Yes. Insurance for a single day is available.

Rental Car Insurance in France: The Best Coverage

When planning a car rental in France, it’s important to consider the vital aspect of car rental insurance. Securing the right insurance coverage ensures peace of mind and financial protection in case of accidents, damages, or other unforeseen incidents during your rental period.

Compare and Buy Car Rental Insurance in France

Get StartedCar Rental Insurance in France Coverage Chart

| Warranty | What does it cover? | How much does it cover? |

|---|---|---|

| Damage due to collision or theft | Reimbursement of the deductible applied by the rental company as a result of accidental damage caused to the vehicle, including tires, windshield, underbody and other parts | $ 2,500 - $ 4,500 |

| Improper Fuel Use Charges | Tank emptying costs and vehicle towing, when the wrong fuel is refueled into the vehicle by mistake. | $ 500 |

| Loss or theft of keys | In the replacement of lost or stolen keys, including lock and locksmith costs. | $ 500 |

| Towing charges | Covers the tow truck of the rented car in the event of a breakdown or accident. | $ 500 |

| Vehicle return charges | If as a result of an accident or illness with hospitalization you cannot return the vehicle. | $ 250 |

| Personnal belongings | In case your baggage, personal belongings or valuables are taken, permanently lost or unintentionally damaged during your trip | $ 500 |

| Hotel expensses | If You are unable to use your rental vehicle as a result of it being stolen or damaged | $ 150 |

Vehicle rental excess insurance

What is insured?

- Excess reimbursement up to US$ 4,500

- Damage Waiver (LDW) up to US$ 4,500

- Towing charges up to US$ 500

- Improper fuel charges up to US$ 500

- Loss or theft of keys up to US$ 500

- Vehicle return charges up to US$ 250

- Personnal belongings up to US$ 500

- Hotel expenses up to US$ 150

What is not covered?

- Damage to the vehicle or property of a third party

- Damage caused by a person not authorized to drive the rented vehicle

- Mechanical failure of the rented vehicle

- Loss or damage to the vehicle’s interior that is not related to a collision.

- Parking tickets or fines, traffic violations and such

- Any loss that occurs outside the validity of the insurance

- Any rental contract of more than 45 days

Is the coverage subject to any type of restrictions?

- Any claim resulting from a direct breach of any of the terms and conditions of your rental agreement

- Any person under 21 or above 84 years of age

- Rentals that begin or end outside the insurance period, as indicated on the insurance certificate

- The policyholder must be designated as the main driver in the rental agreement

- The maximum amount that can be claimed for a single loss is US$ 4,500

- Damage to Recreational vehicles (RVs) / Motorhomes / Campervans (unless you have purchased a specific cover)

- Damage to vehicles provided by a peer-to-peer vehicle rental service platform or a subscription vehicle service is excluded (unless purchased specific coverage)..

Where do I have coverage?

- Anywhere in the world except trips in, to or through Afghanistan, Cuba, Congo, Iran, Iraq, Ivory Coast, Liberia, North Korea, Myanmar, Russia, Sudan, Syria, Ukraine and Zimbabwe

What are my obligations?

- When applying for your policy, you must exercise reasonable care to honestly and carefully answer any questions asked.

- You must take all reasonable steps to avoid or reduce any loss (for example, you must report accidents or other damage to your rental company nd to CarInsuRent as soon as reasonably possible).

- If you make a claim, you must provide the documents and other evidence that claims handlers need to process your claim.

- You must repay any sums to which you are not entitled (for example, if we pay your claim for an accident which is later compensated by a third party).

- You must not violate the terms of the rental agreement.

When and how do I make the payment?

- The premium must be paid in full before the policy start date. Payment can be made by credit or debit card or PayPal through our website

What is the start and end date of coverage?

- As set out in the insurance certificate, as agreed in the application process, your policy will cover you from the start date and time of your booking to the end date and time of your booking.

How do I cancel the contract?

- You can cancel your policy before the start date or within 14 days from your purchase through our customer service team.

Amazing service. always efficient, friendly, responsive. I got my payment within days of submission. Bill is warm. A pleasure to work with them. highly recommended. I feel safe with them.

