Yes. Insurance for a single day is available.

What is Car Hire Excess Insurance?

PUBLISHED ON Jan, 20 2023

UPDATED ON Feb, 27 2024

Understanding Car Hire Excess Insurance

The Basics of Car Hire Excess Insurance Policy

Excess reduction is an optional service offered by car rental companies which minimizes the renter’s financial liability in case of damage or theft. When you opt for excess reduction, your excess – the amount you’re responsible for if there’s a claim – is lowered, meaning you pay less out of pocket if an unfortunate incident occurs. This could make a significant difference; without it, renters may face hefty excess charges that could exceed thousands of dollars depending on the rental agreement.

How Excess Insurance Protects You During Car Rentals

Car hire excess insurance, or excess waiver insurance, is your shield against the financial strain imposed by high excess fees that come with rental car agreements. When you secure this additional policy, you’re effectively ensuring that, in the event of theft or damage to your rental vehicle, you will not have to shoulder the full brunt of the excess charges. Think of it as a safety net, allowing you to enjoy your rental experience without the looming worry of incurring substantial costs from unexpected incidents. It’s a layer of protection that covers the gap between the rental company’s own insurance and the excess fee, giving you peace of mind on your travels.

So, what is Car Hire Excess Insurance Policy?

When you rent a car, it usually comes with basic insurance included in the price, also know as Collision Damage Waiver (CDW), so that you won’t have to pay the full cost of replacing a stolen or damaged car. But the basic coverage is subject to an ‘excess’ meaning that you could have to pay towards repair or theft costs, regardless of who is at fault.

Let’s take a simple example: If we take a car collision that results in a €2,500 cost to repair the damage, and your excess was €900, as an example, under the terms of a car rental agreement you would have to pay an excess of €900 to the car rental company, and the car rental company would be liable to pay the remaining amount.

This is where car hire excess cover comes in as it is there to prevent you from having to pay these hefty excess fee charges and to give you peace of mind should something go wrong.

Here’s how car hire excess insurance saved a customer a significant amount of money

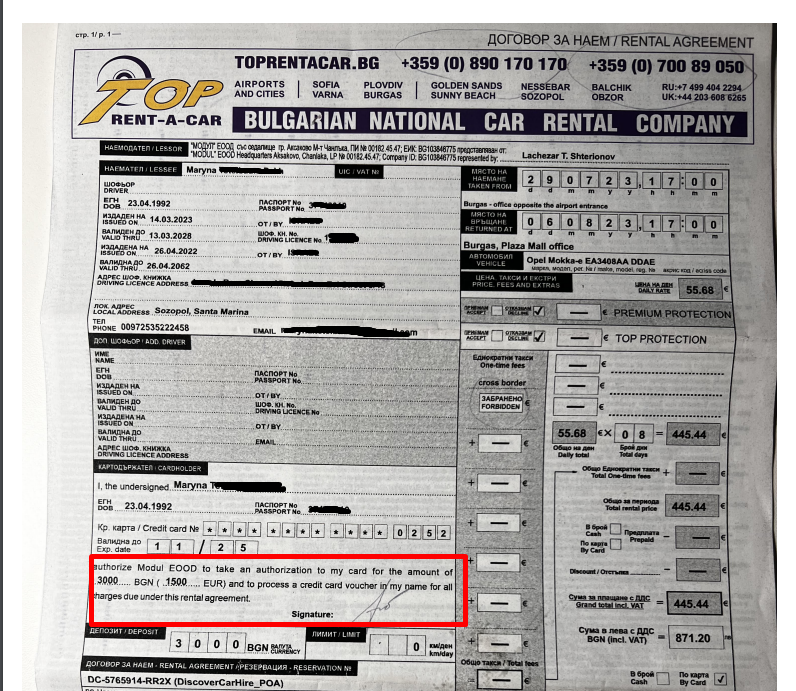

A customer named Maryna rented a car for a week-long vacation in Europe (Bulgaria). Despite declining the rental company’s insurance coverage due to its high cost, Maryna decided to purchase standalone car hire excess insurance from CarInsuRent after reading about its benefits.

