Yes. Insurance for a single day is available.

Iceland Rental Car Insurance: Do You Need It? How Does it Work?

Renting a car and exploring the majestic landscapes of Iceland is a thrilling adventure on many travelers’ bucket lists. However, alongside the excitement of planning your road trip, comes the rather less exhilarating, yet crucial, topic of rental car insurance in Iceland.

Compare and Buy Iceland Rental Car Insurance

Get StartedCar Hire Excess Insurance Iceland Coverage Chart

| Warranty | What does it cover? | How much does it cover? |

|---|---|---|

| Damage due to collision or theft | Reimbursement of the deductible applied by the rental company as a result of accidental damage caused to the vehicle, including tires, windshield, underbody and other parts | $ 2,500 - $ 4,500 |

| Improper Fuel Use Charges | Tank emptying costs and vehicle towing, when the wrong fuel is refueled into the vehicle by mistake. | $ 500 |

| Loss or theft of keys | In the replacement of lost or stolen keys, including lock and locksmith costs. | $ 500 |

| Towing charges | Covers the tow truck of the rented car in the event of a breakdown or accident. | $ 500 |

| Vehicle return charges | If as a result of an accident or illness with hospitalization you cannot return the vehicle. | $ 250 |

| Personnal belongings | In case your baggage, personal belongings or valuables are taken, permanently lost or unintentionally damaged during your trip | $ 500 |

| Hotel expensses | If You are unable to use your rental vehicle as a result of it being stolen or damaged | $ 150 |

Vehicle rental excess insurance

What is insured?

- Excess reimbursement up to US$ 4,500

- Damage Waiver (LDW) up to US$ 4,500

- Towing charges up to US$ 500

- Improper fuel charges up to US$ 500

- Loss or theft of keys up to US$ 500

- Vehicle return charges up to US$ 250

- Personnal belongings up to US$ 500

- Hotel expenses up to US$ 150

What is not covered?

- Damage to the vehicle or property of a third party

- Damage caused by a person not authorized to drive the rented vehicle

- Mechanical failure of the rented vehicle

- Loss or damage to the vehicle’s interior that is not related to a collision.

- Parking tickets or fines, traffic violations and such

- Any loss that occurs outside the validity of the insurance

- Any rental contract of more than 45 days

Is the coverage subject to any type of restrictions?

- Any claim resulting from a direct breach of any of the terms and conditions of your rental agreement

- Any person under 21 or above 84 years of age

- Rentals that begin or end outside the insurance period, as indicated on the insurance certificate

- The policyholder must be designated as the main driver in the rental agreement

- The maximum amount that can be claimed for a single loss is US$ 4,500

- Damage to Recreational vehicles (RVs) / Motorhomes / Campervans (unless you have purchased a specific cover)

- Damage to vehicles provided by a peer-to-peer vehicle rental service platform or a subscription vehicle service is excluded (unless purchased specific coverage)..

Where do I have coverage?

- Anywhere in the world except trips in, to or through Afghanistan, Cuba, Congo, Iran, Iraq, Ivory Coast, Liberia, North Korea, Myanmar, Russia, Sudan, Syria, Ukraine and Zimbabwe

What are my obligations?

- When applying for your policy, you must exercise reasonable care to honestly and carefully answer any questions asked.

- You must take all reasonable steps to avoid or reduce any loss (for example, you must report accidents or other damage to your rental company nd to CarInsuRent as soon as reasonably possible).

- If you make a claim, you must provide the documents and other evidence that claims handlers need to process your claim.

- You must repay any sums to which you are not entitled (for example, if we pay your claim for an accident which is later compensated by a third party).

- You must not violate the terms of the rental agreement.

When and how do I make the payment?

- The premium must be paid in full before the policy start date. Payment can be made by credit or debit card or PayPal through our website

What is the start and end date of coverage?

- As set out in the insurance certificate, as agreed in the application process, your policy will cover you from the start date and time of your booking to the end date and time of your booking.

How do I cancel the contract?

- You can cancel your policy before the start date or within 14 days from your purchase through our customer service team.

I wholeheartedly recommend CarInsuRent. Their response time was exceptionally prompt. They requested standard documentation and photos of the damage, and I received payment directly to my PayPal account almost immediately.

