Yes. Insurance for a single day is available.

National Car Rental Insurance: Should You Buy It?

PUBLISHED ON May, 21 2023

National Car Rental is one of the leading car rental companies globally, offering a wide range of vehicles to suit different travel needs. When renting a car from National, one important consideration is insurance coverage. Understanding the insurance options provided by National Car Rental is crucial for a smooth and worry-free rental experience. This article aims to provide an in-depth analysis of National car rental insurance, helping you navigate through the coverage types, terms, and considerations. By gaining a comprehensive understanding of National car rental insurance, you can make informed decisions and ensure they have the right level of coverage to protect themselves and their rental vehicle during their journey.

Types of Insurance Offered by National Car Rental

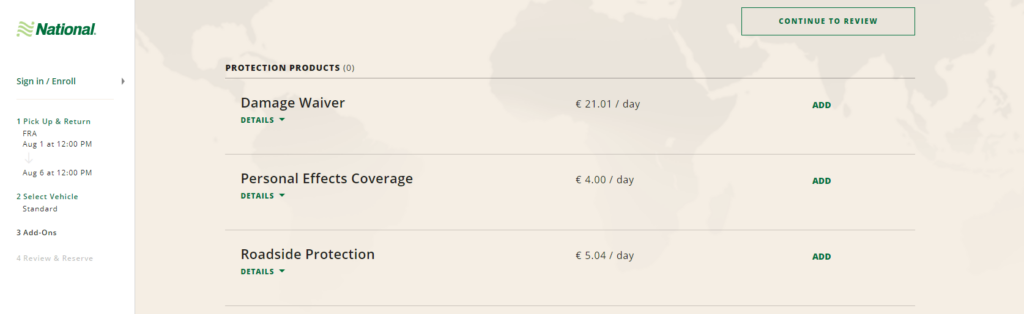

National Car Rental provides various insurance options to cater to the needs of their customers. Understanding these insurance offerings will help you choose the coverage that best suits your requirements and provides adequate protection during your rental period. Here are the main types of insurance offered by National Car Rental:

A. Damage Waiver – Damage Waiver (DW) reduces liability in the event that the vehicle is damaged or stolen and no accountable party can be found. Renter is fully liable for the car if DW is not included in the reservation. All sizes of cars and SUVs, including Mini, Economy, Compact, Intermediate, Standard, and Small Passenger Vans, have a 950 EUR excess if it is included in the reservation. The excess for Full-size and Premium cars, Large Passenger Vans, Large SUVs, and Small Cargo Vans is 1150 EUR, for all other Cargo Vans it is 1500 EUR, and for the Luxury Elite Electric it is 2500 EUR.

National Damage Waiver does not cover: braking damage, operational damage, pure breakage damage, intentional damage, gross negligence but pro-rata according to the level of culpability, if renter grossly neglected his or her duties according to National’s Terms and Conditions of Vehicle Rental if such neglect of duties was cause for the damage, and intentionally violated his or her duty to involve the police. Damage Waiver will be voided if damage is caused by: using the vehicle outside the countries listed on the front of the contract, driving under the influence of narcotics, alcohol or drugs, transporting easily flammable, toxic or otherwise dangerous substances, illegal purposes, car races, driver and vehicle tests, towing other vehicles or towing trailers, use on unpaved roads, racetracks and test courses, in violation of the legally prescribed safety precautions, or for the purpose beyond the predictable and usual use, in particular any careless or reckless use, or intentional damaging of the vehicle.

See How Much You Can Save on Your Car Rental Insurance

Get StartedB. Personal Effects Coverage – Personal Effects Coverage (PEC) offered by National Car Rental is an insurance option designed to provide protection for your personal belongings and valuables while renting a vehicle. PEC coverage ensures that your personal effects are covered in the event of theft, loss, or damage during the rental period. National PEC provides coverage for a wide range of personal items, including but not limited to:

- Electronics: This includes items such as laptops, tablets, smartphones, cameras, and other electronic devices.

- Jewelry and Accessories: PEC can cover valuable items like jewelry, watches, and accessories.

- Clothing and Personal Items: Coverage extends to clothing, footwear, personal care items, and other essential personal belongings.