Maryna’s rental agreement

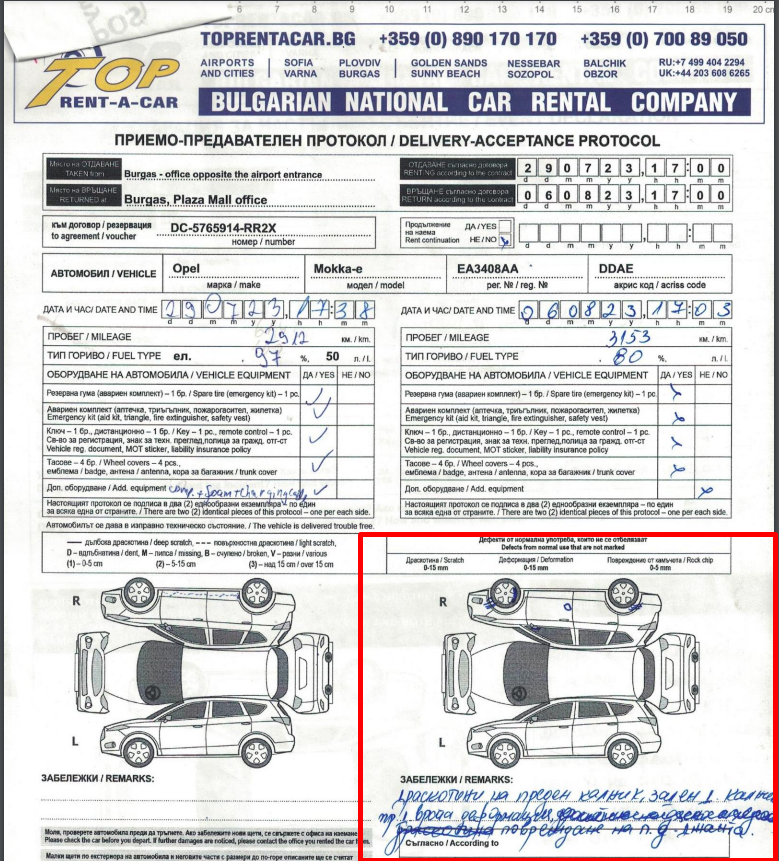

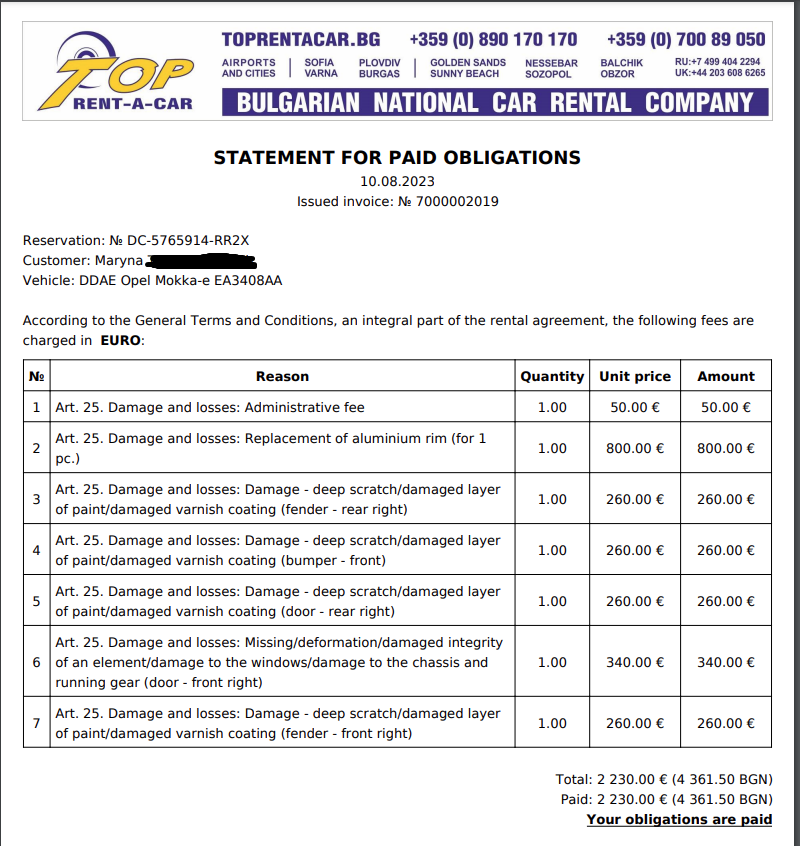

During her trip, Maryna was driving along the road and collided with a tree. Despite adhering to all traffic regulations, including speed limits, the circumstances led to scratches over the right side of the car, and small deformations of the right front door and right front aluminum rim. When she returned the car, the rental company quoted her an excessive – EUR 2,230 repair cost, which included the fixing the damages plus additional administrative fees.