Rental Car Insurance in Iceland Comparison: CarInsuRent vs. Cost at Counter

We compared and analyzed Super Collision Damage Waiver costs for a 7-day rental of a standard car class (July 1st – July 7th). The rental car insurance rates listed here are subject to change by the car rental companies without notice. For the most up-to-date pricing information, we encourage you to request a free online quote prior to booking. CarInsuRent’s car hire excess protection for rental vehicles in Iceland offers the same coverage at a 70% lower cost!

| Car Rental Company | Collision Damage Waiver (CDW) + Theft Protection (TP) | Wind & Gravel Protection | Avg. Super Collision Damage Waiver Cost at Counter* | Avg. Insurance Deductible at Counter | Avg. Cost for Rental Car Excess Insurance with CarInsuRent | Cost of Deductible with Zero-Excess from CarInsuRent |

| Avis | US$ 21.50 | US$ 23.00 | US$ 44.61 | US$ 1,400 | US$ 16.66 per day or US$ 350.00 for annual coverage | $0 USD |

| Budget | US$ 21.50 | US$ 23.00 | US$ 24.00 | US$ 1,400 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Enterprise | US$ 10.87 | US$ 21.00 | US$ 18.12 | US$ 3,620 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Europcar | Included at the rental price | US$ 28.69 | US$ 1,840 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD | |

| Sixt | Included at the rental price | € 46.00 | € 1,500 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

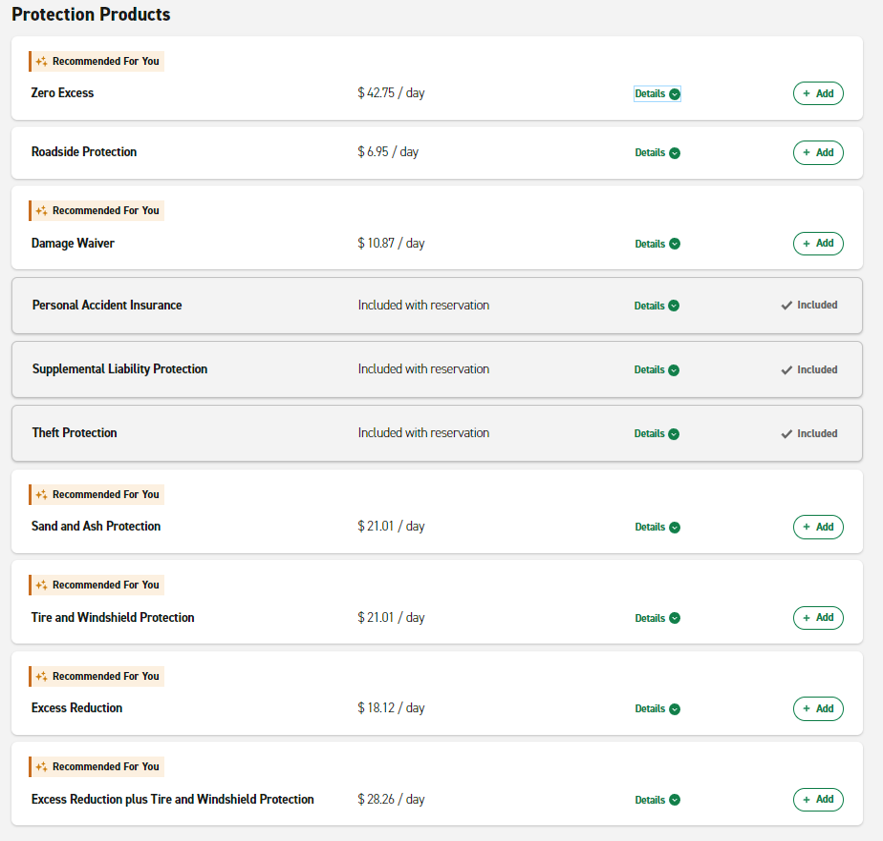

Enterprise Rental Car Insurance in Iceland

The Importance of Rental Car Insurance in Iceland

This guide aims to demystify the often confusing world of rental car insurance, breaking down what you need, how it works, and most importantly, whether you really need it.

The two fundamental types of insurance offered when renting a car in Iceland are Collision Damage Waiver (CDW) and Third-Party Liability (TPL). In essence, TPL is a mandatory requirement by Icelandic law, covering any damage that you may cause to another person, vehicle, or property, and is usually included at no extra cost with your rental car. CDW, on the other hand, protects you against significant financial losses if the rental car incurs damage during your period of use, excluding specific types of damage such as water, undercarriage, tires, and wind damage, among others.

