SLI protects renters from claims made by third parties for bodily injury or property damage resulting from an accident in the rental car. SLI is optional liability coverage that can be added to LDW or CDW protection at an additional cost.

Hertz Insurance coverage options can vary by location, so it’s essential to check with your local Hertz office to understand which plans are available to you. It’s also important to note that rental car insurance coverage options are not mandatory, but they offer added protection and peace of mind while driving a rental vehicle.

Hertz Rental Car Insurance Cost

The answer to the question “how much is Hertz rental car insurance?” can vary depending on the coverage options selected.

While the Hertz collision damage waiver is part of your rental fee, it is subjected to an excess. Should something happen to your rental vehicle, you are financially responsible for this excess which ranges between € 950 – € 1500.

SuperCover, a package offered by Hertz, lowers the excess for the majority of cars to € 0. Hertz insurance cost per day for this service is € 28. If you purchase CarInsuRent car rental insurance, the excess amount can be eliminated and reduced to zero for as low as $6.49 per day* to $94.90 for an annual policy.

*Prices based on 10 days coverage

The Personal Insurance (PI) covers the authorized drivers, passengers and their personal effects and is offered in most locations but can only be purchased at time of pick-up for an additional amount of € 16.18 (including tax) per day, € 80.92 (including tax) per week, or € 161.95 (including tax) per rental.

See How Much You Can Save on Your Hertz Rental Car Insurance

How does CarInsuRent differ from Hertz Car Rental Insurance?

- CarInsuRent car hire excess insurance starts from as low as $6.49 per day* to $94.90 for an annual policy. Hertz SuperCover can be purchased separately for € 28 per day.

- CarInsuRent covers baggage and personal belongings – up to US$ 1,500 included at the price.

- CarInsuRent covers the replacement of a lost or stolen Rental Car key.

- CarInsuRent covers exorbitant rental company fees added to your repair bill – including fees for loss of use, processing, relocation and towing.

- CarInsuRent covers single-vehicle accidents – claim even if the damage or theft to your car was not your fault.

- CarInsuRent offers annual worldwide car hire excess Insurance for hiring cars around the world for up to 45 days.

*Prices based on 10 days coverage

Here’s How CarInsuRent Car Hire Excess Insurance saved Our Client a Significant Amount of Money

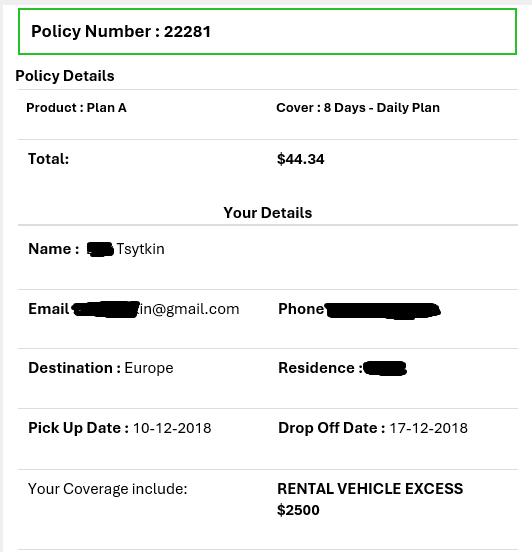

Mr. Tsytkin, rented a Mercedes SUV for 7 days in Munich airport, Germany. Despite declining the rental company’s insurance coverage due to its high cost, Mr. Tsytkin decided to purchase standalone car hire excess insurance from CarInsuRent after reading about its benefits.