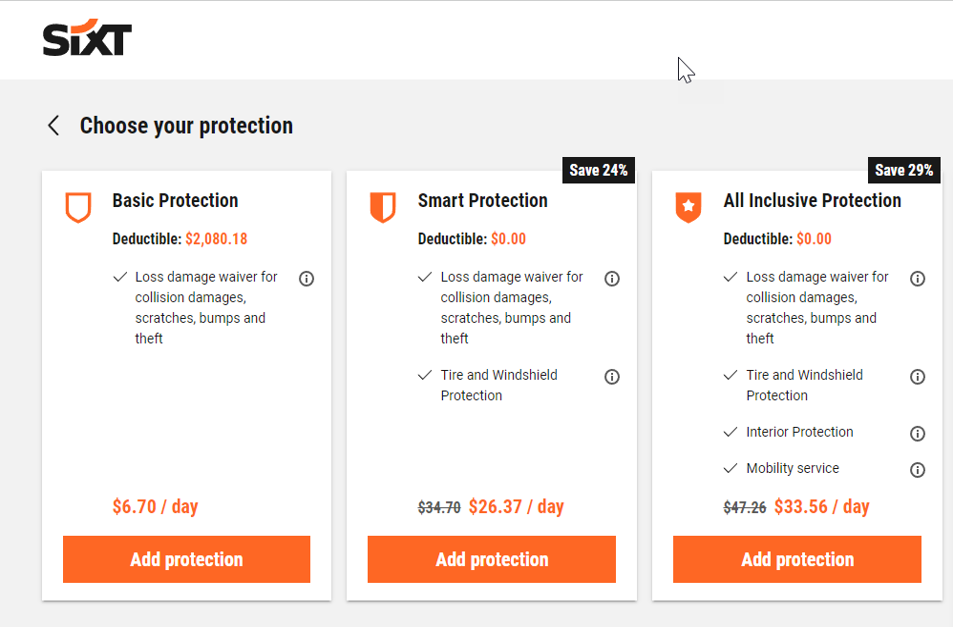

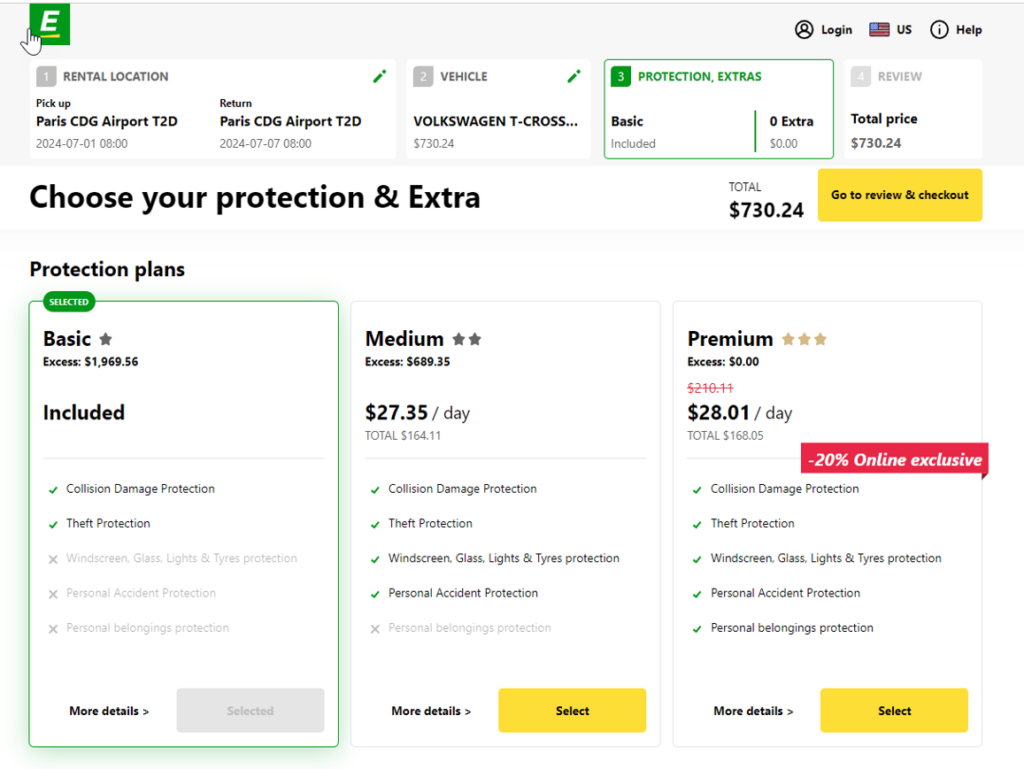

Rental Car Insurance in France Comparison: CarInsuRent vs. Cost at Counter

We compared and analyzed Super Collision Damage Waiver costs for a 7-day rental of a standard car class (July 1st – July 7th). The car rental insurance rates listed here are subject to change by the car rental companies without notice. For the most up-to-date pricing information, we encourage you to request a free online quote prior to booking. CarInsuRent’s car hire excess protection for rental vehicles in France offers the same coverage at a 70% lower cost!