Yet, Iceland’s unique landscapes present additional risks not typically covered by basic insurance plans. This is where additional insurance coverage options such as Gravel Protection and Sand and Ash Protection come into play, potentially lowering your self-risk amount or providing coverage for specific risks such as loose gravel or volcanic ash damage.

While it may be tempting to opt for the most comprehensive coverage available, the key to making the right decision lies in understanding your specific needs, the nature of your trip, and your risk tolerance. That’s why it’s vital to carefully study the car rental’s terms and conditions to understand what each insurance option covers and excludes. Stay with us as we delve deeper into the specifics of car rental insurance in Iceland, giving you the knowledge to make informed decisions and ensure peace of mind as you embark on your Icelandic adventure.

When renting a car in Iceland, having rental car insurance is of utmost importance. This insurance coverage provides protection and peace of mind during your travels, safeguarding you from potential financial liabilities and unexpected expenses. Here are some key reasons highlighting the importance of car rental insurance in Iceland:

- Protection Against Accidents and Damages: Rental car insurance covers you in the event of accidents, collisions, or damages to the rental vehicle. It helps minimize your financial responsibility and ensures that you won’t be left with hefty repair bills or replacement costs.

- Liability Coverage: Car rental insurance typically includes liability coverage, which protects you from potential legal and financial obligations in case you cause bodily injury or property damage to others while driving the rental vehicle. This coverage is crucial to comply with Iceland’s legal requirements and offers financial protection against potential lawsuits.

- Peace of Mind: Having car rental insurance provides peace of mind throughout your journey. It allows you to enjoy the stunning landscapes and attractions in Iceland without worrying about the potential financial burdens that may arise from accidents or damages to the rental vehicle.

- Protection Against Theft and Vandalism: Rental car insurance often includes coverage for theft and vandalism. In case the rental vehicle is stolen or vandalized, the insurance can help cover the costs of replacement or repairs, ensuring that you are not left solely responsible for the financial consequences.

- Assistance and Support: Car rental insurance may provide additional benefits such as roadside assistance, towing services, and support in navigating the insurance claim process. These services offer convenience and peace of mind, knowing that help is just a phone call away in case of emergencies or breakdowns.

Before renting a car in Iceland, carefully review the terms and conditions of the car rental insurance policy. Understand the coverage limits, deductibles, exclusions, and any additional fees that may apply. Consider your personal circumstances, the value of the rental vehicle, and your risk tolerance to determine the level of coverage you require.

Remember that rental car insurance is typically optional but highly recommended. While it adds to the overall cost of renting a car, the protection and security it provides are well worth the investment. By opting for car rental insurance in Iceland, you can explore the country with confidence, knowing that you are adequately covered in case of unexpected events on the road.

The Basics of Iceland Rental Car Insurance

In the picturesque country of Iceland, renting a car is a popular way for tourists to explore the land of ice and fire. Understanding the ins and outs of car rental insurance in the country is crucial to ensure a stress-free journey.

When renting a car in Iceland, two basic types of insurance are usually offered: Collision Damage Waiver (CDW) and Third Party Liability (TPL).

Third-Party Liability insurance, a legal requirement in Iceland, typically covers any damage that you might cause to another person, vehicle, or property while driving the rental car. It also extends to passengers in your car in case they suffer damage or injuries. Normally, this is included in your rental package at no extra cost.

The Collision Damage Waiver, on the other hand, refers to the car rental company waiving its right to hold you fully liable for damages to the rental car. Instead, you are left with a set self-risk amount that you are liable for. This self-risk amount can vary greatly between car rental companies but usually hovers around 2,000 EUR. A Super Collision Damage Waiver (SCDW) can be availed to substantially lower this self-risk amount. However, it’s essential to remember that the CDW often does not cover the vehicle for certain types of damage, such as water damage, undercarriage, tires, headlights, windscreen, wind damage to doors, and damage caused by negligence.

In addition to these basic coverages, optional insurances like the Super Collision Damage Waiver, Theft Protection, Gravel Protection, Sand and Ash Protection, Undercarriage/Chassis Insurance, Tire Insurance, Window Insurance, Door Insurance, Water Insurance, Animal Encounter Insurance, and Towing Insurance can also be considered based on your individual needs.

Gravel Protection

Gravel Protection is a form of rental car insurance in Iceland that provides coverage for damages resulting from gravel and similar materials impacting the rental vehicle. Given the prevalence of gravel roads throughout the country, this type of insurance can be critical for those planning to rent a car and travel within Iceland.

