Yes. Insurance for a single day is available.

Car Hire Excess Insurance Europe from US$7.45 /day

Heading to Europe on business or a vacation? If a rental car is part of your plans, you should also be aware of your responsibilities for that vehicle. While it is possible that your credit card or travel insurance may offer some coverage for your rental vehicle, protection can vary dramatically, and, in some cases, coverage can be excluded when you are out of your home country.

See How Much You Can Save on Your Car Hire Excess Insurance Europe

Get StartedCar Hire Excess Insurance Europe Coverage Chart

| Warranty | What does it cover? | How much does it cover? |

|---|---|---|

| Damage due to collision or theft | Reimbursement of the deductible applied by the rental company as a result of accidental damage caused to the vehicle, including tires, windshield, underbody and other parts | $ 2,500 - $ 4,500 |

| Improper Fuel Use Charges | Tank emptying costs and vehicle towing, when the wrong fuel is refueled into the vehicle by mistake. | $ 500 |

| Loss or theft of keys | In the replacement of lost or stolen keys, including lock and locksmith costs. | $ 500 |

| Towing charges | Covers the tow truck of the rented car in the event of a breakdown or accident. | $ 500 |

| Vehicle return charges | If as a result of an accident or illness with hospitalization you cannot return the vehicle. | $ 250 |

| Personnal belongings | In case your baggage, personal belongings or valuables are taken, permanently lost or unintentionally damaged during your trip | $ 500 |

| Hotel expensses | If You are unable to use your rental vehicle as a result of it being stolen or damaged | $ 150 |

Vehicle rental excess insurance

What is insured?

- Excess reimbursement up to US$ 4,500

- Damage Waiver (LDW) up to US$ 4,500

- Towing charges up to US$ 500

- Improper fuel charges up to US$ 500

- Loss or theft of keys up to US$ 500

- Vehicle return charges up to US$ 250

- Personnal belongings up to US$ 500

- Hotel expenses up to US$ 150

What is not covered?

- Damage to the vehicle or property of a third party

- Damage caused by a person not authorized to drive the rented vehicle

- Mechanical failure of the rented vehicle

- Loss or damage to the vehicle’s interior that is not related to a collision.

- Parking tickets or fines, traffic violations and such

- Any loss that occurs outside the validity of the insurance

- Any rental contract of more than 45 days

Is the coverage subject to any type of restrictions?

- Any claim resulting from a direct breach of any of the terms and conditions of your rental agreement

- Any person under 21 or above 84 years of age

- Rentals that begin or end outside the insurance period, as indicated on the insurance certificate

- The policyholder must be designated as the main driver in the rental agreement

- The maximum amount that can be claimed for a single loss is US$ 4,500

- Damage to Recreational vehicles (RVs) / Motorhomes / Campervans (unless you have purchased a specific cover)

- Damage to vehicles provided by a peer-to-peer vehicle rental service platform or a subscription vehicle service is excluded (unless purchased specific coverage)..

Where do I have coverage?

- Anywhere in the world except trips in, to or through Afghanistan, Cuba, Congo, Iran, Iraq, Ivory Coast, Liberia, North Korea, Myanmar, Russia, Sudan, Syria, Ukraine and Zimbabwe

What are my obligations?

- When applying for your policy, you must exercise reasonable care to honestly and carefully answer any questions asked.

- You must take all reasonable steps to avoid or reduce any loss (for example, you must report accidents or other damage to your rental company nd to CarInsuRent as soon as reasonably possible).

- If you make a claim, you must provide the documents and other evidence that claims handlers need to process your claim.

- You must repay any sums to which you are not entitled (for example, if we pay your claim for an accident which is later compensated by a third party).

- You must not violate the terms of the rental agreement.

When and how do I make the payment?

- The premium must be paid in full before the policy start date. Payment can be made by credit or debit card or PayPal through our website

What is the start and end date of coverage?

- As set out in the insurance certificate, as agreed in the application process, your policy will cover you from the start date and time of your booking to the end date and time of your booking.