| Car Rental Company | Collision Damage Waiver (CDW) + Theft Protection (TP) | Avg. Super Collision Damage Waiver Cost at Counter* | Avg. Insurance Deductible at Counter* | Avg. Cost for Rental Car Excess Insurance with CarInsuRent | Cost of Deductible with Zero-Excess from CarInsuRent |

| Avis | US$ 14.05 | Available at the counter | € 2,000 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Budget | US$ 14.05 | Available at the counter | € 2,300 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Dollar | Included at the rental price | € 19.16 | US$ 1,524 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Enterprise | US$ 26.40 / day | US$ 35.65 | US$ 1,524 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Europcar | Included at the rental price | US$ 27.35 | US$ 1,969 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Sixt | US$ 6.70 / day | US$ 26.37 | € 1,200 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

Sixt Rental Car Insurance in France

Introduction to Car Rental Insurance for France

This article serves as a comprehensive guide to car rental insurance in France, providing valuable insights into the types of coverage available, mandatory insurance requirements, and key considerations for choosing the best insurance options. By understanding the nuances of car rental insurance in France, you can make informed decisions to safeguard yourself and your rental vehicle, allowing you to enjoy a worry-free and memorable journey through the picturesque landscapes of France.

The Importance of Car Rental Insurance in France

Renting a car in France offers the freedom and flexibility to explore its scenic roads and charming cities at your own pace. However, it’s crucial to understand the importance of car rental insurance to protect yourself and your finances in case of unforeseen events. Here are some key reasons why car rental insurance is essential when renting a vehicle in France:

- Financial Protection: Car accidents, theft, or damage to the rental vehicle can result in significant financial liabilities. Car rental insurance provides coverage that helps mitigate these costs, ensuring you’re not held personally liable for expensive repairs or replacement expenses. Keep in mind that should something happen to your rental car, you are financially responsible for the excess.

- Compliance with Legal Requirements: France has specific legal requirements for car rental insurance. It is mandatory to have at least third-party liability insurance (TPL) to meet legal obligations and drive legally on French roads. Failure to comply with these requirements can lead to legal consequences and potential fines.

- Peace of Mind: Having adequate car rental insurance offers peace of mind during your trip. It means you can focus on enjoying your journey without worrying about the potential financial burdens that may arise from accidents, damages, or theft.

- Protection Against Unforeseen Events: Even the most cautious drivers can face unexpected events on the road. Car rental insurance provides coverage for various risks, including collision damage, theft, vandalism, and third-party liability, ensuring you’re prepared for any unforeseen circumstances.

- Assistance and Support: In case of accidents or emergencies, car rental insurance often includes valuable benefits such as roadside assistance, towing services, and support in navigating the insurance claim process. This ensures that you have the necessary support and guidance during challenging situations.

- Coverage for Personal Liability: Car rental insurance not only protects against damages to the rental vehicle but also offers liability coverage for bodily injury or property damage caused to third parties. This is especially crucial as accidents involving personal injury or property damage can lead to legal and financial liabilities.

It is important to carefully review the terms, conditions, and coverage limits of the car rental insurance options available to ensure they align with your needs. Additionally, consider any existing insurance coverage you may have, such as personal auto insurance or credit card benefits, to avoid duplicating coverage and make informed decisions.

By securing the right car rental insurance for your trip to France, you can embark on your journey with confidence, knowing that you’re adequately protected and prepared for any unexpected situations that may arise on the road.

Car Rental Insurance for France Explained

When renting a car in France, it’s important to understand the intricacies of car rental insurance to ensure you have the right coverage and protection during your trip. Here is an explanation of the key aspects of car rental insurance for France:

- Mandatory Insurance Requirements: In France, it is mandatory to have at least third-party liability insurance (TPL) when renting a car. TPL covers damages caused to third parties, including injury or property damage, and ensures compliance with legal requirements.

- Collision Damage Waiver (CDW): CDW is an optional insurance coverage that protects you from financial liability for damages to the rental vehicle in case of an accident or collision. It typically comes with a deductible, and choosing CDW can help minimize out-of-pocket expenses in the event of damages.

- Theft Protection (TP): TP coverage provides protection against theft or attempted theft of the rental vehicle. It can help alleviate the financial burden of replacing the vehicle or covering any damages resulting from theft.