The potential for damage is not limited to driving directly on gravel roads. Rocks or gravel can get lodged in the tires of other vehicles that have been on such roads, and once these vehicles are back on paved roads, those stones can be flung out, potentially hitting your vehicle. Depending on the size of the rock and the speed of the vehicles, this can cause significant damage, particularly to the windshield.

The Gravel Protection insurance typically covers damage to the body of the rental car, the headlights, and the front windshield. If you plan to drive on F-Roads, narrow gravel roads accessible only with a jeep or 4×4, it is highly recommended to have Gravel Protection Insurance. It is important to note, though, that while Gravel Protection Insurance would still apply on F-Roads, there is generally no insurance coverage when crossing rivers.

Considering the unique conditions of Iceland’s roads and landscapes, opting for such coverage can be a wise choice to avoid unexpected costs related to potential damage. As with any insurance decision, it’s important to weigh the cost of the insurance against the potential risk and your own comfort with that risk.

Sand and Ash Protection

Sand and Ash Protection (SAAP) is a specific type of insurance coverage that protects rental cars from potential damage caused by volcanic ash and sand in Iceland. It was created due to the volcanic eruptions that have left loose ash and fine sand in certain areas of Iceland, such as from the Eyjafjallajökull eruption. As the wind blows, it may cause the ash and sand to whirl up and cause damage to vehicles, especially to their paintwork, windows, lights, plastics, chromes, and wheels.

This type of damage is not covered under regular Collision Damage Waiver (CDW) policies from Icelandic insurance companies, necessitating the need for a separate protection. This optional coverage is highly recommended for travelers planning to drive in Iceland, especially during the Sand & Ash period, typically in February, March, and April[2]. During this time, thawed snow and insufficiently grown grass fail to hold the sand in place, resulting in its dispersion onto roads, causing potential vehicle damage.

In the event of a sandstorm, travelers are advised to change plans and wait out the storm to avoid damage. If damage occurs, without the SAAP, the vehicle might need to be spray painted again, incurring a considerable sum.

SAAP insurance can be purchased through your car hire company and typically has a deductible of 50,000 IKR for all rental cars in the fleet. CarInsuRent Car Hire Excess Insurance for Iceland include SAAP and GP with zero deductible.

It’s crucial to carefully review the terms and conditions of the car rental insurance policy, including coverage details, exclusions, deductibles, and any limitations. Take note of any restrictions on off-road driving or certain types of vehicles, as violating these terms may invalidate your insurance coverage.

Additionally, consider any existing insurance coverage you may have, such as personal auto insurance or travel insurance, as they might provide overlapping coverage for certain aspects of car rental insurance.

To make an informed decision, compare insurance options from different rental companies, considering factors such as coverage benefits, costs, and customer reviews. Understanding the coverage available and selecting the appropriate options based on your needs will ensure that you are adequately protected during your rental period in Iceland.

Remember, car rental insurance is not mandatory in Iceland, but it is highly recommended to protect yourself and your financial interests. By securing the right car rental insurance, you can enjoy your journey through Iceland with confidence and peace of mind.

Car Rental Insurance for Iceland Cost

The cost of car rental insurance in Iceland can vary depending on several factors, including the rental location, the duration of the rental, the type of coverage selected, and any additional options or add-ons chosen. It’s important to note that insurance costs are typically separate from the base rental rate.