- Sports Equipment: PEC can include coverage for sports equipment like golf clubs, tennis rackets, and other gear.

- Luggage and Bags: Your suitcases, travel bags, and backpacks may be protected under PEC.

It’s important to note that PEC coverage typically comes with certain limits and deductibles, which may vary based on the rental agreement and the specific policy terms. Exclusions may apply for certain items, such as cash, antiques, artwork, or items of extreme value. It is crucial to review the policy terms and conditions to understand the full scope of coverage, limitations, and exclusions. In the unfortunate event of theft, loss, or damage to your personal effects, you would need to follow the procedures outlined by National Car Rental to report the incident and file a claim for reimbursement. This may involve providing documentation, such as police reports, proof of ownership, and receipts for the affected items.

When considering whether to opt for PEC, it is important to evaluate your personal belongings’ value and the level of coverage you already have through other insurance policies, such as homeowners or travel insurance. If you determine that additional coverage is necessary, PEC can provide valuable protection and peace of mind during your rental period.

Before making a decision, carefully review the rental agreement and insurance requirements to ensure compliance and to understand any mandatory PEC provisions. Consider your individual needs, the nature of your trip, and the value of your personal belongings to determine whether Personal Effects Coverage is the right option for you. Determine whether personal coverage is sufficient to cover damage, theft, loss of revenue, administrative costs, value reduction, and any towing, storage, or impound fees before investing in DW. The tenant will be responsible for paying these fees and pursuing reimbursement from their personal insurance provider if DW is rejected. Insurance is not DW.

C. Roadside Protection – National Car Rental offers reliable and convenient roadside assistance services to ensure a smooth and hassle-free rental experience for their customers. Here is a description of the roadside assistance services provided:

- 24/7 Availability: National Car Rental’s roadside assistance services are available round the clock, ensuring that help is just a phone call away, no matter the time or location.

- Emergency Towing: In the event of a breakdown or mechanical failure, National Car Rental’s roadside assistance team can arrange for a tow truck to transport the rental vehicle to the nearest authorized repair facility. This service helps ensure that you and your vehicle are taken care of promptly.

- Jump Starts: If the rental vehicle’s battery dies, National Car Rental’s roadside assistance can provide a jump-start to get you back on the road. Their trained professionals will assist in jump-starting the vehicle, enabling you to continue your journey without delays.

- Flat Tire Assistance: If you encounter a flat tire, National Car Rental’s roadside assistance team can help by providing tire change services. They will either replace the flat tire with a spare or inflate it, depending on the situation, to ensure your safety and mobility.

- Lockout Service: Accidentally locking the keys inside the rental vehicle can be a frustrating experience. With National Car Rental’s lockout service, you can quickly regain access to your vehicle. Their roadside assistance team will assist in unlocking the rental car, allowing you to retrieve your keys and continue your journey.

- Fuel Delivery: If you run out of fuel during your rental period, National Car Rental’s roadside assistance can arrange for fuel delivery. They will provide enough fuel to reach the nearest gas station, ensuring that you can refuel and get back on the road without inconveniences.

It’s important to note that specific terms and conditions may apply to National Car Rental’s roadside assistance services. The details of the coverage, response time, and any associated fees or limitations should be reviewed in the rental agreement and discussed with National Car Rental’s customer service representatives.

See How Much You Can Save on Your Car Rental Insurance

Get StartedNational Car Rental Insurance Cost

The cost of National Car Rental insurance can vary based on several factors, including the type of coverage selected, the rental location, the duration of the rental, and any additional options or add-ons chosen. It is important to note that insurance costs are typically separate from the base rental rate.

To determine the exact cost of National Car Rental insurance, it is advisable to obtain a quote directly from National Car Rental or consult their website. By providing details about your rental dates, location, and desired coverage options, you can receive an accurate estimate of the insurance cost.

Additionally, it is recommended to carefully review the terms and conditions of the insurance coverage, including any deductibles or limitations that may impact the overall cost. Understanding the coverage details and associated costs will help you make an informed decision regarding National Car Rental insurance and its affordability in relation to your specific rental needs.

Keep in mind that alternative insurance options may be available, such as purchasing insurance through a third-party provider or relying on coverage provided by your personal auto insurance or credit card. Comparing the costs and coverage details of different insurance options can help you make a cost-effective choice that meets your requirements while staying within your budget.