- Personal Accident Insurance (PAI): PAI offers coverage for medical expenses and personal injuries sustained by the driver and passengers in the rental vehicle. It provides added peace of mind in case of accidents, ensuring that medical costs are covered.

- Additional Coverage Options: Car rental companies in France may offer additional coverage options, such as roadside assistance, loss of keys, or coverage for damage to tires and windows. These options can provide enhanced protection and convenience, but it’s essential to evaluate their costs and benefits.

To make an informed decision, compare insurance options from different rental companies, considering factors such as coverage benefits, costs, and customer reviews. Understanding the insurance coverage available and selecting the appropriate options based on your needs and preferences will help ensure a smooth and protected rental experience in France.

Remember, each rental company may have variations in their insurance offerings, so take the time to read and understand the specific terms and conditions associated with the car rental insurance policy you choose.

Car Rental Roadside Assistance

Car Rental Insurance for France Cost

The cost of car rental insurance for France can vary based on several factors, including the type of coverage selected, the rental location, the duration of the rental, and any additional options or add-ons chosen. It’s important to note that insurance costs are typically separate from the base rental rate.

To determine the exact cost of car rental insurance for France, it is advisable to obtain a quote directly from the car rental company or consult their website. By providing details about your rental dates, location, and desired coverage options, you can receive an accurate estimate of the insurance cost.

Additionally, it is recommended to carefully review the terms and conditions of the insurance coverage, including any deductibles or limitations that may impact the overall cost. Understanding the coverage details and associated costs will help you make an informed decision regarding car rental insurance and its affordability in relation to your specific rental needs in France.

Keep in mind that alternative insurance options may be available, such as purchasing insurance through a third-party provider or relying on coverage provided by your personal auto insurance or credit card. Comparing the costs and coverage details of different insurance options can help you make a cost-effective choice that meets your requirements while staying within your budget.

See How Much You Can Save on Your Car Rental Insurance

Get StartedBenefits of Having Car rental insurance for France

Having car rental insurance for France offers several benefits that can provide peace of mind and financial protection during your rental period. Here are some key benefits of having car rental insurance:

- Coverage for Damages: Car rental insurance provides coverage for damages to the rental vehicle in case of accidents, collisions, or vandalism. This coverage helps protect you from significant financial liabilities that may arise from repairing or replacing the vehicle.

- Theft Protection: Car rental insurance typically includes theft protection coverage, which safeguards you in the unfortunate event of theft or attempted theft of the rental vehicle. It can help cover the costs of the stolen vehicle or any damages resulting from theft.

- Liability Coverage: Car rental insurance often includes liability coverage, protecting you against claims for bodily injury or property damage caused to third parties. This coverage is essential to comply with legal requirements and offers financial protection in case of accidents involving others.

- Peace of Mind: By having car rental insurance, you can enjoy your trip in France with greater peace of mind. Knowing that you are adequately covered in case of unforeseen events or accidents can help you relax and fully immerse yourself in your travel experiences.

- Convenience and Assistance: Many car rental insurance policies provide additional benefits such as roadside assistance, which can be particularly helpful in case of breakdowns, flat tires, or other emergencies. Having access to support and assistance during your rental period adds convenience and ensures a smoother journey.

- Protection for Personal Belongings: Some car rental insurance policies also offer coverage for personal belongings inside the rental vehicle. This can be valuable in case of theft or damage to your personal items, providing financial compensation for the loss or replacement costs.

By opting for car rental insurance in France, you can enjoy your journey with greater confidence, knowing that you are protected against potential financial risks and have the necessary support in case of emergencies or unforeseen circumstances.

In summary, having car rental insurance in France can protect you from potential financial liabilities and give you peace of mind while you enjoy your trip. It is important to research and understand the coverage options and costs to make an informed decision that best fits your needs. CarInsuRent car hire excess insurance starts from as low as $6.49 per day* to $94.90 for an annual car hire excess insurance policy. Our policies covers the excess on damage and theft up to €2,500 and provide full protection that Includes single vehicle damage, roof and undercarriage damage, auto glass and widescreen damage, towing expenses, misfuelling, loss of car key and tire damage. We cover multiple drivers between the ages of 21 and 84 years.

Car rental insurance for France – Your Options

Purchase Car Rental Insurance Directly With the Rental Company

- Rental company’s insurance – Most rental car companies offer their own insurance, which typically includes damage cover (CDW), theft cover (Theft Protection), and third-party cover (Third-Party Liability). These types of insurance options usually come with an excess, which is the first part of the bill that the renter will be responsible for. The rental company’s insurance is convenient, but it can be expensive and may not provide comprehensive coverage.