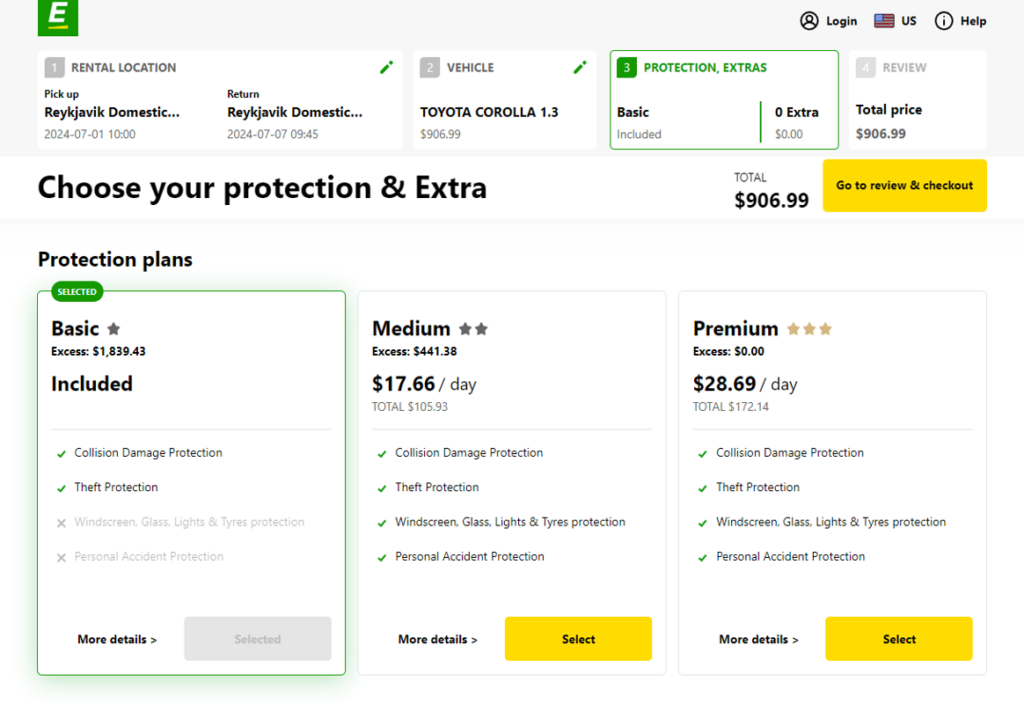

Europcar Rental Car Insurance in Iceland

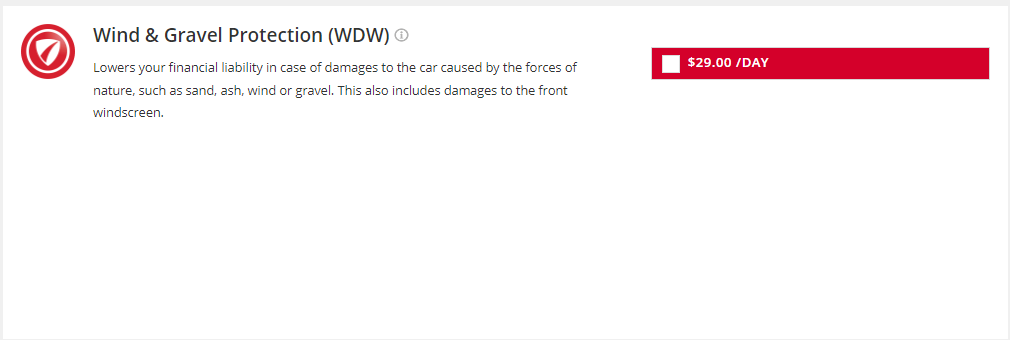

Avis Wind & Gravel Protection (WDW) lowers your financial liability in case of damages to the car caused by the forces of nature, such as sand, ash, wind or gravel. This also includes damages to the front windscreen. The cost of Avis Wind & Gravel Protection is US$ 29.00/day. Other providers may offer Gravel Protection for EUR 13.55/day and SAAP for EUR 13.55/day.

Avis WDW cost

Keep in mind that alternative insurance options may be available, such as purchasing insurance through a third-party provider or relying on coverage provided by your personal auto insurance or credit card benefits. Comparing the costs and coverage details of different insurance options can help you make a cost-effective choice that meets your requirements while staying within your budget. CarInsuRent car hire excess insurance for Iceland starts from as low as $35.00 per day* to $350.00 for an annual car hire excess insurance policy. Our Iceland policy covers the excess on damage and theft up to €2,500 and provide full protection that Includes single vehicle damage, roof and undercarriage damage, auto glass and widescreen damage, towing expenses, misfuelling, loss of car key, tire damage, SAAP and Gravel Protection. We cover multiple drivers between the ages of 21 and 84 years.

Ultimately, it is essential to balance the cost of car rental insurance with the level of coverage and protection it provides. By evaluating your needs, comparing insurance options, and considering your budget, you can select the most suitable car rental insurance for your trip to Iceland.

See How Much You Can Save on Your Iceland Car Rental Insurance

Get StartedBenefits of Having Car rental insurance for Iceland

When renting a car in Iceland, having car rental insurance offers several important benefits that can provide peace of mind and financial protection throughout your journey. Here are some key benefits of having car rental insurance for Iceland:

- Protection against Accidents and Damages: Car rental insurance covers you in case of accidents, collisions, or damages to the rental vehicle. It helps minimize your financial responsibility and ensures that you won’t be left with hefty repair bills or replacement costs.