Copy of Mr. Tsytkin Car Hire Excess Policy

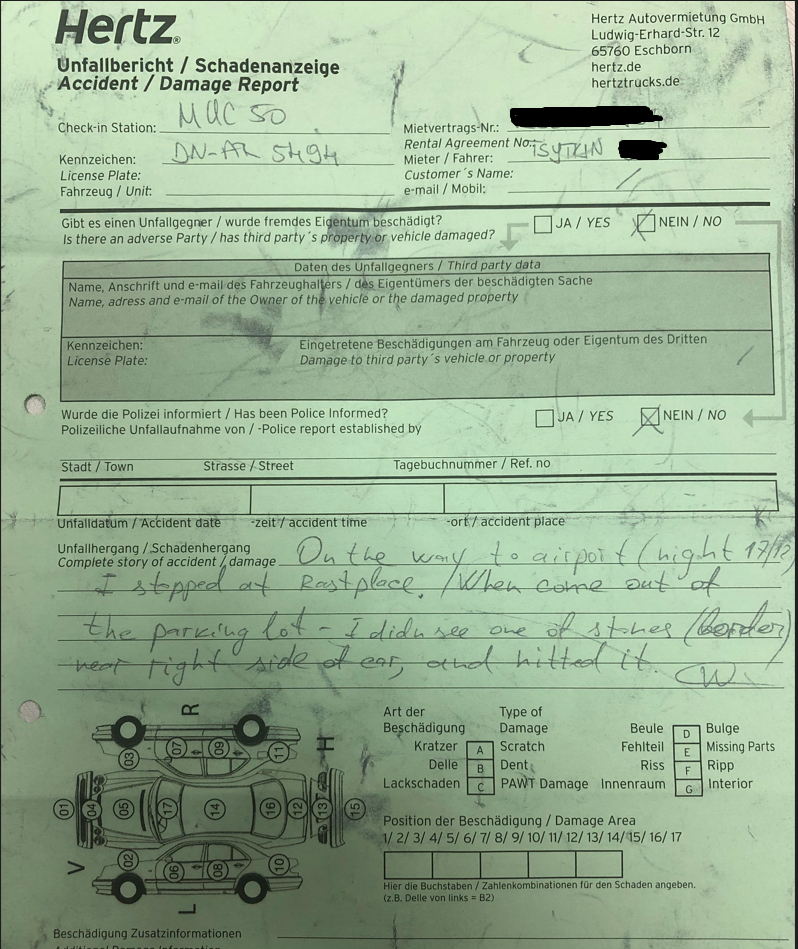

On December 17th, Mr. Tsytkin had an incident with the rental car. It happened at about 04:00 on his way to Munich airport. After an hour of driving on the highway, he stopped at a gas station with a parking lot for a coffee break. The parking lot contained small rocks that marked the corner-points of some parking lots. While parking, he missed a stone on his right, and the right rear door of the car was damaged.

Hertz Damage to Rental Car

Hertz Damage Report

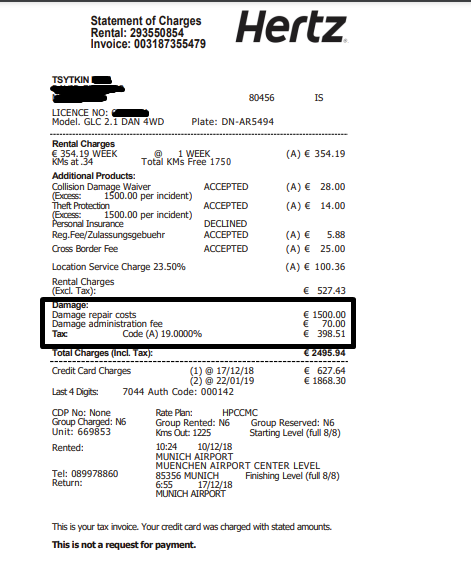

Unfortunately, Avis charged Mr. Tsytkin EUR 1,868.30 for the damage.

Hertz Damage Repair Costs

However, Mr. Tsytkin had purchased car hire excess insurance, which covered the excess amount he would have to pay in such situations. As a result, he was able to file a claim with CarInsuRent, and we reimbursed him for the repair costs incurred by the rental company. This saved him almost two thousand Euros, as he only had to pay US$ 44.34 for the car hire excess coverage instead of the full repair bill.

I had a fantastic experience with CarInsurent. Their service was exceptional, and they handled my claim swiftly and efficiently after an accident. Their team was responsive, professional, and caring throughout the process. I highly recommend CarInsurent for anyone in need of car rental insurance.

How much could you save on Car Hire Excess Insurance for your Hertz car hire?

Car hire excess insurance for 10 days rental in Europe with CarInsuRent will cost US$64.90 compared to US$ 295 when purchasing the equivalent liability coverage from Hertz. Total potential saving: US$ 230.10.