Europcar Rental Car Insurance in France

Cover Your Excess Through CarInsuRent

- Third-party car rental insurance – Third-party car rental insurance is an affordable option that can provide comprehensive coverage for rental cars. This type of insurance typically covers collision damage, theft protection, and liability, and may offer higher coverage limits than rental company insurance. It can provide a cost-effective alternative to rental car company insurance.

Personal auto insurance policies

- Personal auto insurance policies may cover rental cars, but it depends on the policy and the coverage. If the policy includes collision and comprehensive coverage, it may extend to rental cars. However, liability coverage may not extend to rental cars, so it’s important to check with the insurance company before renting a car.

Travel insurance –

- Travel insurance may offer coverage for rental cars, including collision damage and theft protection. However, it is important to check the policy to confirm the coverage and any limitations or exclusions.

Credit card rental car insurance benefits –

- Some credit cards offer rental car insurance benefits, which may include coverage for damage and theft. However, the coverage and limitations can vary by credit card, so it’s important to check with the credit card company to confirm the coverage. Check if your personal insurance or credit card covers rental car insurance.

Don’t Buy Any Additional Insurance At All

- You are not required by law to buy a Rental Vehicle Excess Insurance or a Collision Damage Waiver. Such products are completely optional. In case of an accident (whether major or minor), rental companies would quickly bill your credit card the maximum damage. Excess fee can reach $3,000–$8,250 depending on the company and the type of car you rented.

See How Much You Can Save on Your Car Rental Insurance

Get StartedRental Company Insurance vs. CarInsuRent – Which Option is Best for You?

When renting a car, excess insurance is an optional add-on that can help reduce the excess amount that you would be liable for in the event of damage or theft of the rental car. Car rental companies charge for excess insurance by offering a CDW insurance France, which will reduce the renter’s financial liability in the event of an accident, and/or a Loss Damage Waiver (LDW), which will cover the cost of repairing or replacing the rental car in case of damage or theft. The cost of CDW and LDW can vary significantly from one rental company to another and can depend on the type of vehicle, the location, and the duration of the rental.

On the other hand, third-party providers like CarInsuRent offer excess cover insurance, which is usually more affordable and comprehensive than CDW or LDW offered by rental companies. The excess cover insurance from CarInsuRent will provide you with coverage for the excess amount that you are liable to pay in case of damage or theft of the rental car, and it can be purchased separately from the car rental agreement. Excess cover insurance can be purchased at any time before the rental period and it can be customized to fit your needs, which can be a more flexible option than the insurance offered by rental companies.

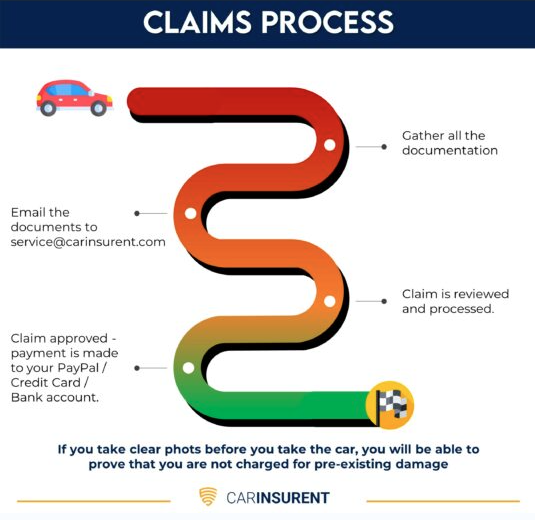

How to File a Claim

What to Do in Case of an Accident or Damage – If you are involved in an accident while driving a rental car, there are certain steps you should follow to file a claim with the rental car insurance company. First, exchange personal information with the other driver, including name, address, license plate number, rental vehicle information, insurance company, and policy number, and document the accident with pictures and notes. If the other driver is at fault, you should get their contact and insurance information and call their insurance company directly to file a claim. If you are at fault or have non-collision damage, you can file a claim with the rental car insurance company. The process for filing a claim with the rental car insurance company may vary depending on the provider, but typically, you would need to provide details of the incident, including the date, time, and location of the accident, as well as any police report numbers, if applicable. Additionally, you may need to provide documentation of the damage, such as photographs or repair estimates.