- Liability Coverage: Car rental insurance typically includes liability coverage, which protects you from potential legal and financial obligations if you cause bodily injury or property damage to others while driving the rental vehicle. This coverage is crucial to comply with Iceland’s legal requirements and offers financial protection against potential lawsuits.

- Peace of Mind: Having car rental insurance provides peace of mind throughout your journey. It allows you to explore the stunning landscapes of Iceland without worrying about the potential financial burdens that may arise from accidents or damages to the rental vehicle.

- Protection against Theft and Vandalism: Car rental insurance often includes coverage for theft and vandalism. In case the rental vehicle is stolen or vandalized, the insurance can help cover the costs of replacement or repairs, ensuring that you are not solely responsible for the financial consequences.

- Assistance and Support: Car rental insurance may provide additional benefits such as roadside assistance, towing services, and support in navigating the insurance claim process. These services offer convenience and peace of mind, knowing that help is just a phone call away in case of emergencies or breakdowns.

- Flexibility and Customization: Car rental insurance options in Iceland can be customized to suit your specific needs. You can choose from different coverage levels, deductibles, and additional options to tailor the insurance to your preferences and budget.

Having car rental insurance in Iceland is highly recommended to protect yourself and your financial interests. It ensures that you can enjoy your trip with confidence, knowing that you are adequately covered in case of unexpected events on the road. Before selecting car rental insurance, carefully review the policy terms, coverage details, and any limitations or exclusions. By understanding the benefits of car rental insurance and selecting the right coverage, you can have a worry-free and enjoyable experience while exploring the stunning landscapes of Iceland.

It is important to research and understand the coverage options and costs to make an informed decision that best fits your needs. CarInsuRent car hire excess insurance for Iceland starts from as low as $35.00 per day* to $350.00 for an annual car hire excess insurance policy. Our Iceland policy covers the excess on damage and theft up to €2,500 and provide full protection that Includes single vehicle damage, roof and undercarriage damage, auto glass and widescreen damage, towing expenses, misfuelling, loss of car key, tire damage, SAAP and Gravel Protection. We cover multiple drivers between the ages of 21 and 84 years.

Car rental insurance for Iceland – Your Options

Purchase Car Rental Insurance Directly With the Rental Company

- Rental company’s insurance – Most rental car companies offer their own insurance, which typically includes damage cover (CDW), theft cover (Theft Protection), and third-party cover (Third-Party Liability). These types of insurance options usually come with an excess, which is the first part of the bill that the renter will be responsible for. The rental company’s insurance is convenient, but it can be expensive and may not provide comprehensive coverage.

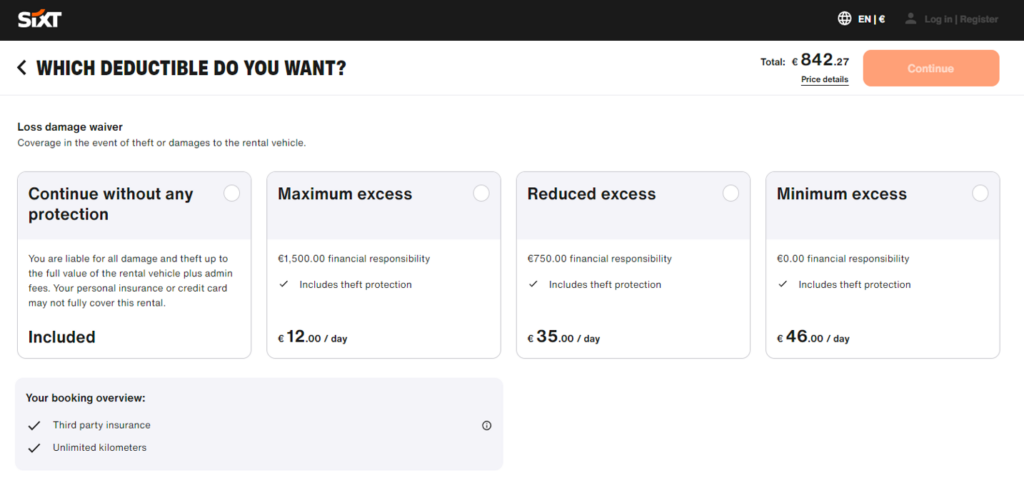

Sixt Rental Car Insurance in Iceland

Cover Your Excess Through CarInsuRent

- Third-party car rental insurance – Third-party car rental insurance is an affordable option that can provide comprehensive coverage for rental cars. This type of insurance typically covers collision damage, theft protection, and liability, and may offer higher coverage limits than rental company insurance. It can provide a cost-effective alternative to rental car company insurance.