How do I cancel the contract?

- You can cancel your policy before the start date or within 14 days from your purchase through our customer service team.

Amazing service. always efficient, friendly, responsive. I got my payment within days of submission. Bill is warm. A pleasure to work with them. highly recommended. I feel safe with them.

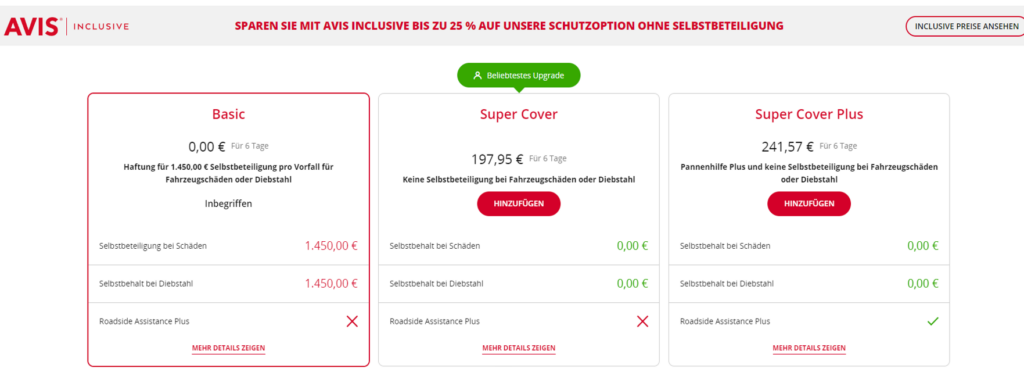

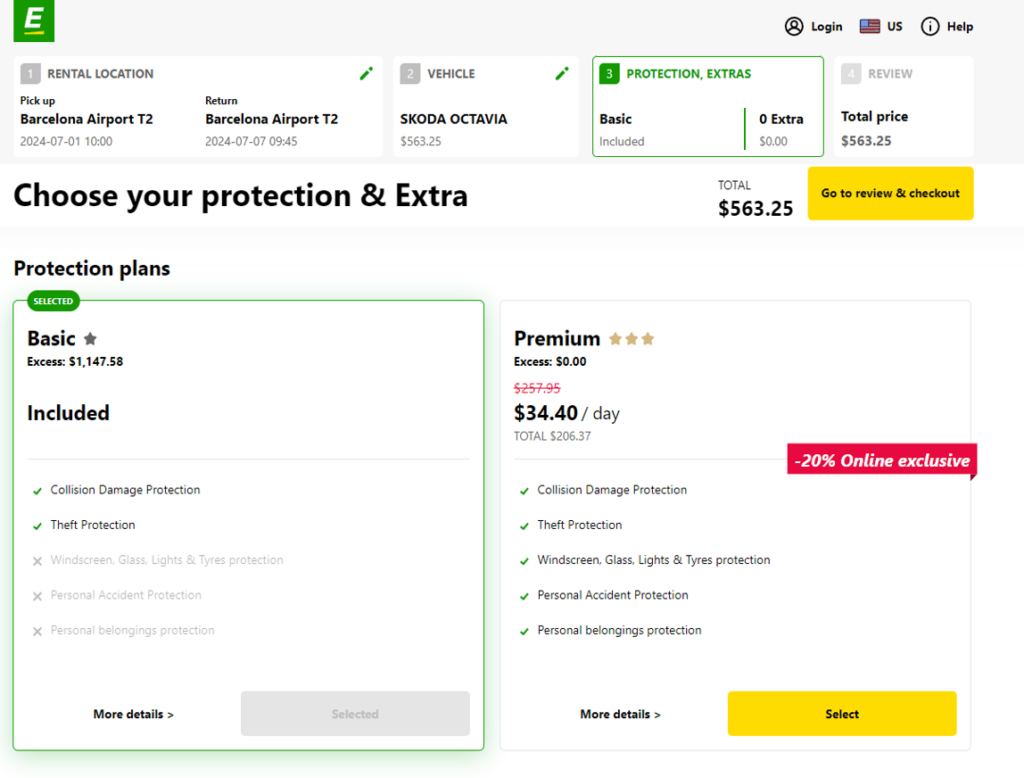

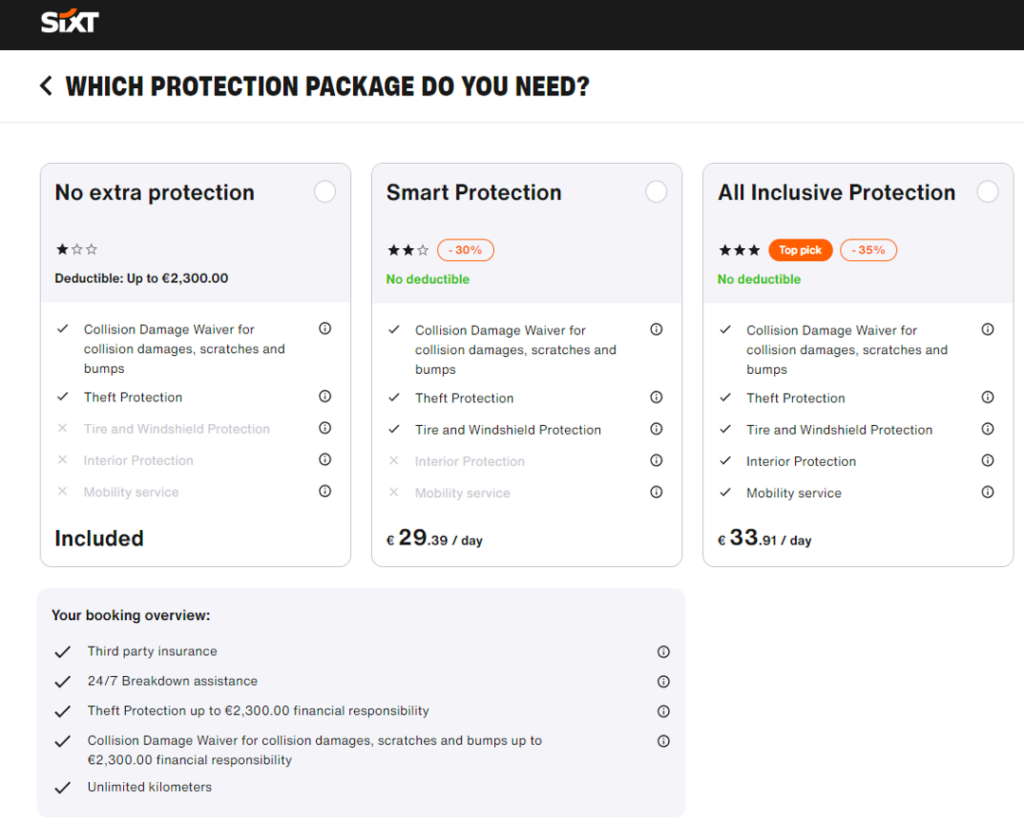

Car Hire Excess Insurance Europe Comparison: CarInsuRent vs. Cost at Counter

We compared and analyzed Super Collision Damage Waiver costs for a 7-day rental of a standard car class (July 1st – July 7th). The car rental insurance rates listed here are subject to change by the car rental companies without notice. For the most up-to-date pricing information, we encourage you to request a free online quote prior to booking. CarInsuRent’s car hire excess protection for rental vehicles in Europe offers the same coverage at a 70% lower cost!

| Country | Collision Damage Waiver (CDW) + Theft Protection (TP) | Avg. Super Collision Damage Waiver Cost at Counter* | Avg. Insurance Deductible at Counter* | Avg. Cost for Rental Car Excess Insurance with CarInsuRent | Cost of Deductible with Zero-Excess from CarInsuRent |

| France | Included at the rental price | € 19.00 | € 2,250 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Germany | Included at the rental price | € 28.00 | € 1,250 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Iceland | Included at the rental price | € 32.00 | € 1,950 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Ireland | Included at the rental price | € 25.00 | € 2,300 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Italy | Included at the rental price | € 36.00 | € 2,200 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Spain | Included at the rental price | € 32.00 | € 1,850 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

