Yes. Insurance for a single day is available.

Essential Guide: Do You Need Extra Insurance for Rental Cars?

PUBLISHED ON Jan, 20 2023

Within most of Europe – and certainly within the European Union – it’s required that your car-rental fee include basic liability coverage. That’s the protection you need against all but damage to the car or any harm you cause to someone who’s outside the car.

Is Rental Car Insurance Coverage A Good Idea?

Nevertheless, if your holiday rental car is damaged or stolen, you are usually liable to pay an Excess, or Collision Damage charge.

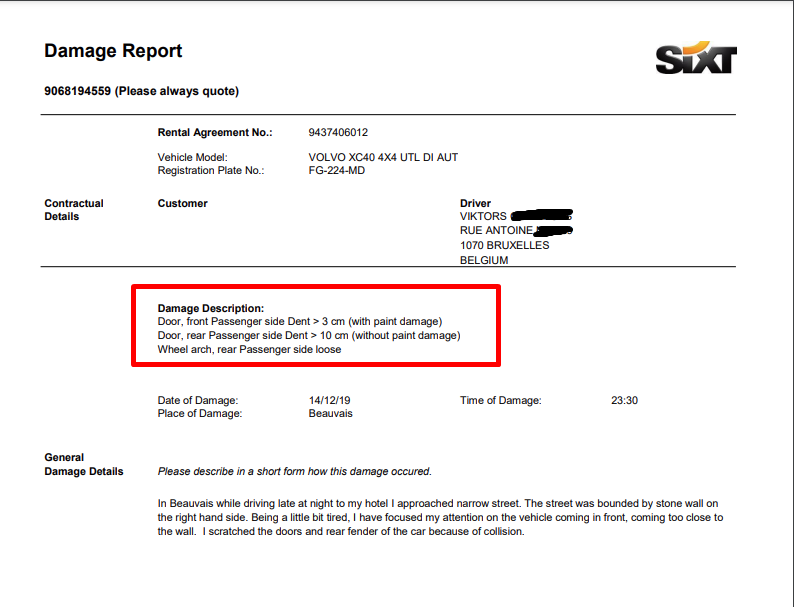

No one likes to imagine being in an accident, and it’s tempting to assume that, as been a good driver, you won’t have one. But it’s not just your own driving you have to worry about with car hire. Finding your wing mirror is missing after parking your car outside your hotel, or sizable dent in the passenger-side front bumper are pretty common.

Avis Damage to Rental Car

You should always have comprehensive insurance when renting abroad. But rental insurance is tricky as there are different rules for different countries.

To begin with, most rental rates in Europe include Collision damage waiver (CDW). This is an insurance that provides cover in the event of damage or theft of the vehicle so that you won’t have to pay the full cost of replacing a stolen or damaged vehicle. CDW in Europe carries an excess (also known as deductible) of around €1,000 – €2,000 even if the damage wasn’t your fault. CDW doesn’t cover your tires, windows, roof, undercarriage, or interior.

Should You Buy Extra Rental Car Insurance At The Counter?

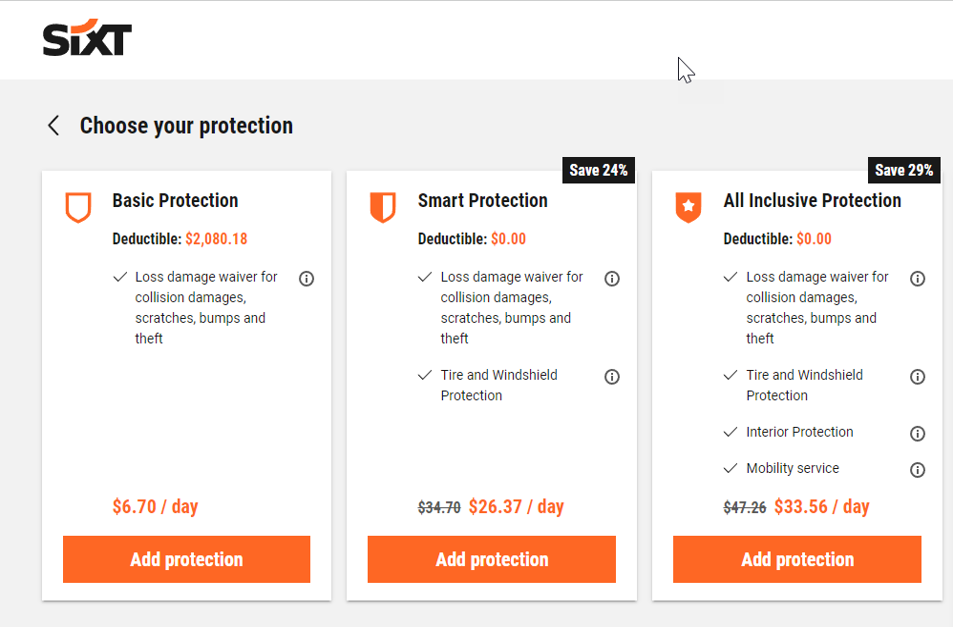

Car hire companies sell Super Collision Damage Waiver (SCDW), allowing you to reduce your excess to a very small amount, often zero. This cover has many different names, including Excess Waiver, Super Cover and Excess Protection.