We compared and analyzed Super Collision Damage Waiver costs for a 7-day rental of a standard car class (July 1st – July 7th). The car rental insurance rates listed here are subject to change by the car rental companies without notice. For the most up-to-date pricing information, we encourage you to request a free online quote prior to booking.

CarInsuRent’s car hire excess protection for rental vehicles offers the same coverage at a 70% lower cost!

| Country | Collision Damage Waiver (CDW) + Theft Protection (TP) | Avg. Super Collision Damage Waiver Cost at Counter* | Avg. Insurance Deductible at Counter* | Avg. Cost for Rental Car Excess Insurance with CarInsuRent | Cost of Deductible with Zero-Excess from CarInsuRent |

| Germany | Included at the rental price | € 32.99 | € 1,450 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Ireland | Included at the rental price | € 29.13 | € 2,500 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Italy | Included at the rental price | € 48.80 | € 2,000 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| New Zealand | Included at the rental price | NZ$ 46.00 | Up to the full value of the vehicle | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Spain | Included at the rental price | € 41.14 | € 2,000 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

Hertz Rental Car Insurance in Ireland

See How Much You Can Save on Your Hertz Rental Car Insurance

Hertz Rental Car Insurance Exclusions

Please note your liability for damage to or loss of the vehicle will not be reduced where you or an authorized driver are grossly negligent (for example failure to assess the vehicle’s height, driving on unsuitable road conditions, improper use of the vehicle, contribution to damage to / theft of the vehicle) and in particular, but not limited to, in the following circumstances:

- Striking overhead or overhanging objects;

- Driving into a barrier that is too low for the vehicle to pass beneath;

- Driving into a barrier in a car park before it fully opens;

- Driving on a road in bad condition without due care resulting in damage to the undercarriage;

- Driving on a beach causing damage by salt water and/or sand;

- Driving through flooded roads causing damage to the engine;

- Putting wrong fuel in the vehicle or otherwise contaminating the fuel;

- Damage occurring as a result of ignoring a warning light;

- Burning a clutch (which requires persistent ill use) or using the handbrake incorrectly;

- Damage to the wheel rim caused by driving with a flat tyre;

- Fitting unauthorized objects to the interior or exterior of the vehicle;

- Carrying especially dirty or smelly materials that require extra cleaning costs or that damage or burn the interior;

- Damage resulting from locking the keys in the vehicle or losing the keys;

- Damage resulting from leaving the windows open;

Do You Need Insurance to Rent a Car From Hertz?

Hertz typically requires that renters have some form of insurance coverage, although the specific requirements may vary depending on the location and type of rental.

In many cases, your personal car insurance policy may provide coverage for rental cars. You should check with your insurance provider to see what type of coverage you have and whether it applies to rental cars.

Alternatively, you may be able to purchase insurance directly from Hertz when you rent the car.

What are Hertz Car Rental Insurance Requirements?

Hertz rental car insurance requirements can vary depending on the location and type of rental, but here are some general guidelines. you must meet minimum requirements related to age and have a debit card in place.

Renters must have a debit card with them at the time of renting so that money can be taken out of their account to pay for the fees.

Hertz will advise you against driving without insurance, and will try to sell you their costly Hertz car rental insurance. Although it is unwise to drive a rental automobile without insurance, they aren’t being completely honest with their suggestion, thus it seems to reason that you will enroll in a rental car insurance.

How to File a Claim

What to Do in Case of an Accident or Damage – If you are involved in an accident while driving a rental car, there are certain steps you should follow to file a claim with the rental car insurance company. First, exchange personal information with the other driver, including name, address, license plate number, rental vehicle information, insurance company, and policy number, and document the accident with pictures and notes. If the other driver is at fault, you should get their contact and insurance information and call their insurance company directly to file a claim. If you are at fault or have non-collision damage, you can file a claim with the rental car insurance company. The process for filing a claim with the rental car insurance company may vary depending on the provider, but typically, you would need to provide details of the incident, including the date, time, and location of the accident, as well as any police report numbers, if applicable. Additionally, you may need to provide documentation of the damage, such as photographs or repair estimates.