Avis Rental Car Insurance in Germany

Liability Coverage is Included in Your Rental Fee

Car hire excess insurance in Europe typically includes mandatory liability coverage that is included in the rental fee. This type of coverage can be used if the car is damaged or if the renter causes harm to someone on the road. It is important to check the maximum protection cover amounts for material damages for the specific European country you plan to rent a car in, as they may vary. We encourage you to check out our specific car hire excess insurance for the following destinations:

-

Car Rental Insurance France

-

Rental Car Insurance Germany

-

Car Rental Insurance Iceland

-

Car Rental Insurance Ireland

-

Car Rental Insurance Italy

-

Car Rental Insurance Spain

Most car rental companies offer a Collision Damage Waiver (CDW) or a Loss Damage Waiver (LDW) which can help lower your out-of-pocket costs if you are in an accident. However, both protections come with an excess or deductible that must be paid, and this can range from $500 to $2,500 or more.

A car hire excess insurance policy is a very affordable way to make sure that an excess or deductible payment doesn’t ruin your holiday. This coverage will reimburse you if you must pay the excess or deductible due to an accident with your hire car.

This guide will walk you through all you need to know about CDWs and LDWs in the UK and EU as well as how a car hire excess insurance policy can help you save money while renting a car.

See How Much You Can Save on Your Car Hire Excess Insurance Europe

Get StartedRental Car Coverage in Europe

Hiring a car in Europe can be dramatically different than renting in other countries, particularly when it comes to insurance coverage.

In most cases, if you damage a hire car, you will be on the hook for the cost to repair or replace it unless you have some type of damage waiver in place.

Most rental car companies in Europe offer a Collision Damage Waiver (CDW) or a Loss Damage Waiver (LDW) which helps limit your out-of-pocket costs if the car is damaged or stolen while you are renting it. There is one major difference between the two, and they both come with an excess or deductible that will need to be paid so it is important to understand what a CDW or LDW covers and what it doesn’t.

In addition, it is possible to purchase car hire excess insurance for rental cars which will reimburse you for the excess or deductible that comes with a CDW or LDW. Keep reading to learn everything you need to know about protecting your wallet when renting a vehicle in Europe.

Europcar Rental Car Insurance in Spain

What is a CDW?

A Collision Damage Waiver or CDW is protection you can purchase when renting a vehicle in Europe that puts a cap on your financial obligation if the vehicle is damaged in a collision. A CDW is not insurance. A CDW will cover the cost to repair your rental vehicle as well as any loss of rental income for the rental agency if the vehicle is damaged in a collision.

A CDW does come with exclusions, it only covers the bodywork of the vehicle, excluding other sections of the car. In addition to limited coverage, a CDW has an “excess” or “deductible” that must be paid by you before it will cover the balance of the repair.

A CDW is designed to limit the amount you will have to pay out of pocket if the car is involved in an accident. While it can vary by rental car company and the type of vehicle you rent, the excess or deductible will usually range between $500 and $2,500 but it can be much higher in some cases.

What is a loss damage waiver?

A loss damage waiver or LDW simply combines a CDW with theft protection (TP), so the vehicle is not only protected from body damage but theft as well. A LDW will cover the following:

- Theft of car

- Vandalism damage

- Collision damage

- Fire damage

- Damage caused by acts of nature

There are some car hire companies that only offer an LDW, eliminating the CDW. An LDW also comes with an excess or deductible that must be paid if you are involved in an accident with your hire car, while it varies by company and other factors, the excess or deductible often ranges between $500 and $2,500.

What is excess insurance for rental cars?