What are the benefits of buying insurance from the rental company? It protects you from significant out-of-pocket expenses associated with loss or damage to the vehicle, including theft. But it’s expensive. Rental car insurance costs vary by company and coverage. You may pay €15 to €25 a day. It’s not insurance, in the technical sense, that rental companies offer. Rental companies are not licensed insurance agents in every state. Instead, they offer a protection package.

If you decide to purchase insurance through the rental car company, be sure to read the fine print. Every car rental agreement can be different, and you should be aware of that when renting a car. For example, the agreement might not cover the excess related to damage to tires, windows, roof, undercarriage, or interior.

See How Much You Can Save on Your Car Rental Insurance

Get StartedThird-Party Car Rental Insurance

What Are Third-Party Rental Car Insurance Providers?

Third-Party Rental Car Insurance Providers are like the caring neighbors who lend you gardening tools; they’re not the rental companies themselves but offer resources you need. Companies like CarInsuRent, step into this space, offering coverage that may include liability, collision, and other types of insurance for rental cars.

What sets them apart is that they provide insurance separately from the rental transaction, often at a more economical rate than rental company counters. They cater to renters who prefer to arrange their insurance beforehand or those seeking a potentially more affordable alternative.

Comparing Costs and Coverage of Third-Party Insurance

When it comes to third-party rental car insurance, the adage “shop around” is sound advice. Comparing the costs and coverage can lead to significant savings and better protection. For example, we offer a car hire excess coverage at around $6.90 per day, substantially lower than the typical $25 charged by rental car companies like Budget, Enterprise, and Hertz.

You can choose to buy Excess Reimbursement Insurance policy from a third-party insurance company. This is normally far cheaper, and often more comprehensive than the cover offered by car hire companies, as it will cover tyres, wheels, undercarriage, roof and windscreen. to cover your rental, so it’s insured more comprehensively. You can do this online when you book the car, online separately from your booking, or a few moments before you arrive to pick up your car.

We offer annual insurance policies much cheaper than rental agencies. With annual policies from $79.90, this can easily be more cost-wise especially if you are making multiple bookings over a year.

We recommend to take out excess waiver insurance. This means that if you have an accident you would have no excess to pay. The car rental companies offer this cover at the rental desk but it’s a lot cheaper to get it here BEFORE you travel from a specialist provider. We provide coverage for European Car Hire Excess Insurance, USA & Canada Car Hire Excess Insurance, Australia Car Hire Excess Insurance, UK Car Hire Excess Insurance.

Amazing service. always efficient, friendly, responsive. i got my payment within days of submission. Bill is warm. A pleasure to work with them. highly recommended. I feel safe with them.

We compared and analyzed Super Collision Damage Waiver costs for a 7-day rental of a standard car class (July 1st – July 7th). The car rental insurance rates listed here are subject to change by the car rental companies without notice. For the most up-to-date pricing information, we encourage you to request a free online quote prior to booking.

CarInsuRent’s car hire excess protection for rental vehicles in Europe offers the same coverage at a 70% lower cost!

| Country | Collision Damage Waiver (CDW) + Theft Protection (TP) | Avg. Super Collision Damage Waiver Cost at Counter* | Avg. Insurance Deductible at Counter* | Avg. Cost for Rental Car Excess Insurance with CarInsuRent | Cost of Deductible with Zero-Excess from CarInsuRent |

| France | Included at the rental price | € 19.00 | € 2,250 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Germany | Included at the rental price | € 28.00 | € 1,250 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Iceland | Included at the rental price | € 32.00 | € 1,950 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Ireland | Included at the rental price | € 25.00 | € 2,300 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Italy | Included at the rental price | € 36.00 | € 2,200 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Spain | Included at the rental price | € 32.00 | € 1,850 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

Sixt Rental Car Insurance in France

See How Much You Can Save on Your Car Rental Insurance

Get StartedCircumstances When Extra Rental Car Insurance is Recommended

When it comes to deciding on extra rental insurance, anticipate the unexpected. Here are some compelling scenarios where saying ‘yes’ might be the prudent choice:

- Your existing policy is looking a bit threadbare on liability or doesn’t include rental vehicle damage coverage. Don’t rely on a bare-bones policy to cover a fully-loaded situation.

- The thought of paperwork makes you queasy. By opting in, you sidestep dealing with claims and potential out-of-pocket expenses that your insurance might not extend to.

- Paying a deductible feels like pulling teeth. If a minor scrape happens, rental car insurance can take the bite out of expenses that otherwise nudge towards your savings.

- You’re leveling up with a luxury rental. More expensive cars may soar beyond your personal policy’s limits, leaving you financially exposed without additional coverage.

- The driving responsibilities are being shared with someone who isn’t covered by your auto policy. Ensuring everyone’s covered simplifies any claims that might need to be made.

Sixt Damage Report

Why You Might Not Need to Purchase Additional Insurance

Knowing when to graciously decline extra insurance at the rental counter can save you from redundancy in coverage. Here’s why you may not need to sign up for more:

- If your personal auto insurance is comprehensive and collision-ready, it likely extends to rentals, which means your current policy could be all the cushion you need.