Personal auto insurance policies

- Personal auto insurance policies may cover rental cars, but it depends on the policy and the coverage. If the policy includes collision and comprehensive coverage, it may extend to rental cars. However, liability coverage may not extend to rental cars, so it’s important to check with the insurance company before renting a car.

Travel insurance –

- Travel insurance may offer coverage for rental cars, including collision damage and theft protection. However, it is important to check the policy to confirm the coverage and any limitations or exclusions.

Credit card rental car insurance benefits –

- Some credit cards offer rental car insurance benefits, which may include coverage for damage and theft. However, the coverage and limitations can vary by credit card, so it’s important to check with the credit card company to confirm the coverage. Check if your personal insurance or credit card covers rental car insurance.

Don’t Buy Any Additional Insurance At All

- You are not required by law to buy a Iceland car hire excess insurance or a Collision Damage Waiver. Such products are completely optional. In case of an accident (whether major or minor), rental companies would quickly bill your credit card the maximum damage. Excess fee can reach $3,000–$8,250 depending on the company and the type of car you rented.

See How Much You Can Save on Your Iceland Rental Car Insurance

Get StartedRental Company Insurance vs. CarInsuRent – Which Option is Best for You?

When renting a car, Iceland car rental excess insurance is an optional add-on that can help reduce the excess amount that you would be liable for in the event of damage or theft of the rental car. Car rental companies charge for excess insurance by offering a CDW insurance, which will reduce the renter’s financial liability in the event of an accident, and/or a Loss Damage Waiver (LDW), which will cover the cost of repairing or replacing the rental car in case of damage or theft. The cost of CDW and LDW can vary significantly from one rental company to another and can depend on the type of vehicle, the location, and the duration of the rental.

On the other hand, third-party providers like CarInsuRent offer excess cover insurance, which is usually more affordable and comprehensive than CDW or LDW offered by rental companies. The excess cover insurance from CarInsuRent will provide you with coverage for the excess amount that you are liable to pay in case of damage or theft of the rental car, and it can be purchased separately from the car rental agreement. Excess cover insurance can be purchased at any time before the rental period and it can be customized to fit your needs, which can be a more flexible option than the insurance offered by rental companies.

How to File a Claim

What to Do in Case of an Accident or Damage – If you are involved in an accident while driving a rental car, there are certain steps you should follow to file a claim with the rental car insurance company. First, exchange personal information with the other driver, including name, address, license plate number, rental vehicle information, insurance company, and policy number, and document the accident with pictures and notes. If the other driver is at fault, you should get their contact and insurance information and call their insurance company directly to file a claim. If you are at fault or have non-collision damage, you can file a claim with the rental car insurance company. The process for filing a claim with the rental car insurance company may vary depending on the provider, but typically, you would need to provide details of the incident, including the date, time, and location of the accident, as well as any police report numbers, if applicable. Additionally, you may need to provide documentation of the damage, such as photographs or repair estimates.

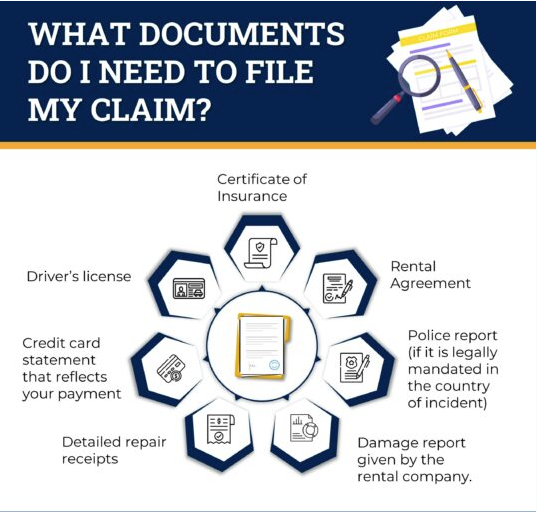

Required Documentation for Filing a Claim

- A copy of the Certificate of Insurance

- A copy of the rental agreement

- A copy of the police report if:

- you got in an accident with a third party

- It is legally mandated in the country of incident

- your claim is about stolen personal belongings

- A copy of the damage report given by the rental company, detailing each cost incurred. Photographs of the damage are optional but may help ensure that the charges are reasonable.