As mentioned above, both a CDW or LDW comes with an excess or deductible amount that must be paid if your hire car is damaged or stolen, which often ranges between $500 and $2,500. car hire excess insurance simply reimburses you for any excess or deductible amount that you must pay on a CDW or LDW if you are involved in an accident with your rental vehicle.

How does car hire excess insurance work?

The amount of CDW and LDW liability or excess will vary depending on your car rental company as well as the type of vehicle you are renting and the location of your rental. In Europe, the excess payment will usually run between € 500 to €2,000 (£430 – 1,750) for a common car type. In many cases, the excess or deductible amount will exceed the cost of renting the car.

If you are involved in an accident or the vehicle is stolen, you will have to cover this excess or deductible amount out of pocket. As an example, if you hire a car whose value is €20,000 with an excess of €1,000, you will have to cover that €1,000 out of pocket if the rental car is damaged.

Car rental excess insurance may refund the entire €1,000 excess cost depending on your car hire excess insurance policy and benefits cap. Car rental excess coverage is available to everyone driving in the EU or UK, you do not have to be a resident to purchase this coverage from CarInsuRent.

What Does Car Hire Excess Insurance Cover?

While the rates and terms will vary by plan, in most cases, the following are covered by both a daily car hire excess plan as well as an annual plan which covers your car rentals for a year:

- Covers the excess on damage and theft up to €2,500 per year

- Includes single vehicle damage, roof and undercarriage damage, auto glass and widescreen damage, towing expenses

- Insures multiple drivers between the ages of 21 and 84 years

- 45 consecutive day rental period

- Misfuelling, loss of car key and tire damage

- Cover for courtesy or replacement car

A typical European car hire excess insurance excludes the following:

- Rentals where the insurance policyholder is not mentioned as the main driver

- Policy purchased after the rental has started

- Vehicles over 10 years old

- Very expensive high-end vehicles

- Any damage that is caused by off-road driving.

- Commercial vehicles or any vehicles with more than 9 seats unless you have purchased specific coverage

- Charges for services that are the hire car company’s responsibility. This includes things such as a mechanical breakdown or towing costs

Always read the policy in full so you are aware of both what is covered and what is excluded. There can be restrictions or requirements for non-EU or UK residents.

See How Much You Can Save on Your Car Hire Excess Insurance Europe

Get StartedHow to File a Claim

What to Do in Case of an Accident or Damage – If you are involved in an accident while driving a rental car, there are certain steps you should follow to file a claim with the rental car insurance company. First, exchange personal information with the other driver, including name, address, license plate number, rental vehicle information, insurance company, and policy number, and document the accident with pictures and notes. If the other driver is at fault, you should get their contact and insurance information and call their insurance company directly to file a claim. If you are at fault or have non-collision damage, you can file a claim with the rental car insurance company. The process for filing a claim with the rental car insurance company may vary depending on the provider, but typically, you would need to provide details of the incident, including the date, time, and location of the accident, as well as any police report numbers, if applicable. Additionally, you may need to provide documentation of the damage, such as photographs or repair estimates.

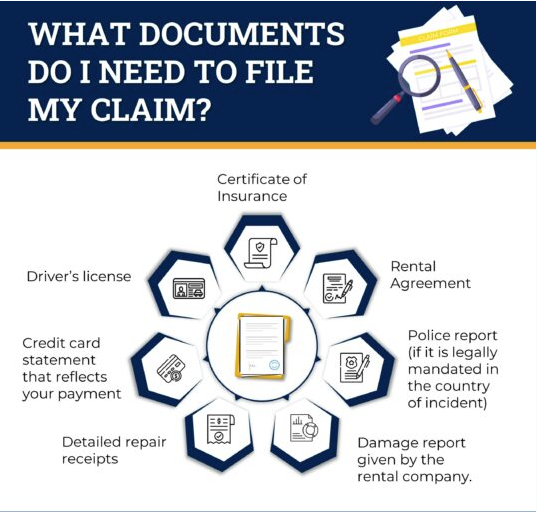

Required Documentation for Filing a Claim

- A copy of the Certificate of Insurance

- A copy of the rental agreement

- A copy of the police report if:

- you got in an accident with a third party

- It is legally mandated in the country of incident

- your claim is about stolen personal belongings

- A copy of the damage report given by the rental company, detailing each cost incurred. Photographs of the damage are optional but may help ensure that the charges are reasonable.