National Damage Waiver cost EUR 21.01 per day, and for 1 week rental will cost a total of EUR 147.07. Keep in mind that, as mentioned above, according to National’s terms and conditions, all sizes of cars have a 950 – 2500 EUR excess if it is included in the reservation.

National PEC cost EUR 4.00 / day and roadside protection EUR 5.04 / day. You can save money by shopping around and buy car rental insurance online for as low as $6.49 per day* to $94.90 for an annual policy.

How Does CarInsuRent Differ from National DW?

- CarInsuRent car hire excess insurance starts from as low as $6.49 per day* to $94.90 for an annual policy. National DW for damage & theft waiver Can be purchased separately for US$ 22.45 per day. Note that if you purchase National DW for Damage you are still liable for excess £100.

- National Roadside Assistance Protection covers tire & glass / Replacement keys costs can be purchased separately for an extra fee of US$ 5.39 per day. CarInsuRent car hire excess waiver insurance covers damage to the rental car’s windscreen, auto glass, tires, undercarriage or roof and is included at the price of the policy.

- CarInsuRent covers baggage and personal belongings – up to US$ 1,500 included at the price.

- CarInsuRent covers towing expenses, misfuelling, and the replacement of a lost or stolen Rental Car key.

- CarInsuRent covers exorbitant rental company fees added to your repair bill – including fees for loss of use, processing, relocation and towing.

- CarInsuRent covers single-vehicle accidents – claim even if the damage or theft to your car was not your fault.

- CArInsuRent cover multiple drivers between the ages of 21 and 84 years.

- CarInsuRent offers annual worldwide car hire excess Insurance for hiring cars around the world for up to 45 days.

How Much Could You Save on Car Hire Excess Insurance for Your National Car hire?

Car hire excess insurance for 10 days rental in Europe with CarInsuRent will cost US$64.90 compared to EUR 300.5 when purchasing the equivalent coverage from National. Total potential saving: US$ 260.

See How Much You Can Save on Your Car Rental Insurance

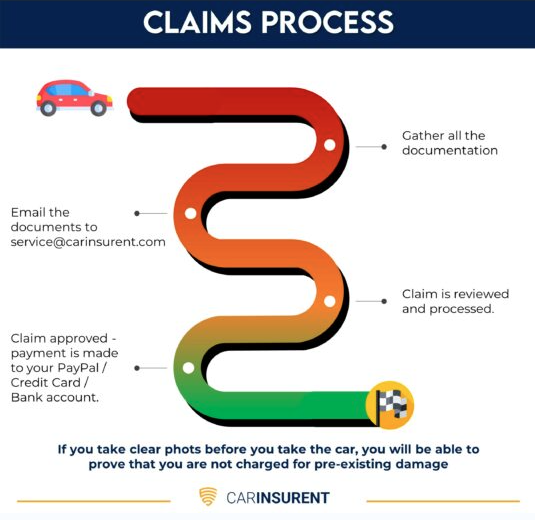

Get StartedHow to File a Claim

What to Do in Case of an Accident or Damage – If you are involved in an accident while driving a rental car, there are certain steps you should follow to file a claim with the rental car insurance company. First, exchange personal information with the other driver, including name, address, license plate number, rental vehicle information, insurance company, and policy number, and document the accident with pictures and notes. If the other driver is at fault, you should get their contact and insurance information and call their insurance company directly to file a claim. If you are at fault or have non-collision damage, you can file a claim with the rental car insurance company. The process for filing a claim with the rental car insurance company may vary depending on the provider, but typically, you would need to provide details of the incident, including the date, time, and location of the accident, as well as any police report numbers, if applicable. Additionally, you may need to provide documentation of the damage, such as photographs or repair estimates.