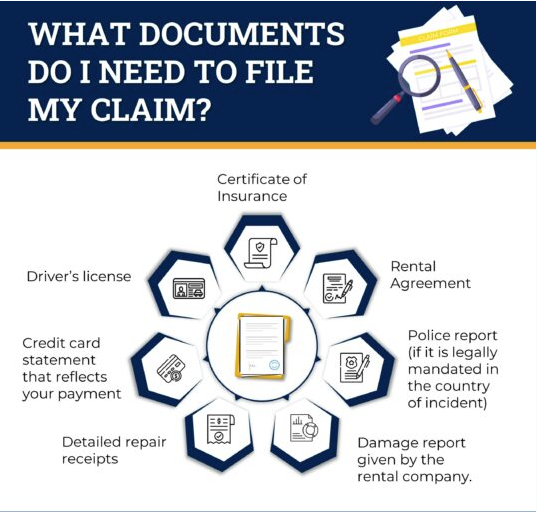

Required Documentation for Filing a Claim

- A copy of the Certificate of Insurance

- A copy of the rental agreement

- A copy of the police report if:

- you got in an accident with a third party

- It is legally mandated in the country of incident

- your claim is about stolen personal belongings

- A copy of the damage report given by the rental company, detailing each cost incurred. Photographs of the damage are optional but may help ensure that the charges are reasonable.

- Detailed repair receipts, invoices or other documents showing the breakdown of the amount the rental company charged you for the accidental damage or loss

- A copy of your credit card statement that reflects your payment for the claimed damages

- A copy of the driver’s license of the person driving the car during the accident

What Documents Do I Need to File My Claim?

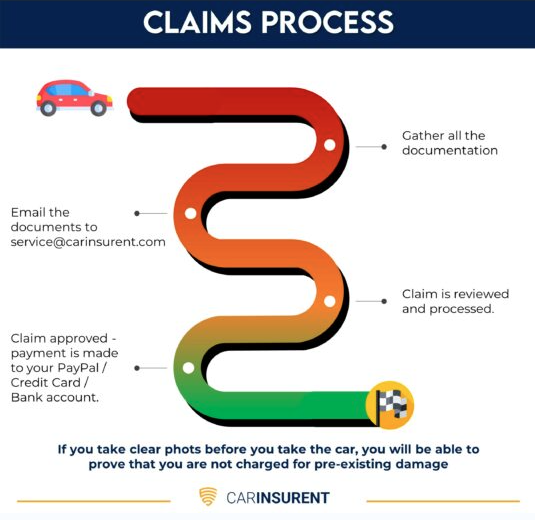

Tips for a Smooth Claims Process: Filing an insurance claim can be a complicated and stressful process. The following tips can help ensure a smoother claims process:

- Document everything: Documenting all the details of the accident or loss, including taking photos and notes, can help speed up the claims process and reduce the possibility of disputes.

- Communication: Communication is key in any insurance claim process. Keep thorough records of all communication with the insurer, and discuss your expectations for the claims process with the adjuster. You can also ask about the frequency of updates and the preferred type of communication.

- Avoid duplicate claims: Avoid submitting duplicate claims, as it slows down the claims payment process and creates confusion.

- Understand your coverage: It’s important to understand your insurance coverage, including the limits and deductibles, before filing a claim. Understanding your policy can help ensure that you receive the maximum benefit to which you are entitled.

- Be patient: Claims processing can take time, so it’s important to be patient.

By following these tips, you can help ensure a smoother claims process, and increase the chances of receiving the maximum benefit that you are entitled to under your insurance policy.

Claims Process

Final Thoughts and Recommendations

In summary, while Hertz offers LDW rental car insurance, it’s important to review the policy carefully to ensure it meets your needs. If you’re looking for additional coverage, you can save money by shopping around and buy car rental insurance online for as low as $6.49 per day* to $94.90 for an annual policy.

See How Much You Can Save on Your Hertz Rental Car Insurance

Get Started2 Responses

Leave a Reply

Frequently Asked Questions (FAQ)

No. We provide a single journey plan. You are covered from the time you pick up the rental car up to the time you return it or on the last date written on your Certificate of Insurance, whichever comes first.

No. You should purchase a policy before starting your travel.

Find the answers you’re looking for to the most frequently asked car hire insurance questions as well as other questions relating to our products and services.

does you supercover policy cover car rental (hertz) taiwan

Thank you for taking the time to contact us.

Our car rental excess waiver covers any licensed rental company in Korea.

Have a safe trip

The CarInsuRent Team