- Detailed repair receipts, invoices or other documents showing the breakdown of the amount the rental company charged you for the accidental damage or loss

- A copy of your credit card statement that reflects your payment for the claimed damages

- A copy of the driver’s license of the person driving the car during the accident

What Documents Do I Need to File My Claim?

Tips for a Smooth Claims Process: Filing an insurance claim can be a complicated and stressful process. The following tips can help ensure a smoother claims process:

- Document everything: Documenting all the details of the accident or loss, including taking photos and notes, can help speed up the claims process and reduce the possibility of disputes.

- Communication: Communication is key in any insurance claim process. Keep thorough records of all communication with the insurer, and discuss your expectations for the claims process with the adjuster. You can also ask about the frequency of updates and the preferred type of communication.

- Avoid duplicate claims: Avoid submitting duplicate claims, as it slows down the claims payment process and creates confusion.

- Understand your coverage: It’s important to understand your insurance coverage, including the limits and deductibles, before filing a claim. Understanding your policy can help ensure that you receive the maximum benefit to which you are entitled.

- Be patient: Claims processing can take time, so it’s important to be patient.

By following these tips, you can help ensure a smoother claims process, and increase the chances of receiving the maximum benefit that you are entitled to under your insurance policy.

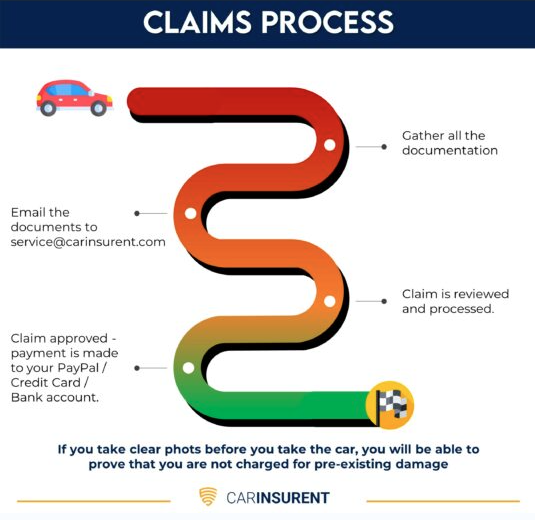

Claims Process

By following these tips, you can help ensure a smoother claims process, and increase the chances of receiving the maximum benefit that you are entitled to under your insurance policy.

Do I need Car Hire Excess Insurance in the UK & Europe?

While there is no legal requirement to carry car hire excess insurance cover in Europe, it is often a good idea. If you can easily afford to pay up to €2,500 in the event you are in an accident with your rental vehicle, then there is no need to carry car hire insurance excess.

However, if covering a €2,500 bill would ruin your vacation or impact your budget, you should absolutely consider purchasing a car hire excess policy.

It’s important to note that in addition to the €2,500 excess or deductible, most CDWs and LDWs exclude coverage for items such as all the windows in the vehicle, tyres, lost keys, and even misfuelling the car which means your out-of-pocket costs could be much higher than the excess or deductible payment. A car hire excess policy will cover these losses up to the coverage limits in the policy.

Purchasing a car hire excess policy is not the only way to protect your finances when renting a car in the E.U. or U.K. Here are a few different options that may be available to you:

Car Hire Excess Insurance

The simplest way to protect your vacation budget from unexpected rental car expenses is to purchase a European car insurance excess waiver from CarInsuRent. This policy will cover the cost of your excess or deductible up to your coverage limits. We sell a variety of different policies including daily and annual excess waivers. Once your claim is filed, we will pay the claim within 5 business days. Our policies are very affordable with an annual policy only costing $89.