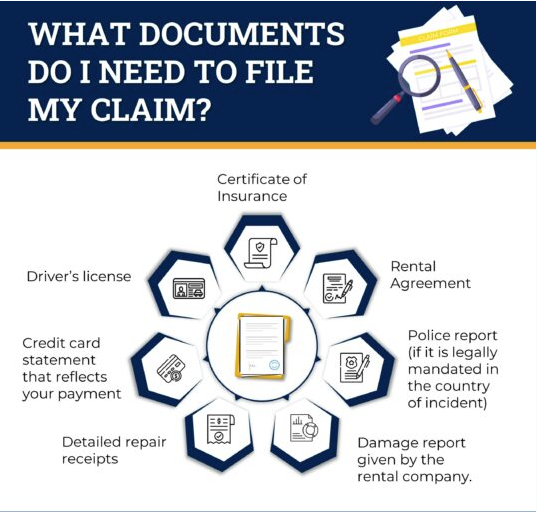

Required Documentation for Filing a Claim

- A copy of the Certificate of Insurance

- A copy of the rental agreement

- A copy of the police report if:

- you got in an accident with a third party

- It is legally mandated in the country of incident

- your claim is about stolen personal belongings

- A copy of the damage report given by the rental company, detailing each cost incurred. Photographs of the damage are optional but may help ensure that the charges are reasonable.

- Detailed repair receipts, invoices or other documents showing the breakdown of the amount the rental company charged you for the accidental damage or loss

- A copy of your credit card statement that reflects your payment for the claimed damages

- A copy of the driver’s license of the person driving the car during the accident

What Documents Do I Need to File My Claim?

Tips for a Smooth Claims Process: Filing an insurance claim can be a complicated and stressful process. The following tips can help ensure a smoother claims process:

- Document everything: Documenting all the details of the accident or loss, including taking photos and notes, can help speed up the claims process and reduce the possibility of disputes.

- Communication: Communication is key in any insurance claim process. Keep thorough records of all communication with the insurer, and discuss your expectations for the claims process with the adjuster. You can also ask about the frequency of updates and the preferred type of communication.

- Avoid duplicate claims: Avoid submitting duplicate claims, as it slows down the claims payment process and creates confusion.

- Understand your coverage: It’s important to understand your insurance coverage, including the limits and deductibles, before filing a claim. Understanding your policy can help ensure that you receive the maximum benefit to which you are entitled.

- Be patient: Claims processing can take time, so it’s important to be patient.

By following these tips, you can help ensure a smoother claims process, and increase the chances of receiving the maximum benefit that you are entitled to under your insurance policy.

Claims Process

Final Thoughts and Recommendations

In conclusion, National Car Rental offers a range of insurance options to provide peace of mind and protect you during your rental period. Before making a decision, it is essential to carefully review and understand the details of each insurance option, including coverage, limitations, and associated costs. Here are some final thoughts and recommendations to consider:

- Assess Your Needs: Evaluate your personal circumstances, travel plans, and existing insurance coverage to determine the level of protection you require. Consider factors such as the rental location, duration, and the value of the vehicle you are renting.

- Read the Fine Print: Thoroughly review the terms and conditions of National Car Rental’s insurance coverage. Pay attention to coverage inclusions, exclusions, deductibles, and any additional fees or charges that may apply.

- Compare Insurance Options: Explore alternative insurance options, such as third-party providers, personal auto insurance, or credit card coverage. Compare the benefits, coverage limits, costs, and any restrictions to find the most suitable and cost-effective option for your needs.

- Consider Your Budget: Evaluate the cost of National Car Rental’s insurance in relation to your budget and the value it provides. Assess whether the coverage justifies the additional expense or if other insurance options offer more favorable terms.

- Seek Clarification: If you have any questions or concerns regarding National Car Rental’s insurance options, reach out to their customer service team for clarification. They can provide you with detailed information and address any inquiries you may have.

Ultimately, the decision to purchase National Car Rental insurance should be based on your individual circumstances, risk tolerance, and preferences. By conducting thorough research, understanding the coverage details, and comparing different insurance options, you can make an informed decision that ensures you are adequately protected during your rental period.

See How Much You Can Save on Your Car Rental Insurance

Get StartedTravel Tips and Guides

Frequently Asked Questions (FAQ)

No. We provide a single journey plan. You are covered from the time you pick up the rental car up to the time you return it or on the last date written on your Certificate of Insurance, whichever comes first.

No. You should purchase a policy before starting your travel.

Find the answers you’re looking for to the most frequently asked car hire insurance questions as well as other questions relating to our products and services.