- Many credit cards offer rental car insurance as a perk, meaning you’re potentially covered if you use the card to pay for the rental.

- If your home or renters’ insurance includes personal property coverage, it might protect you against theft of personal items from the rental car (a glance at your policy’s fine print can confirm this).

- If you’re comfortable with — and can afford — the risk of paying the rental company’s deductible in case of an incident. It could be lower than the cost of the additional insurance over time.

- Driving on familiar roads or for short periods could mean you’re less likely to incur damages that justify the added expense of extra insurance.

Being aware of what you’re already paying for in terms of insurance can safeguard your wallet from unnecessary expenditures, while still keeping you covered on all fronts.

Deciding on Rental Car Insurance

Factors To Consider Before Purchasing Rental Insurance

Before you arrive at the rental desk, ready to embark on your adventure, mull over these factors to decide whether you’ll be signing up for extra insurance:

- Your Existing Coverage: Review your current auto, homeowners, or renters insurance policies to avoid overlap in coverage.

- Coverage Gaps: Identify any potential gaps like collision, comprehensive, or higher liability limits that your current policy doesn’t cover.

- Risk Tolerance: Consider your comfort level with risk. Are you okay with paying out of pocket if something happens to the rental?

- Rental Car Value vs. Personal Car: If you’re renting a car that’s significantly more valuable than your own, additional coverage might be worth it.

- Destination Considerations: Different locations may have unique risks or requirements for insurance. Research is essential.

- Shared Responsibility: If additional drivers are involved and they’re not covered by your policy, extra insurance could be crucial.

- Credit Card Coverage: Verify the extent of any rental insurance benefits provided by your credit card and understand its limitations.

- Cost of Additional Insurance: Weigh the daily cost of additional insurance against the potential out-of-pocket expenses after an incident.

Insight into these aspects will inform you whether purchasing rental insurance is a necessity or if you can slide by without it, keeping more money in your travel fund.

Cost-Effective Rental Car Insurance Strategies

How to Save Money on Rental Car Insurance

Savvy travelers know that saving money on rental car insurance doesn’t mean skimping on coverage. Here’s how to keep your wallet happy while staying properly insured:

- Use Your Existing Policies: Check if your current auto and credit card insurance cover rental cars. No need to double-dip if you’re already protected.

- Avoid Airport Rentals: If you can, rent from locations away from the airport where rates are lower. A short taxi or ride-share trip could lead to substantial savings.

- Discount Codes and Memberships: Organizations like AAA, Costco, or your employer may offer rental insurance discounts that can help trim the costs.

- Daily vs. Weekly Rates: Renting for longer periods could reduce your daily insurance rate. Compare prices to find the best deal for your timeframe.

- Pre-Purchase Online: Sometimes, insurance is cheaper when you book it in advance online rather than at the rental counter.

- High-Deductible Plans: If you’re comfortable with your risk level, consider a plan with a higher deductible for lower daily rates.

By combining these tactics, you mitigate risk without inflating your budget.

They are very fast and efficient. I had to cancel because we changed plans and they were very understanding. I got my full refund. I will definitely use them next time

Frequently Asked Questions

Does rental car reimbursement apply if I’m not at fault?

Yes, you can access rental car reimbursement even if you’re not at fault. You can either claim it from the at-fault driver’s insurance or use your own coverage while waiting for fault determination. Your insurer may then recover the cost through a process called subrogation.

What is the average cost of rental car insurance per day?

The average cost of rental car insurance can range widely from about $30 to $60 per day. It varies based on coverage types and where you’re renting. Always compare prices for the best deal aligned with your needs.

Do credit cards offer rental car insurance, and how does it work?

Yes, many credit cards offer rental car insurance as a cardholder benefit, typically providing collision damage coverage. To activate it, pay for the rental with the card and decline the rental company’s insurance. Coverage limits and terms vary, so check with your card issuer.

4 Responses

Leave a Reply

Travel Tips and Guides

What is Rental Car Insurance? How does it Work?

Gil Farkash

Frequently Asked Questions (FAQ)

No. We provide a single journey plan. You are covered from the time you pick up the rental car up to the time you return it or on the last date written on your Certificate of Insurance, whichever comes first.

No. You should purchase a policy before starting your travel.

Find the answers you’re looking for to the most frequently asked car hire insurance questions as well as other questions relating to our products and services.

Need a quote

Thank you for taking the time to contact us.

You can simply fill the form and get a quote on our homepage – http://www.carinsurent.com.

Alternatively you can use the contact us form, send us your details – pickup date + drop-off date + country of residence + country where you plan your hire, and we will send you a quote.

All the best,

The CarInsuRent Team

I want to buy extra SLI, pick up date 22 Sep and drop off 23 Sep, country of residence: Hong Kong.

Place i am picking up and dropping off the rental car: New york.

age>25 and below 75

Thank you for taking the time to contact us.

Unfortunately, we do not offer SLI, we only offer car rental excess insurance.

All the best,

The CarInsuRent Team