Maryna’s damage report

However, Maryna had purchased car hire excess insurance, which covered the excess amount she would have to pay in such situations. As a result, she was able to file a claim with CarInsuRent, and we reimbursed her for the repair costs incurred by the rental company. This saved Maryna thousands of Euros, as she only had to pay for the car hire excess coverage instead of the full repair bill.

Maryna’s excess payment statement

This scenario highlights how car hire excess insurance can save customers a significant amount of money by covering unexpected damages to rental cars, providing peace of mind and financial protection during travels.

See How Much You Can Save on Your Car Hire Excess Insurance

Get StartedCar Rental Super CDW Is Ridiculously Overpriced

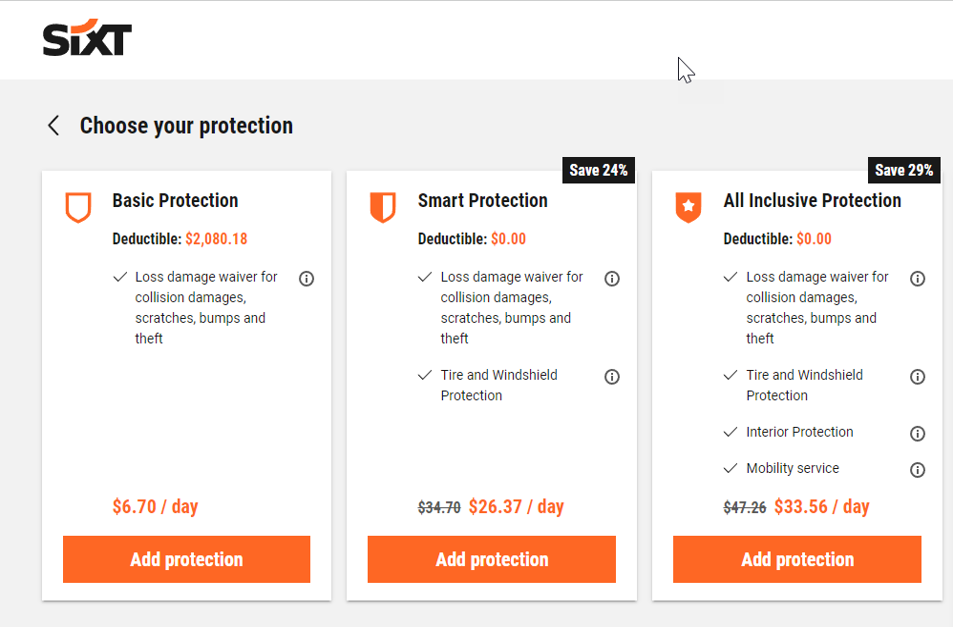

Car rental companies sell Super Collision Damage Waiver (SCDW), allowing you to reduce your excess to a very small amount, often zero. This cover has many different names, including excess waiver coverage, Super Cover and Excess Protection. But it’s not cheap and can double the price of the rental.

The SCDW that reduce the excess to zero might cost from €15 to €30 per day. One major advantage of paying the car hire company for SCDW is that the company will not require a large pre-authorisation on your credit card. Pre-authorisations can be as high as €2,500 with some of the low-cost rental companies.

Sixt Rental Car Insurance in France

Comparing Rental Company Car Rental Excess Insurance with Third-Party Providers

When comparing rental company insurance with third-party providers, there’s a clear distinction, particularly in cost and coverage. Rental companies often offer convenience but at higher prices with their insurance products. On the other hand, third-party providers typically present more affordable options with potentially broader coverage, often including parts of the car that rental companies exclude, like tires and windshields.