Credit Card Coverage

Some credit cards do offer car rental insurance that offers zero-deductible collision coverage as well as some liability coverage. However, there can be numerous exclusions with this coverage, particularly if you are out of your home country.

It is always important to contact your credit card company before traveling to verify they offer coverage in the locations you are traveling to as well as any exclusions to coverage.

You may find that the coverage offered is not sufficient or offered where you are traveling. If your credit card does offer coverage, you can forego the CDW or LDW offered by your car rental company.

Collision Coverage Through Your Travel-Insurance Provider

In many cases, you can add-on collision insurance to a travel insurance policy. Coverage and exclusions will vary by policy so be sure to read it in full to make sure you understand what is covered and what is excluded.

Super CDW or LDW

A Super CDW or LDW ups the coverage when compared to a standard CDW or LDW. These waivers cover more of the vehicle while also reducing the excess you must pay in the event you are in an accident. While some SCDWs or SLDWs take the excess or deductible down to zero, these waivers can be very expensive and may come with additional exclusions.

Sixt Rental Car Insurance in Italy

CarInsuRent and Non-UK Residents

A CarInsuRent car hire excess policy is often one of the best options for non-UK residents renting a vehicle while traveling in the UK or EU. Our policies are very affordable and can be a financial lifesaver if you are in an accident while renting a car in Europe or the UK. Check our prices now and make sure your rental car is fully covered while traveling.

CarInsuRent urges you to drive safely and stay insured!

See How Much You Can Save on Your Car Rental Insurance Europe

Get StartedFAQs

What is a CDW?

A Collision Damage Waiver or CDW is protection you can purchase when renting a vehicle in Europe that puts a cap on your financial obligation if the vehicle is damaged in a collision. It is not an insurance policy.

A CDW will cover the cost to repair your rental vehicle as well as cover any loss of rental income for the rental agency if the vehicle is damaged in a collision, but it does come with a variety of exclusions so make sure you understand the limitations of these protection.

A CDW comes with an excess or deductible that you will have pay out of pocket if you are involved in an accident. It will vary by rental car company and the type of vehicle you rent, but in most cases, the excess or deductible will usually range between $500 and $2,500 but it can be much higher in some cases.

Is CDW Insurance Mandatory in Europe?

No, CDW is optional in Europe except for Italy where it is a required coverage. Most European car rental companies include liability coverage as part of their baseline rate and offer a CDW or LDW as optional coverages you can purchase.

Is LDW and CDW the same?

LDW stands for Loss Damage Waiver and an LDW if very similar to a CDW, but it includes theft protection (TP) as well. Some car rental companies only offer an LDW, eliminating the CDW. An LDW offers the same protections as a CDW, but it also includes protection if your rental vehicle is stolen.

What is the difference between CDW and excess waiver insurance?

A CDW offers protection for your rental vehicle, it will pay to repair the body of your rental vehicle if it is damaged in an accident. However, a CDW comes with an excess or deductible payment that you must pay out of pocket, and this can range from $500 to $2,500 or more.

Excess waiver insurance will refund the excess or deductible amount that you must pay on your CDW if you are involved in an accident up to the policies benefit ceiling. Excess waiver insurance is very affordable and can be a financial lifesaver if you are in an accident with your rental vehicle.

Which insurance is best for a rental car?

While your needs will vary depending on where you are going, in most cases, the best combination is a CDW with an excess waiver insurance policy. This will ensure the vehicle is repaired if it is damaged in an accident and you will not have to pay a huge excess or deductible out of pocket.

About the author:

Mark Vallet have over 15 years’ experience writing about insurance and automotive subjects. Mark have written for autos.com, carsdirect.com, YourMechanic.com, and is also a regular contributor to carinsurance.com, insure.com and insurance.com. His work has been published online at MSN, Yahoo Autos, Fox Business, Business Insider Australia and more.

29 Responses

Leave a Reply

Travel Tips and Guides

Frequently Asked Questions (FAQ)

No. We provide a single journey plan. You are covered from the time you pick up the rental car up to the time you return it or on the last date written on your Certificate of Insurance, whichever comes first.