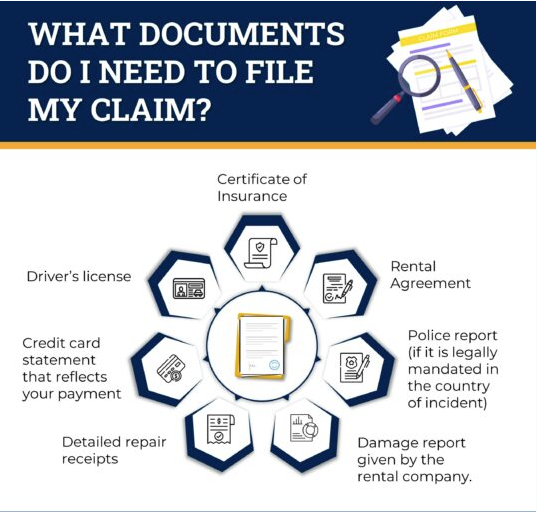

Required Documentation for Filing a Claim

- A copy of the Certificate of Insurance

- A copy of the rental agreement

- A copy of the police report if:

- you got in an accident with a third party

- It is legally mandated in the country of incident

- your claim is about stolen personal belongings

- A copy of the damage report given by the rental company, detailing each cost incurred. Photographs of the damage are optional but may help ensure that the charges are reasonable.

- Detailed repair receipts, invoices or other documents showing the breakdown of the amount the rental company charged you for the accidental damage or loss

- A copy of your credit card statement that reflects your payment for the claimed damages

- A copy of the driver’s license of the person driving the car during the accident

What Documents Do I Need to File My Claim?

Tips for a Smooth Claims Process: Filing an insurance claim can be a complicated and stressful process. The following tips can help ensure a smoother claims process:

- Document everything: Documenting all the details of the accident or loss, including taking photos and notes, can help speed up the claims process and reduce the possibility of disputes.

- Communication: Communication is key in any insurance claim process. Keep thorough records of all communication with the insurer, and discuss your expectations for the claims process with the adjuster. You can also ask about the frequency of updates and the preferred type of communication.

- Avoid duplicate claims: Avoid submitting duplicate claims, as it slows down the claims payment process and creates confusion.

- Understand your coverage: It’s important to understand your insurance coverage, including the limits and deductibles, before filing a claim. Understanding your policy can help ensure that you receive the maximum benefit to which you are entitled.

- Be patient: Claims processing can take time, so it’s important to be patient.

By following these tips, you can help ensure a smoother claims process, and increase the chances of receiving the maximum benefit that you are entitled to under your insurance policy.

Claims Process

By following these tips, you can help ensure a smoother claims process, and increase the chances of receiving the maximum benefit that you are entitled to under your insurance policy.

Final Thoughts and Recommendations

In conclusion, car rental insurance for France is a valuable investment that provides essential protection and peace of mind during your rental period. Here are some final thoughts and recommendations to consider:

- Evaluate Your Needs: Assess your specific needs and circumstances before selecting car rental insurance. Consider factors such as the rental location, duration, and the value of the vehicle. This evaluation will help you choose the appropriate coverage options and ensure you are adequately protected.

- Read and Understand the Policy: Carefully review the terms and conditions of the car rental insurance policy, including coverage details, limitations, deductibles, and any exclusions. Understanding the policy will help you make informed decisions and avoid any surprises in case of a claim.

- Compare Insurance Options: Explore different insurance providers and compare their coverage benefits, costs, and customer reviews. This will help you find the most suitable and cost-effective insurance option for your rental in France. You can save money by shopping around and buy car rental insurance online.

- Consider Existing Coverage: Check if you already have insurance coverage through your personal auto insurance or credit card benefits. Understanding the coverage provided by other sources can help you avoid unnecessary duplication of coverage.

- Plan Your Budget: Factor in the cost of car rental insurance when planning your budget for the trip. Evaluate the affordability of insurance options while ensuring that you have adequate coverage to meet your needs.

By following these recommendations, you can select the right car rental insurance for your needs and enjoy a worry-free and protected rental experience in France. Remember, the right insurance coverage not only provides financial security but also allows you to fully immerse yourself in the beauty and adventures that France has to offer.

See How Much You Can Save on Your Car Rental Insurance

Get StartedTravel Tips and Guides

Frequently Asked Questions (FAQ)

No. We provide a single journey plan. You are covered from the time you pick up the rental car up to the time you return it or on the last date written on your Certificate of Insurance, whichever comes first.

No. You should purchase a policy before starting your travel.

Find the answers you’re looking for to the most frequently asked car hire insurance questions as well as other questions relating to our products and services.