Third-party insurance can cover you for damages that are not usually included in rental companies’ policies. They can also provide additional perks such as coverage in multiple countries or for additional drivers, making them a versatile choice for many travelers. It’s worth looking beyond the rental desk and considering third-party insurance for a more cost-effective and comprehensive protection plan during your car rental period.

We compared and analyzed Super Collision Damage Waiver costs for a 7-day rental of a standard car class (July 1st – July 7th). The car rental insurance rates listed here are subject to change by the car rental companies without notice. For the most up-to-date pricing information, we encourage you to request a free online quote prior to booking.

CarInsuRent’s car hire excess protection for rental vehicles in Europe offers the same coverage at a 70% lower cost!

| Country | Collision Damage Waiver (CDW) + Theft Protection (TP) | Avg. Super Collision Damage Waiver Cost at Counter* | Avg. Insurance Deductible at Counter* | Avg. Cost for Rental Car Excess Insurance with CarInsuRent |

| France | Included at the rental price | € 19.00 | € 2,250 | US$ 6.49 per day or US$ 94.90 for annual coverage |

| Germany | Included at the rental price | € 28.00 | € 1,250 | US$ 6.49 per day or US$ 94.90 for annual coverage |

| Iceland | Included at the rental price | € 32.00 | € 1,950 | US$ 6.49 per day or US$ 94.90 for annual coverage |

| Ireland | Included at the rental price | € 25.00 | € 2,300 | US$ 6.49 per day or US$ 94.90 for annual coverage |

| Italy | Included at the rental price | € 36.00 | € 2,200 | US$ 6.49 per day or US$ 94.90 for annual coverage |

| Spain | Included at the rental price | € 32.00 | € 1,850 | US$ 6.49 per day or US$ 94.90 for annual coverage |

CarInsuRent Car Rental Excess Waiver Insurance

To avoid having to pay a massive excess and not to double the price of the rental, you can take out car hire excess insurance policy from a third party insurance company, such as CarInsuRent. This is normally far cheaper, and often more comprehensive than the cover offered by car hire companies, as it will cover tyres, wheels, undercarriage, roof and windscreen. You can buy a daily or annual policy.

By buying excess insurance from CarInsuRent, you’ll be covered against excess charges of up to US$4,500. CarInsuRent offer annual insurance policies much cheaper than rental agencies. With European car insurance excess waiver annual policies starting from $89.90, this can easily be more cost-wise especially if you are making multiple bookings over a year.

We recommend to take out excess waiver insurance. This means that if you have an accident you would have no excess to pay. The car rental companies offer this cover at the rental desk but it’s a lot cheaper to get it here BEFORE you travel from a specialist provider. We provide coverage for European Car Hire Excess Insurance, USA & Canada Car Hire Excess Insurance, Australia Car Hire Excess Insurance, UK Car Hire Excess Insurance.

Amazing service. always efficient, friendly, responsive. i got my payment within days of submission. Bill is warm. A pleasure to work with them. highly recommended. I feel safe with them.

The Benefits of Third-Party Car Rental Excess Waiver Insurance

Cost-Effectiveness of Third-Party Insurance Options

Third-party insurance options often prove to be more cost-effective than the rental company’s excess reduction products for several reasons. Firstly, third-party policies are generally more competitively priced, offering similar or even greater coverage at a fraction of the rental company’s daily rate. Also, purchasing from a third-party insurer means you can typically secure coverage for an extended period or multiple rentals, providing better value for frequent renters or longer journeys. It’s a smart move budget-wise, as you can enjoy comprehensive protection without the steep price tag that comes with purchasing excess reduction options directly from the car hire firm.

Extensive Coverage: Why It’s Worth Considering

Opting for third-party car rental excess waiver insurance is worth considering for its extensive coverage. Unlike standard policies from rental firms, which often leave gaps, such as excluding tires, windows, or undercarriage damage, third-party policies usually encompass these vulnerabilities. By covering a broader range of potential incidents, from minor scrapes to significant mishaps, you can drive with added confidence. These policies can also include additional benefits like coverage for lost keys, personal belongings, or misfuelling, further safeguarding your rental experience against the unpredictable. Comprehensive coverage can convert potential stress into peace of mind, making it a smart investment for any car renter.