No. You should purchase a policy before starting your travel.

Find the answers you’re looking for to the most frequently asked car hire insurance questions as well as other questions relating to our products and services.

I would like yearly insurance but not for a mini bus. This is a one off yearly trip

Dear Ian,

Thank you for taking the time to contact us.

You can learn more about how to purchase an annual policy in this link – https://carinsurent.com/faqs/how-to-purchase-an-annual-policy/.

You can learn more about the advantages of our annual policy in the following links: https://carinsurent.com/guides/should-i-take-a-daily-car-hire-excess-insurance-policy-or-an-annual-policy/ and https://carinsurent.com/faqs/can-i-buy-a-product-that-i-can-use-for-a-whole-year-or-for-multiple-trips/

Have a safe trip.

The CarInsuRent Team

Looking for Excess Deductible insurance in Italy for a 9 passenger van

Dear J. Rocco Vicchio,

Thank you for taking the time to contact us.

I noticed that you already submitted a request for a quote.

If there is something that you would like to explore, we encourage you to contact us via email – service@carinsurent.com.

Have a safe trip.

The CarInsuRent Team

It’s an amazing piece of writing in favor of all

the online visitors; they will obtain advantage from it I am sure.

None

No comment

Helpful information. Lucky me I found your site by chance, and I am surprised why this twist of fate didn’t came about in advance! I bookmarked it.

Very useful information for avoiding extra charges when renting a car in Europe.

Thanks

European Car Rental Excess Insurance | CarInsuRent

Very interesting and useful article.

Thanks for the suggestions you write about through your blog.

Thanks a lot for giving everyone an extremely nice possiblity to discover important secrets from this web site. It is usually very enjoyable and stuffed with fun for me personally and my office peers to search the blog particularly three times in 7 days to find out the new items you have got. And lastly, I am always pleased with the beautiful hints you give. Some 4 points in this article are without a doubt the very best we have ever had.

Thanks for the helpful content.

Interesting blog post.

Thank you for another magnificent article. Where else could anybody get that kind of info in such a perfect way of writing? I’ve a presentation next week, and I am on the look for such info.

I am constantly looking online for tips that can help me.

Thank you for the useful article!

An impressive share! I have just forwarded this onto a co-worker who had been conducting a little research on this. And he in fact bought me lunch because I stumbled upon it for him… lol. So let me reword this…. Thank YOU for the meal!! But yeah, thanks for spending some time to talk about this issue here on your internet site.

Its like you read my mind! You appear to know so much about this, like you wrote the book in it or something. I think that you could do with some pics to drive the message home a bit, but instead of that, this is great blog. An excellent read. I’ll definitely be back.

Terrific post but I was wanting to know if you could write a litte more on this topic? I’d be very thankful if you could elaborate a little bit further. Kudos!

It is remarkable, very interesting piece

Thanks for posting this informative article

Certainly. I agree with told all above.

Bravo, this idea is necessary just by the way

I absolutely understand and agree what you mean!

I have been exploring for a bit for any high-quality articles or weblog posts in this sort of space . Exploring in Yahoo I at last stumbled upon this site. Reading this information So i’m satisfied to show that I’ve a very just right uncanny feeling I found out just what I needed. I so much indisputably will make sure to do not put out of your mind this website and give it a look regularly.

I am thinking of hiring a car from a small family company in Favignana, Italy and the car hire company has emailed me saying that insurance is not included. How do I obtain comprehensive car insurance as well as excess cover?

Thank you for taking the time to contact us.

We only offer car hire excess insurance and do not offer full coverage.

All the best

The CarInsuRent Team

Excuse for that I interfere … To me this situation is familiar

Simply want to say your article is as amazing. The clearness to your post is just excellent and i could think you are a professional in this subject.

All together with your permission allow me to clutch your RSS feed to keep updated with drawing close post.

Thanks one million and please keep up the enjoyable work.