- Detailed repair receipts, invoices or other documents showing the breakdown of the amount the rental company charged you for the accidental damage or loss

- A copy of your credit card statement that reflects your payment for the claimed damages

- A copy of the driver’s license of the person driving the car during the accident

What Documents Do I Need to File My Claim?

Tips for a Smooth Claims Process: Filing an insurance claim can be a complicated and stressful process. The following tips can help ensure a smoother claims process:

- Document everything: Documenting all the details of the accident or loss, including taking photos and notes, can help speed up the claims process and reduce the possibility of disputes.

- Communication: Communication is key in any insurance claim process. Keep thorough records of all communication with the insurer, and discuss your expectations for the claims process with the adjuster. You can also ask about the frequency of updates and the preferred type of communication.

- Avoid duplicate claims: Avoid submitting duplicate claims, as it slows down the claims payment process and creates confusion.

- Understand your coverage: It’s important to understand your insurance coverage, including the limits and deductibles, before filing a claim. Understanding your policy can help ensure that you receive the maximum benefit to which you are entitled.

- Be patient: Claims processing can take time, so it’s important to be patient.

By following these tips, you can help ensure a smoother claims process, and increase the chances of receiving the maximum benefit that you are entitled to under your insurance policy.

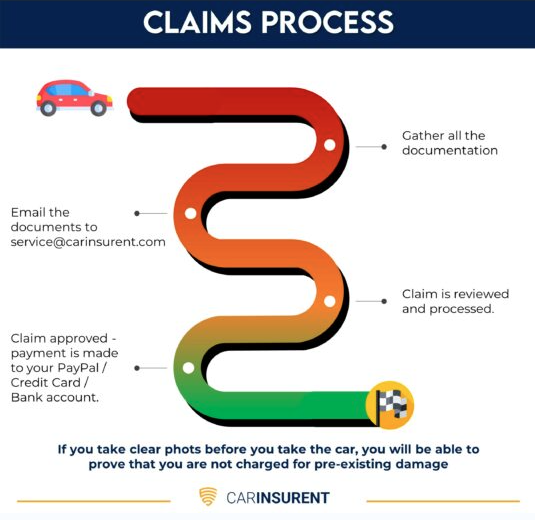

Claims Process

Final Thoughts and Recommendations

In conclusion, car rental insurance for Iceland is a crucial aspect to consider when renting a vehicle for your journey. It offers essential protection and peace of mind, ensuring that you are financially covered in case of accidents, damages, theft, or liability issues. Here are some final thoughts and recommendations to keep in mind:

- Evaluate Your Coverage Needs: Assess your specific needs and circumstances before selecting car rental insurance. Consider factors such as the rental location, duration, and the value of the vehicle. This evaluation will help you choose the appropriate coverage options and ensure you are adequately protected.

- Read and Understand the Policy: Carefully review the terms and conditions of the car rental insurance policy. Understand the coverage limits, deductibles, exclusions, and any additional fees or requirements. Clarify any doubts with the rental company to avoid misunderstandings and ensure you have a clear understanding of your coverage.

- Compare Insurance Options: Explore different insurance providers and compare their coverage benefits, costs, and customer reviews. Look for reputable companies that offer comprehensive coverage and excellent customer support. Consider the overall value provided by the insurance, balancing the cost with the level of coverage and benefits.

- Consider Existing Coverage: Review any existing insurance policies you may have, such as personal auto insurance or travel insurance, to understand if they offer any rental car coverage. This can help you avoid unnecessary duplication of coverage and potentially save on insurance costs.

- Plan Your Budget: Factor in the cost of car rental insurance when planning your overall travel budget. Ensure that you allocate enough funds to cover the insurance premiums while still maintaining a comfortable budget for other travel expenses.

By following these recommendations, you can select the right car rental insurance for your needs and enjoy a worry-free and protected rental experience in Iceland. Remember, the right insurance coverage not only provides financial security but also allows you to fully immerse yourself in the stunning landscapes, vibrant cities, and unique experiences that Iceland has to offer.

See How Much You Can Save on Your Iceland Rental Car Insurance

Get StartedTravel Tips and Guides

Frequently Asked Questions (FAQ)

No. We provide a single journey plan. You are covered from the time you pick up the rental car up to the time you return it or on the last date written on your Certificate of Insurance, whichever comes first.

No. You should purchase a policy before starting your travel.

Find the answers you’re looking for to the most frequently asked car hire insurance questions as well as other questions relating to our products and services.