Car Hire Insurance Explained

Navigating Different Car Hire Insurance Terms

Understanding car hire insurance terminology can be like trying to navigate a road map with missing signs. Here’s a quick guide:

Collision damage waiver (CDW) – Provides cover in the event of damage or theft of the vehicle, and is usually included as standard if you are hiring a car in Europe or Australasia. In the USA it may have to be purchased separately. However, CDW is not complete protection. All it means is that you will not have to pay the full cost of any repairs, but you will have to pay a contribution to repair costs up to an agreed level of ‘excess’ which can be as high as €2,500, regardless of who is at fault. In addition, CDW generally does not cover certain areas of the car, such as the windscreen, tyres and the undercarriage. You will not usually be covered for damage caused while you were breaching the rental agreement, or caused by negligence or using the wrong fuel. You will not usually be covered for damage caused while you were breaching the rental agreement, or caused by negligence or using the wrong fuel.

Super Collision Damage Waiver (SCDW): An upgraded version of CDW that reduces or eliminates the excess. It’s more expensive and offered by the rental companies.

Theft protection (TP) – This covers you against the full cost of replacing the vehicle if it is stolen while in your possession. Like CDW, this insurance is normally included in the price, and like CDW it does not cover everything. For example thefts as a result of negligence, such as leaving the car keys in the ignition, will not be covered. And there will still be an excess to pay.

Personal accident insurance (PAI) – You may also be offered extra cover for any injury to you or passengers while you are driving the car. However, this would normally be covered by your travel insurance. In the same way, you may be offered cover for personal belongings in the car. This is known as personal effects protection (PEP). Again, this may be covered by your travel or home insurance.

Supplemental Liability Insurance (SLI): Increases your liability coverage for damages caused to others.

Remember, terms and coverage can vary by provider and location, so always check the fine print.

See How Much You Can Save on Your Car Hire Excess Insurance

Get StartedFAQ

What does excess reduction mean?

Car rental basic CDW coverage is subject to an ‘excess’. If you have car hire excess waiver insurance, in the event of damage to or theft of the vehicle your financial liability is reduced to zero.

How do I claim on car hire excess insurance?

To claim on car hire excess insurance, follow these steps:

- Report the Incident: Immediately notify the rental company and obtain a damage report.

- Document Everything: Take photos of the damage and keep all rental documentation, including the rental agreement and any repair invoices or police reports if applicable.

- Contact the Insurer: Notify your excess insurance provider as soon as possible and submit the claim according to their guidelines.

- Provide Documentation: Send all required documents to your insurer for the claim process.

Each insurer has its own process, so ensure you understand their specific requirements beforehand.

Is excess insurance for car hire necessary?

Excess insurance for car hire isn’t mandatory, but it’s highly recommended. It safeguards you from paying a high deductible if your rental car is damaged or stolen. Weigh the potential costs of paying a large excess against the daily rate of excess insurance. For many, the small price of the insurance offers invaluable peace of mind. Consider your personal risk tolerance and travel circumstances to decide if it’s a necessary addition to your car rental plan.

Choosing to go without could result in a significant financial burden in the event of an accident or theft, whereas the insurance could cover those unexpected expenses. It’s all about securing your budget and comfort while on the road.

3 Responses

Leave a Reply

Travel Tips and Guides

CDW Insurance Explained: What is CDW in Car Rental and Do You Need A Collision Damage Waiver?

Mark Vallet

Frequently Asked Questions (FAQ)

No. We provide a single journey plan. You are covered from the time you pick up the rental car up to the time you return it or on the last date written on your Certificate of Insurance, whichever comes first.

No. You should purchase a policy before starting your travel.

Find the answers you’re looking for to the most frequently asked car hire insurance questions as well as other questions relating to our products and services.

What i don’t realize is actually how you’re not actually much more well-liked than you might be right now. Your own stuffs outstanding. Always maintain it up!

Thanks a lot for providing individuals with a very spectacular opportunity to read critical reviews from this website. It is often very kind plus full of a great time for me and my office fellow workers to search your website at the least thrice in 7 days to study the newest guidance you have. And of course, we are always impressed with your astonishing guidelines you serve. Some 4 ideas in this post are surely the most impressive we’ve ever had.

Just wanna comment on few general things, The website layout is perfect, the content material is real excellent.